Market Segment

September 18, 2014

U.S. Service Center Flat Rolled Inventories Growing

Written by John Packard

The Metals Service Center Institute (MSCI) released shipment and inventory data on the U.S. service centers this week. Total steel shipments of all steel products rose on a daily basis in August compared to July. The daily shipment rate was 173,000 net tons and shipments totaled 3,634,000 tons. The number of tons shipped was essentially unchanged from one year ago.

U.S. distributors’ inventories grew to 9,013,200 tons by the end of August. Inventories of all steel products were 13.5 percent higher than one year ago when service centers held 7,941,200 tons of steel on their floors. The number of months on hand rose to 2.5 months on a non-seasonally adjusted basis. This is up slightly from the 2.4 months reported one month ago. Last year, at the end of August, distributors held 2.2 months worth of inventories on their floors.

Carbon Flat Rolled

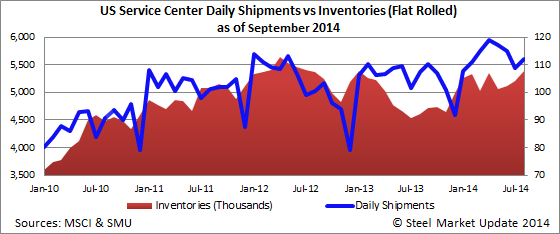

U.S. service centers shipped an average of 112,100 tons of flat rolled steel on a daily basis during the month of August. Total flat rolled shipments were 2,353,700 tons which was slightly lower than July’s shipments (July had one more shipping day than August this year). Shipments were down 0.2 percent compared to August 2013.

Flat rolled inventories stood at 5,389,300 tons at the end of August. At this level, the domestic service centers are carrying 17.1 percent higher inventories than what we saw one year ago. On a non-seasonally adjusted basis, distributors were carrying 2.3 months of inventory. This is up from 2.2 months in July and well above the 2.0 months one year ago.

Distributors shipped 380,900 tons of plate during the month of August. The daily shipping rate was 18,100 tons per day. Shipments were up 6 percent compared to one year ago.

Plate inventories stood at 1,173,600 tons at the end of August, up slightly from the 1,083,700 tons recorded at the end of July. Plate inventories are up 18.6 percent compared to one year ago and the number of months on hand stood at 3.1 months on a non-seasonally adjusted basis (up from 2.9 months).

Carbon Pipe & Tube

Service centers shipped 237,800 tons of pipe and tube products during the month of August. This is 1.7 percent lower than one year ago and slightly lower than July’s total of 241,600 tons. The daily average shipping rate was 11,300 tons per day which was slightly better than July and August 2013 (both were 11,000 tons per day).

Inventories at the distributors stood at 668,400 tons at the end of the month. Inventories were 5.4 percent lower than one year ago. The number of months on hand was 2.8 up slightly from the 2.7 measured on a non-seasonally adjusted basis in July.