Prices

September 28, 2014

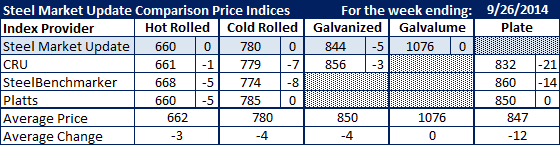

SMU Comparison Price Indices: Numbers Moving Lower

Written by John Packard

Hot rolled dropped $4 per ton based on the averages of the four indexes followed by Steel Market Update. Three of the indexes had hot rolled at $660 per ton (SMU, Platts) or $661 per ton (CRU) with SteelBenchmarker the highest at $668 per ton.

For cold rolled, SteelBenchmarker was the lowest index at $774 per ton with Platts being the highest at $785 per ton. Our cold rolled average dropped $4 per ton to $780 per ton.

Galvanized saw a $4 decline in the average price which now stands at $850 per ton for .060” G90 (using a $3.45/cwt or $69 per ton extra for coating).

Plate prices saw large price movements lower from CRU (-$21) and SteelBenchmarker (-$14) while Platts remained the same. The average price for plate now stands at $847 per ton, down $18 from where it was one week ago.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.