Prices

September 3, 2014

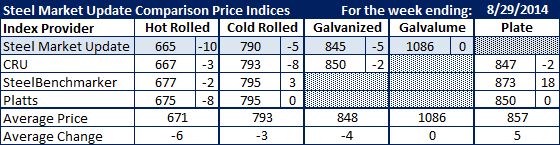

Comparison Price Indices: Another Small Step Lower

Written by John Packard

Flat rolled steel prices continued to slip this past week according to our analysis of the various flat rolled price indexes we follow on a regular basis. The benchmark hot rolled average dropped $6 per ton to $671 per ton with SMU being the lowest at $665 and SteelBenchmarker the highest at $677 per ton.

The cold rolled average dropped $3 per ton to $793 per ton with SMU and CRU taking their numbers down, SteelBenchmarker was up $3 per ton (they only produce prices twice per month) and Platts remained the same. The spread is quite narrow at $5 per ton from low to high.

The galvanized average dropped $4 to $848 as both SMU and CRU lowered their numbers this past week.

Galvalume remained the same and plate prices rose by $5 per ton on the back of the $18 per ton increase seen by SteelBenchmarker and the spread from low to high expanded to $26 per ton. Platts and CRU had their numbers much closer to $850 than $870.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.