Market Data

August 21, 2014

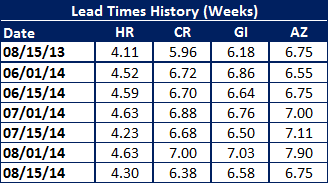

Mill Lead Times Decline from Beginning of the Month

Written by John Packard

Average mill lead times declined ever so slightly across all of the flat rolled steel products being watched by Steel Market Update. We have seen lead times bouncing within a relatively narrow range over the past couple of months as we continue to see a stable market.

Hot rolled lead times averaged 4.30 weeks down from 4.63 weeks reported at the beginning of the month.

Cold rolled lead times averaged 6.38 weeks down from 7.00 weeks reported at the beginning of August.

Galvanized also saw lead times drop from 7.03 weeks at the beginning of August down to 6.58 weeks this week.

Galvalume lead times declined the most of all the flat rolled products dropping by more than 1 week. At the beginning of August we recorded the average AZ lead time as being 7.90 weeks. As of this week AZ lead time averages dropped to 6.75 weeks.

Lead times are important as they indicate how strong (or weak) the mill order books are at this time and if changes in lead times are being reflected in changes in negotiations between the steel mills and their OEM or service center customers.

SMU Note: You can view the interactive graphic on our steel mill lead times data below when you are logged into the website and reading the newsletter online. If you have not logged into the website in the past and need your username and password, contact us at: info@SteelMarketUpdate.com or by calling 800-432-3475. If you need help navigating the website we would also be very happy to assist you.

{amchart id=”112″ SMU Lead Times by Product- Survey}