Market Data

September 2, 2014

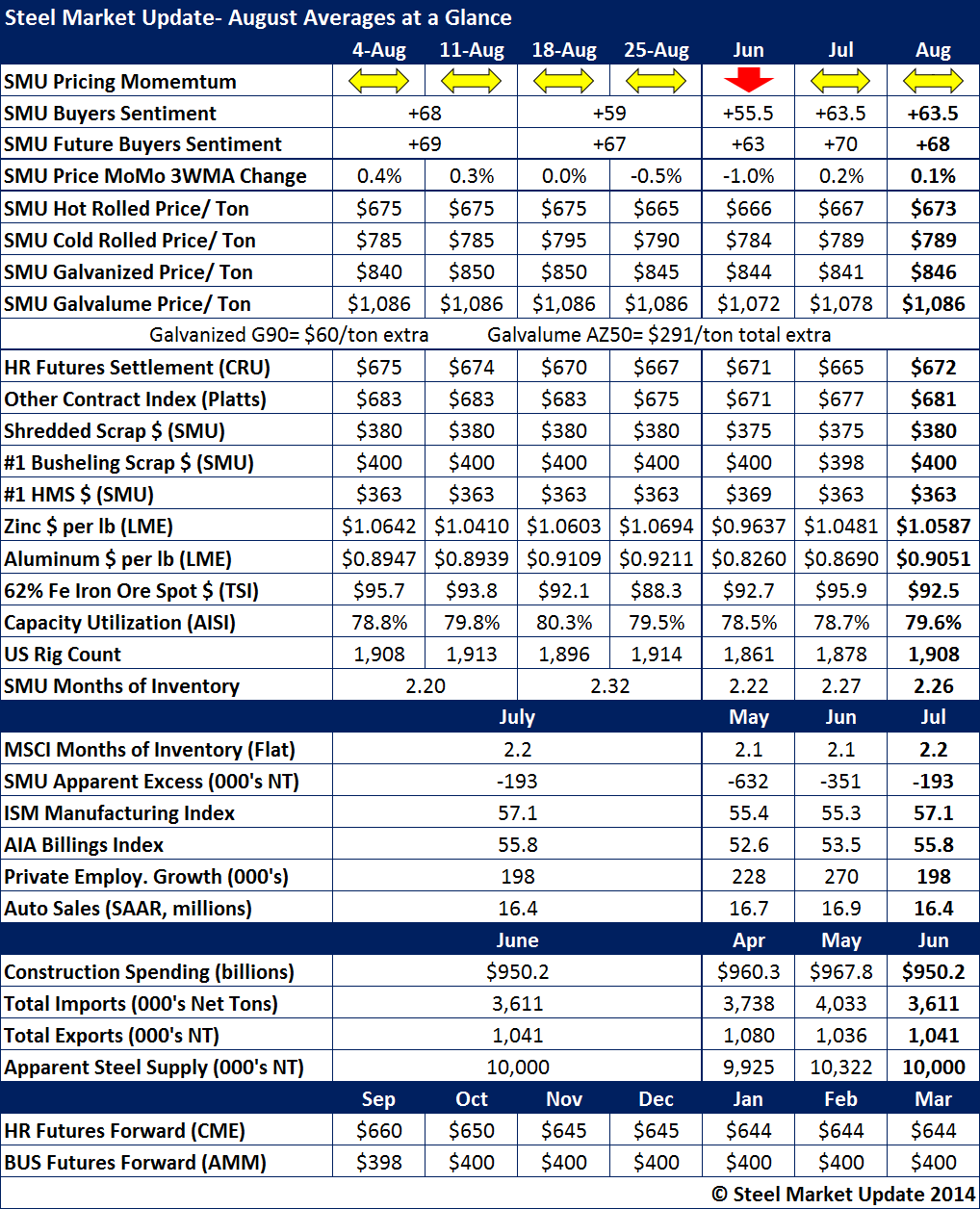

August at a Glance

Written by John Packard

The following is a recap of the data compiled during the month of August 2014. For the second month in a row our SMU Price Momentum Indicator remained at Neutral as steel prices have been relatively stable with the $673 average up $6 from the July average. However, by the end of the month our HRC price average was $665, down $2 from the July average. Our $673 per ton average for the month of August was $1 per ton higher than the $672 posted by CRU. Platts came in at $681 per ton average for the month.