Market Data

September 7, 2014

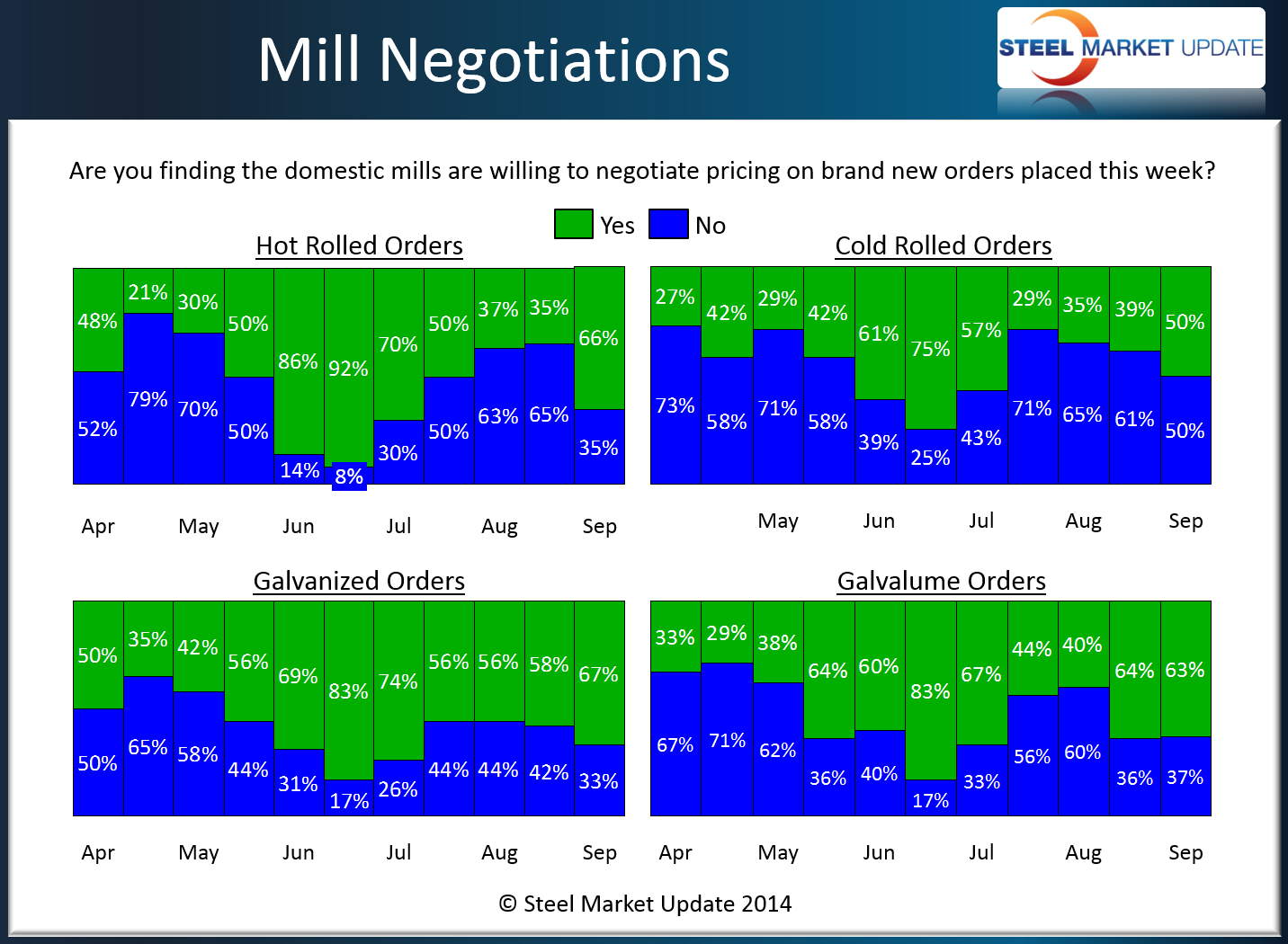

SMU Survey Reports Steel Mills More Willing to Negotiate Flat Rolled Steel Prices

Written by John Packard

Steel Market Update conducted one of our flat rolled steel market surveys this past week. One of the key questions asked during the survey process is regarding the willingness of the domestic flat rolled steel mills to negotiate spot pricing.

In last week’s survey our respondents reported a jump in the percentage reporting the steel mills as willing to negotiate hot rolled spot prices. We had been seeing a reduction in the willingness for a couple of months (see graphic below), actually bottoming in our mid August survey at 35 percent. This past week, 66 percent of our respondents reported the mills as willing to negotiate HRC pricing.

We saw modest growth in the percentages reporting cold rolled as negotiable. In the most recent survey, we found 50 percent of our respondents reporting the mills as now willing to negotiate spot CR pricing. This is up from the 39 percent measured during the middle of August.

Galvanized steel saw a small uptick from 58 percent in mid August to 67 percent this past week.

Galvalume remained about the same as 63 percent reported the mills as willing to negotiate compared with 64 percent reported during the middle of August.

Below is an interactive graph of our steel mill lead time history (open white space if you are not on our website). In order to see and manipulate the graph you will need to be logged in on the SMU website. Contact us at info@SteelMarketUpdate.com or 800-432-3475 if you need assistance.

{amchart id=”113″ SMU Negotiations by Product- Survey}