Market Data

September 7, 2014

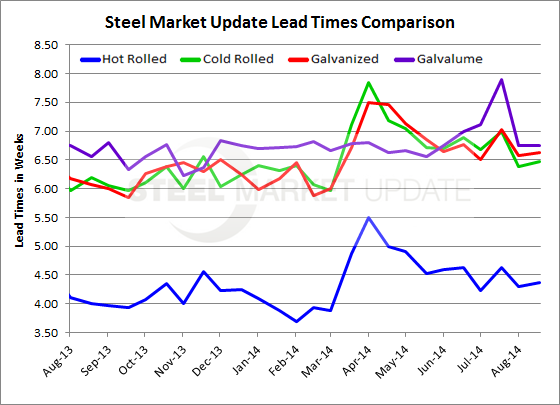

Flat Rolled Steel Mill Lead Times Remain Stable

Written by John Packard

Flat rolled steel mill Lead times remained relatively stable compared to those reported during the middle of August. However, when compared to the lead times reported in early September 2013 we are finding the latest lead times to be slightly extended.

Hot rolled lead times are averaging 4.37 weeks based on the responses received in last week’s analysis of the flat rolled steel market. This is very close to the 4.30 weeks reported in mid August and slightly shorter than what we measured at the beginning of July. One year ago, HRC lead times were reported to be averaging 4.0 weeks.

Cold rolled lead times average 6.48 weeks, up slightly from the 6.38 weeks reported in mid August. This is down from the 6.88 weeks measured at the beginning of July (and 7.0 at the beginning of August) but above the 6.20 weeks measured one year ago.

Galvanized lead times average 6.62 weeks, or about the same as the 6.58 weeks measured during the middle of August. As with cold rolled, galvanized lead times were slightly longer at the beginning of August at 7.03 weeks. One year ago, galvanized lead times were averaging 6.07 weeks.

Galvalume lead times remained at 6.75 weeks which was where they were reported to be during the middle of August. They are shorter than the 7.90 weeks reported at the beginning of August of this year. One year ago Galvalume lead times were measured as averaging 6.55 weeks.

Below is an interactive graph of our steel mill lead time history (open white space if you are not on our website). In order to see and manipulate the graph you will need to be logged in on the SMU website. Contact us at info@SteelMarketUpdate.com or 800-432-3475 if you need assistance.

{amchart id=”112″ SMU Lead Times by Product- Survey}