Market Data

August 21, 2014

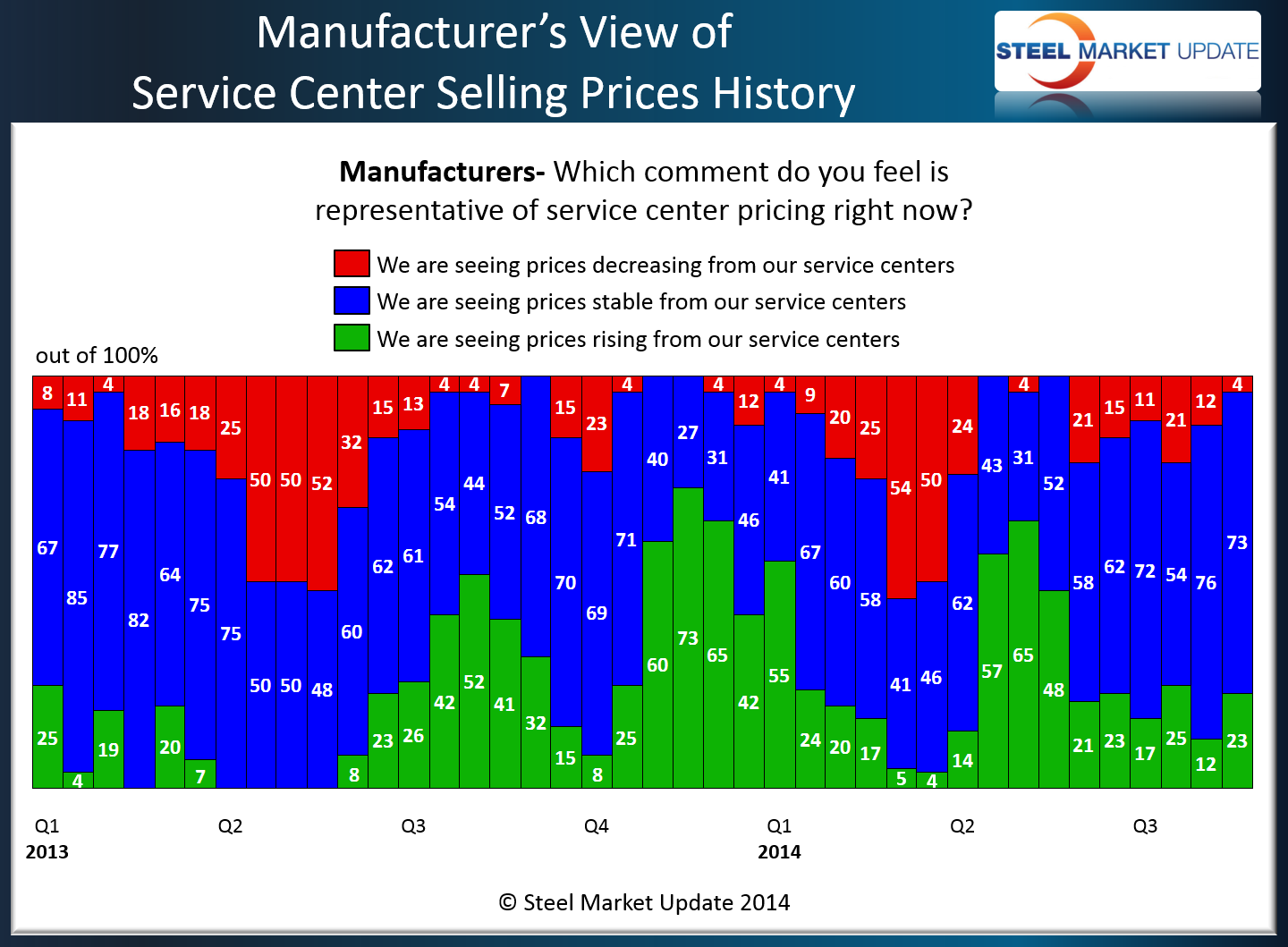

Service Centers Continue to Keep Price Momentum Going

Written by John Packard

Both manufacturing companies and service centers reported similar results regarding the status of spot pricing out of the distributors into their end user customers.

Manufacturers reported distributors spot pricing as being either stable (no change) which gathered 73 percent of the responses or rising which attracted 23 percent of those manufacturing companies who responded to this week’s survey. Only 4 percent reported seeing prices falling from their service center suppliers.

Seventy nine percent of the service centers reported spot prices as remaining the same while the balance of the distributors responding to this week’s survey reported prices as rising (21 percent).

We have seen the service centers as being actively supporting stable to higher spot prices for the past three months. You have to go back to late first quarter to see any price weakness being displayed out of the distributors.