Prices

September 30, 2014

Barges Added to List of Transportation Woes

Written by Sandy Williams

Barge availability is becoming an issue on U.S. waterways. According to the MID-SHIP Report, demand for barges to move record grain production is putting upward pressure on shipping costs. MID-SHIP also reports berth congestion for some breakbulk facilities along the Mississippi River due to strong steel shipments.

Availability constraints in trucking and rail are adding to increased barge demand. The trucking industry has been dealing with a shortage of drivers and regulations that restrict driver hours. Rail capacity has been usurped by oil due to the boom in the shale oil industry. An attractive alternative from rail and road is America’s river system.

The barge industry has been replacing aged vessels over the past several years and is still low at 17,000 barges, according to Informa Economics. Ken Eriksen, senior vice president- transportation at Informa says that with the record harvest this year he is hearing constant complaints from shippers that “I can’t get barges/railcars!” As a result of capacity issues, the U.S. Agriculture Department says the cost to move grain down the rivers for export will reach a six year high during October.

The barge industry has been replacing aged vessels over the past several years and is still low at 17,000 barges, according to Informa Economics. Ken Eriksen, senior vice president- transportation at Informa says that with the record harvest this year he is hearing constant complaints from shippers that “I can’t get barges/railcars!” As a result of capacity issues, the U.S. Agriculture Department says the cost to move grain down the rivers for export will reach a six year high during October.

An official with the Waterways Council noted that “barge availability, is indeed, much more in demand with the record harvest.” The “rail capacity challenges has underscored the need for the waterways as a critically important freight transportation option,” she added.

MID-SHIP reports freight trading “near 1100 percent of tariff for southbound grain movement. However, the USDA is reporting the average rates for St. Louis to NOLA were near 685 percent of tariff as of the week ending September 16, 2014.”

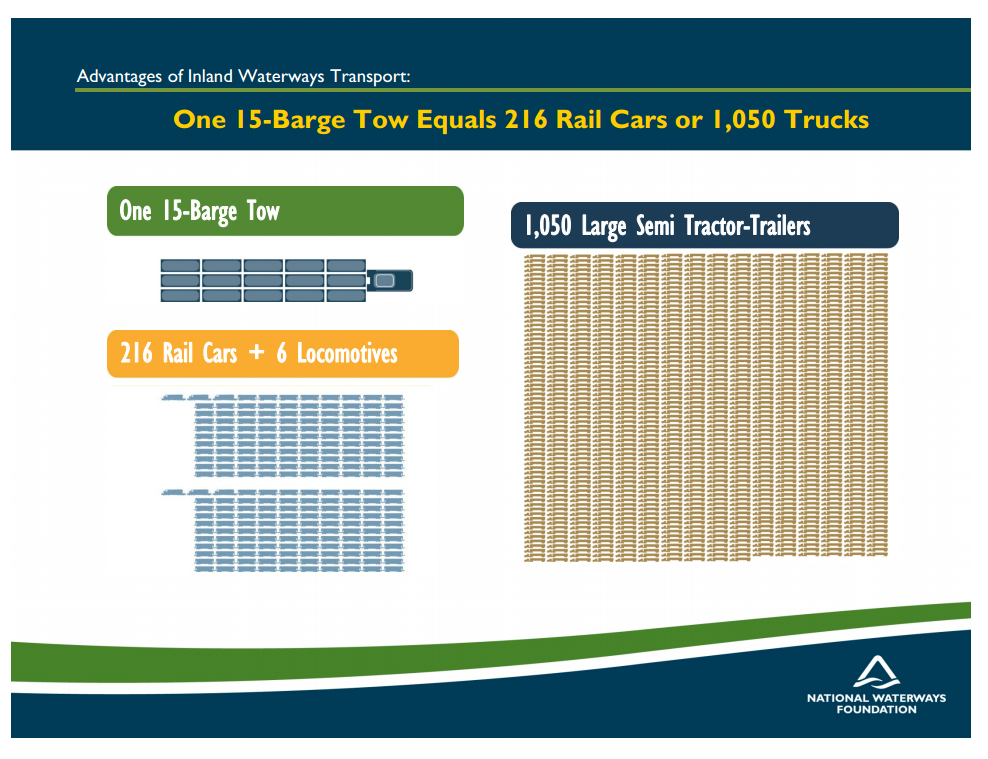

A major advantage for barges is load capacity. According to the National Waterways Foundation, 1 barge can carry 1,750 short tons of dry cargo—equal to 16 rail cars or 70 trucks. For liquid cargos the comparison is even more impressive. One barge can carry 27,500 barrels of liquid cargo as compared to 46 rail cars or 144 trucks. Since barges are generally multiple tows the cargo capacity increases proportionately. The chart below gives the comparison for a 15-barge tow.