Prices

September 11, 2014

Scrap Exports from the US through July

Written by Peter Wright

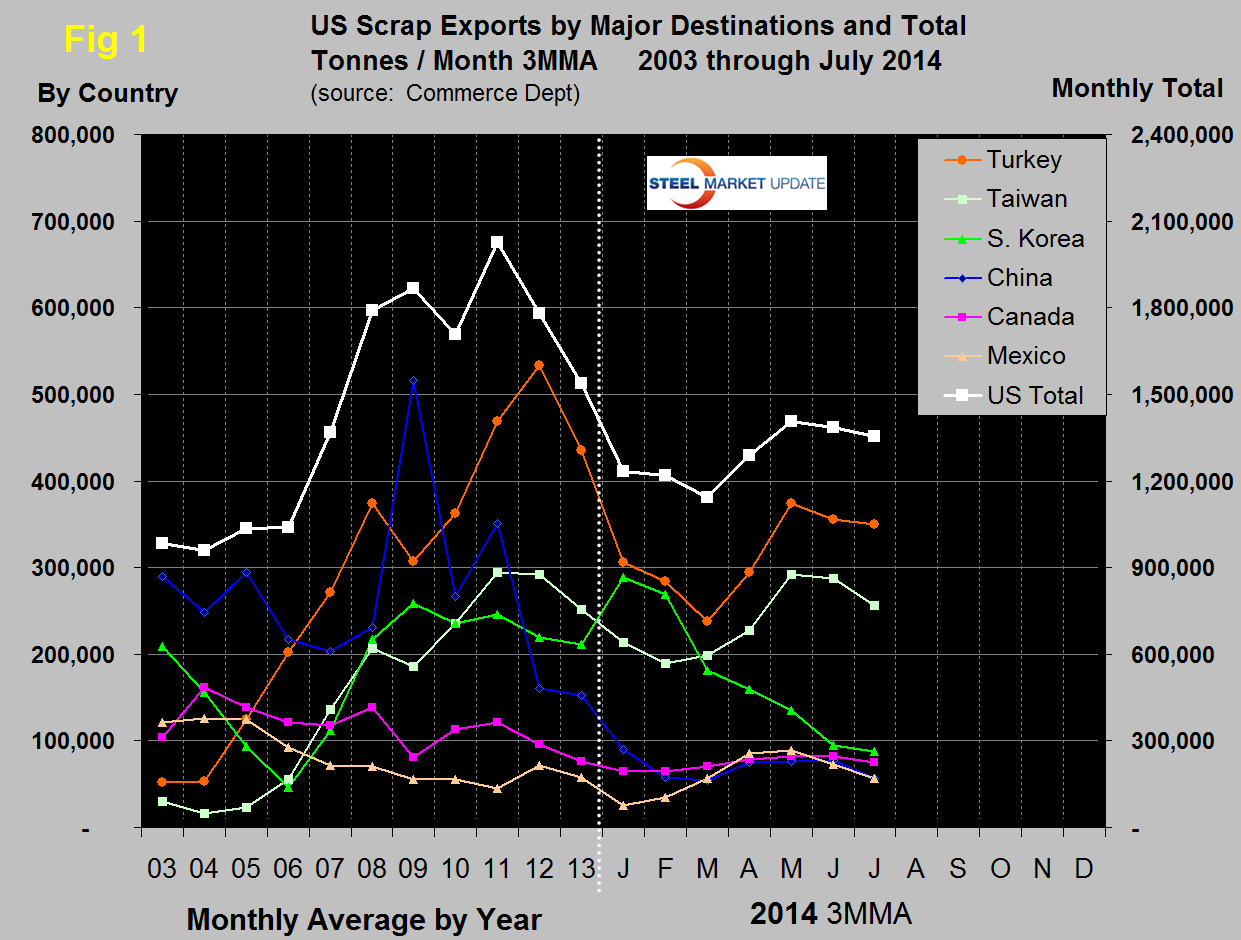

In the first seven months of 2014, total ferrous steel scrap exports totaled 8,828,815 metric tons, down by 20.6 percent from the same period in 2013. In the single month of July exports were 1,248,330 tons, down from June’s volume of 1,270,041 tons. May had by far the highest tonnage of the year, the July volume was in line with February, March and April.

Figure 1 shows that the three month moving average, declined by 2.2 percent in July and continued to be lower than the average in any year from 2007 through 2013. The most obvious trend so far this year continues to be the decline in tonnage to South Korea, down by 69 percent since January. Korea booked three cargoes in the first week of July after weeks of refusing to meet offered prices. The July price was up $8 / tonne identical to the increase Thailand paid for a cargo of 80:20 #1 #2 heavy melt.

YTD 2014 compared to the same period in 2013, the Far East as a whole is down by 13.2 percent and China is down by 60.7 percent. On the same basis, Turkey’s tonnage is down by 32.8 percent which is over a million tons. Other nations not considered in this analysis because they have been historically minor purchasers were down in total by 424,000 tons YTD. Some nations have taken more tonnage this year than last, Indonesia is up by 159,000 tons, Mexico by 83,000 tons, Vietnam by 122,000 tons and Thailand by 239,000 tons. Tonnage moving North over the Canadian border was down by 23,000 tons from last year.

AMM reported on August 19th that, “Higher offer prices from US bulk ferrous scrap exporters are meeting resistance from Turkish steel producers who are instead turning to Baltic Sea suppliers. Turkey’s mills have booked at least fourteen cargoes so far in August with only two from the US and one from Canada. The recent decline of the Euro against the US $ will make European scrap more attractive than US scrap in the eyes of Turkish buyers.”

Scrap export prices are reported every Tuesday for an 80:20 mix of #1 and #2 heavy melt in US $ per tonne FOB New York and Los Angeles for bulk tonnage sales. Prices on the East coast declined by $5 to $362.58 between, August 25th and September 8th. The West coast price was $350.52 on September 8th down by $4 since August 25th. The East Coast price has been higher than the West Coast since July 21st and the gap has been widening.