Analysis

August 24, 2014

NAFTA Light Vehicle Production for August Could be a Blockbuster

Written by Peter Wright

U.S. light vehicle sales declined slightly from June’s high level but, at a seasonally adjusted annual rate (SAAR) of 16.5 million units, were still very strong. Sales have now exceeded 16.0 million units SAAR for five straight months.

Sales in July of autos and light trucks were 8.0 and 8.5 million units, respectively. Autos declined by 300,000 and light trucks by 100,000 from the June result. The drivers continue to be pent-up demand, easier access to credit, and an improving job market. Light vehicles are autos and light trucks (GVW Classes 1-3, under 14,001 lbs.). Crossovers are classified as light trucks which considerably swells that sectors sales and production numbers.

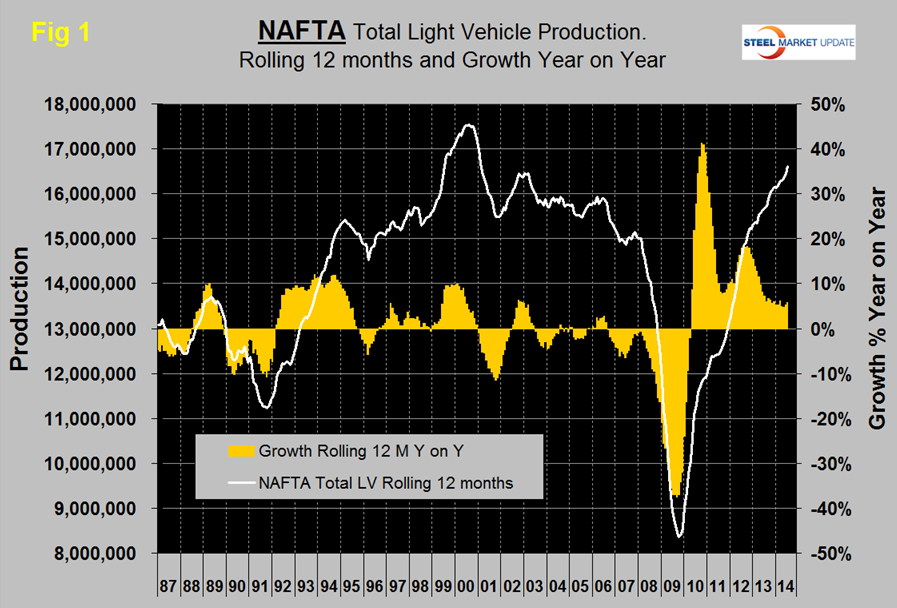

Total light vehicle production in NAFTA in July was at an annual rate of 14,777,652 units, down by 16.6 percent from June. This was the normal July re-tooling slowdown but the decline was much less than normal. Since 2004 the average July slowdown compared to June has been 30.7 percent. The average August acceleration compared to July has been 45.8 percent so stay tuned, the month we are in now could be a blockbuster.

Note: the sales data reported above is seasonally adjusted. These production results are not adjusted.

On a rolling 12 months basis year over year (y/y) light vehicle production in NAFTA increased by 5.9 percent and is now well above the pre-recession peak, (Figure 1).

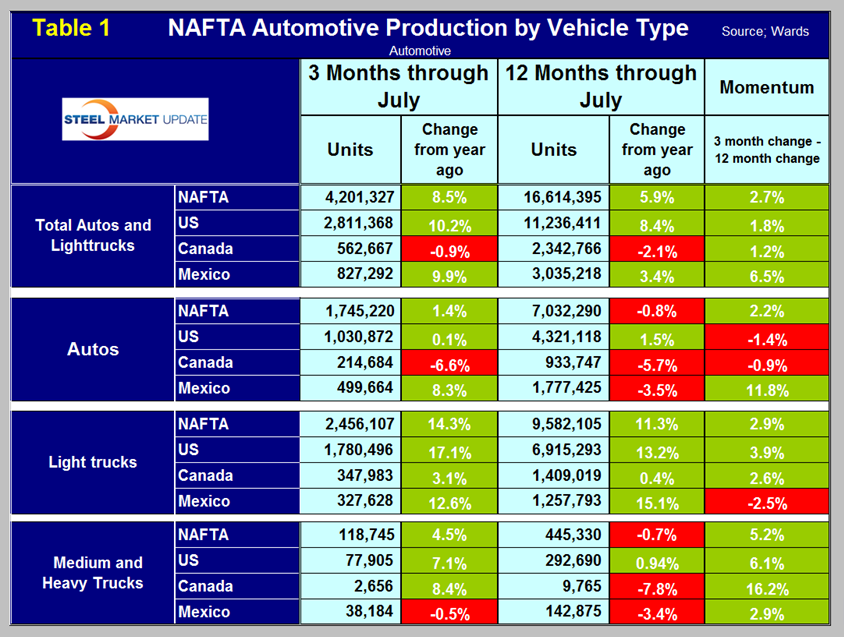

On this basis the US is up by 8.4 percent, Canada is down by 2.1 percent and Mexico is up by 3.4 percent, (Table 1).

For NAFTA as a whole on a rolling 12 month basis y/y, light truck production is up by 11.3 percent and autos are down by 0.8 percent. A time comparison such as this is very strong evidence of a long term shift in consumer preference, probably driven by the crossover sub set of light trucks.

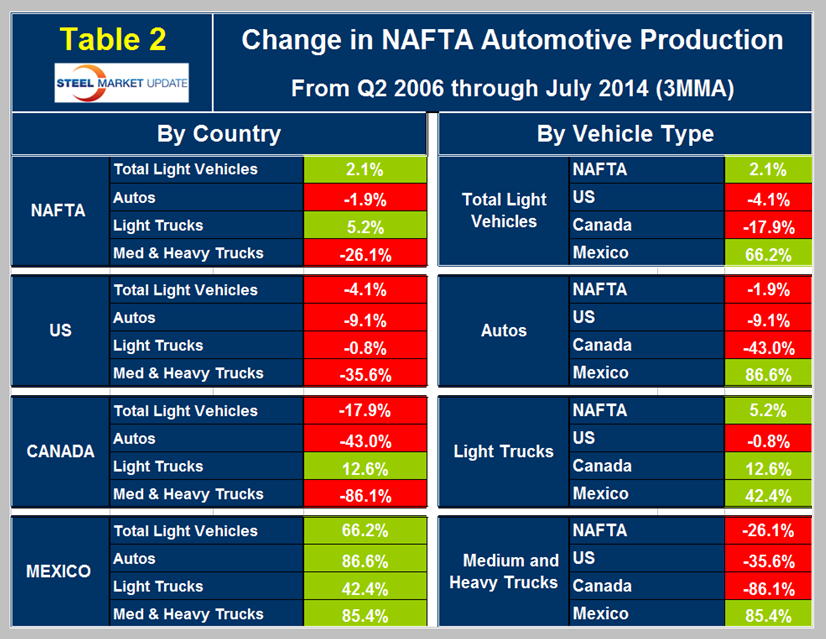

Total light vehicle production in NAFTA on a three month moving average basis is now 2.1 percent higher than it was in the pre-recessionary peak of Q2 2006, however there is a big difference between the recoveries of the three nations, (Table 2).

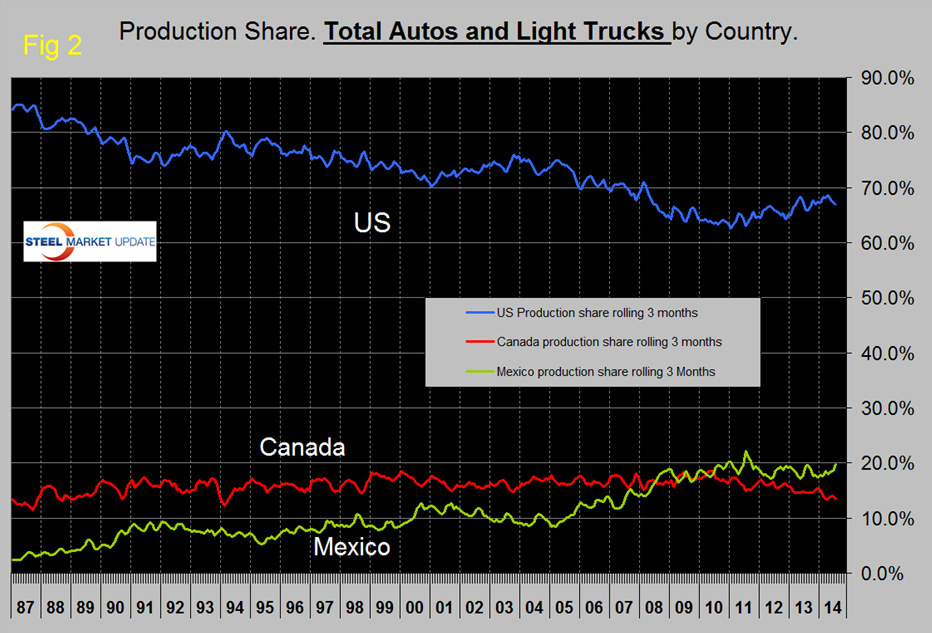

The US is down by 4.1 percent, Canada is down by 17.9 percent and Mexico is up by 66.2 percent. These numbers overstate the performance of Mexico which had a very rapid surge in late 2010 but has since slowed to a rate less than half that of the US on a rolling 12 month basis y/y. Figure 2 shows the production share of light vehicles achieved by the three nations since 1987. The US and Mexico are battling for share but Canada continues to decline. Currently the capital expenditure plans of the auto companies in the US far exceed Mexico.

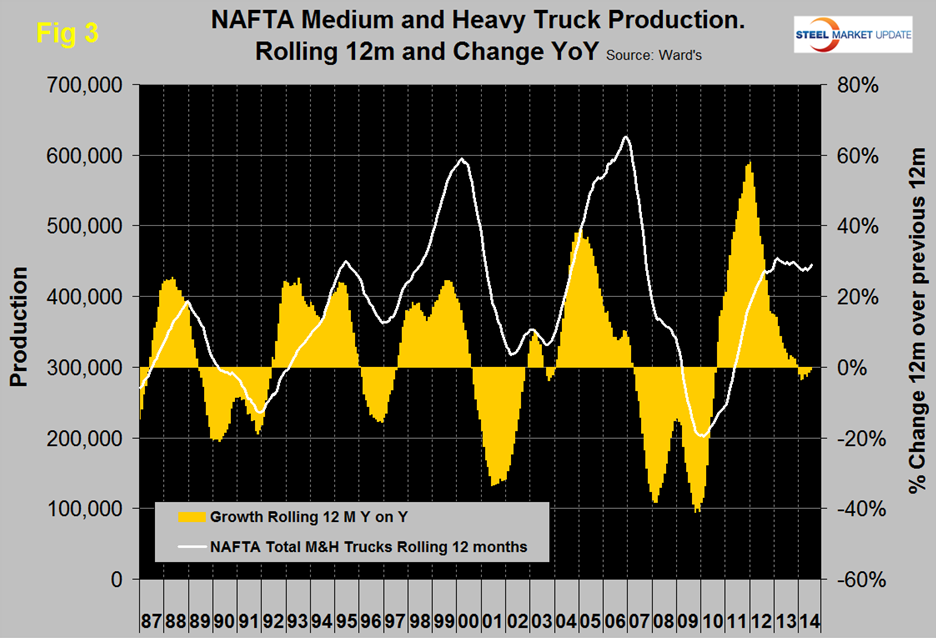

Medium and heavy truck production in NAFTA in July was 508,356 units SAAR, the best performance since January 2007. On a rolling 12 months basis production is still down year over year but the decline has been slowing and fell to 0.7 percent in 12 months through July, (Figure 3).

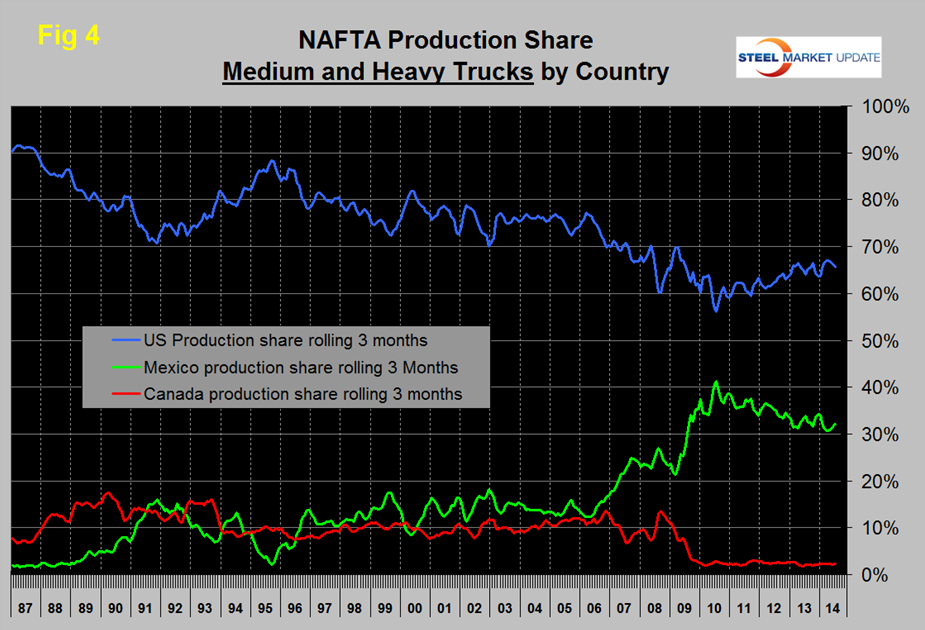

This decline has occurred every month so far in 2014 for NAFTA as a whole and ranges from positive 0.94 for the US to negative 7.8 percent for Canada with Mexico coming in at negative 3.4 percent. The production share trends for M&HTs is similar to light vehicles, (Figure 4).

The US has been gaining share for four years at the expense of Mexico. Canada’s share has been flat since late 2009.

Ward’s Automotive reported last week that light vehicle inventories increased by two days of sales in July to sixty one days. Inventories of the Detroit 3 increased by five to seventy six, the Asian manufacturers declined by two to forty seven, and the Europeans increased by seven to fifty six.

The SMU data file contains more detail than be shown here in this condensed report. Readers can obtain copies of additional time based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck and medium and heavy truck production and growth rate by country and production share of light vehicles by country broken out into autos and light trucks.