Prices

September 13, 2014

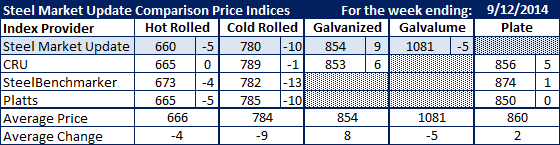

Comparison Price Indices: Numbers Moving Lower

Written by John Packard

Flat rolled steel prices moved lower this past week according to the various steel price indexes followed by Steel Market Update. The largest movement was seen in cold rolled prices but hot rolled prices and Galvalume prices also fell during the past week. The one item which did not see erosion was galvanized prices which were adjust $9 per ton higher due to the change in zinc coating extras. If the new extras were removed galvanized prices would have slipped along with the rest of the flat rolled steels.

Even Platts moved hot rolled prices lower this past week as HRC prices averaged $666 per net ton, down $4 per ton over the past week.

Cold rolled dropped even more dramatically as Steel Market Update, Platts and SteelBenchmarker saw their CRC averages declining by $10 per ton or more during the past week. The CRC average of all four indexes dropped $11 per ton last week.

Galvanized bucked the trend due to purely technical reasons as both CRU and SMU put into place the new coating extra for .060” G90. The new extra is $69 per ton ($3.45/cwt) up $9 per ton from where it had been since January 2012. Our galvanized average advanced $8 per ton compared to the previous week.

Galvalume was down $5 per ton and plate was up $3 per ton over the prior week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.