Prices

August 19, 2014

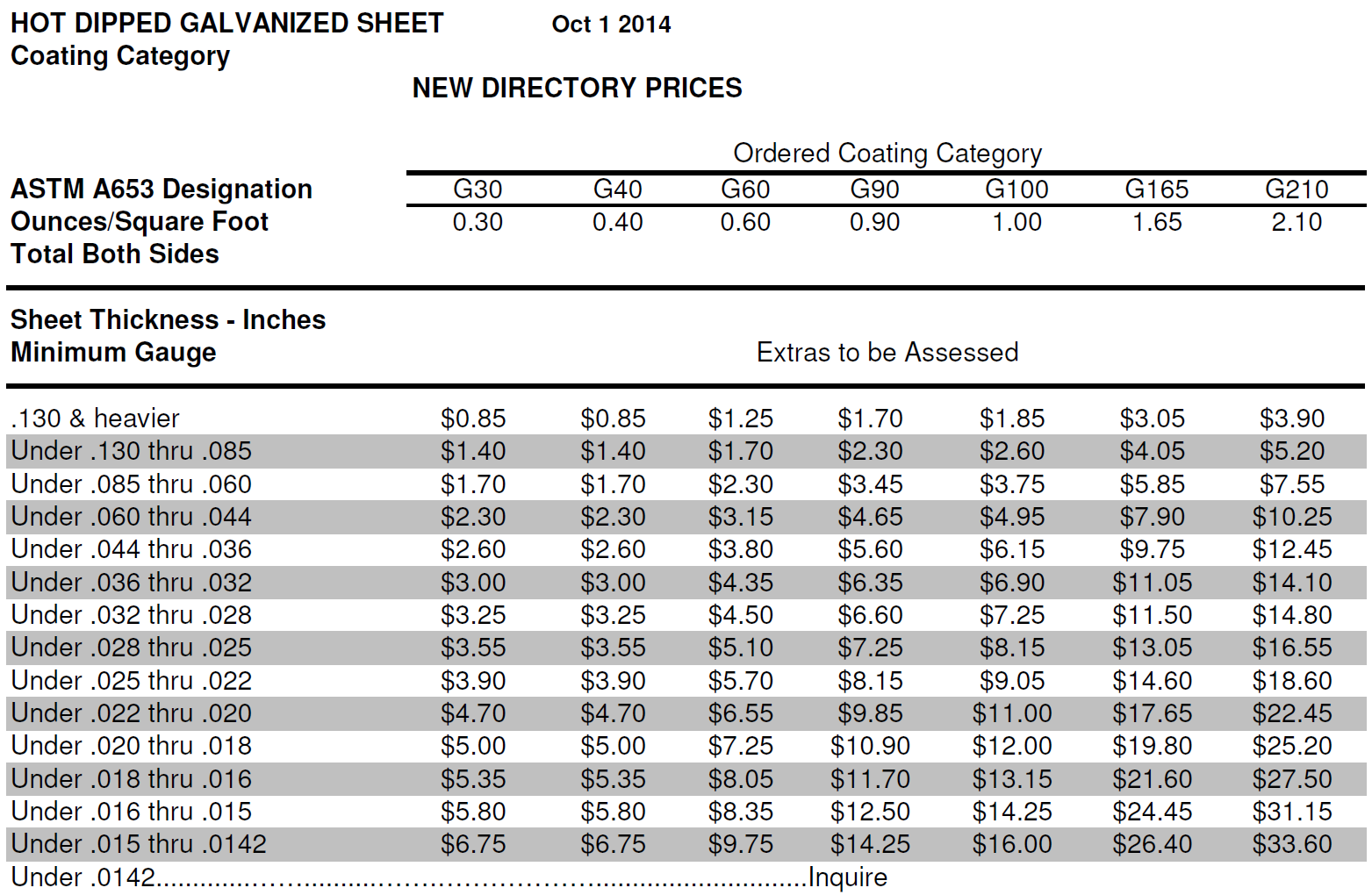

USS Raises Coating Extras for October 2014

Written by John Packard

U.S. Steel has begun to inform their customers of their intention to raise their zinc coating extras effective October 1, 2014. Unlike Nucor, USS did not go back to their 2011 price extras.

Based on our quick analysis, the under .020” thru .018” G90 extra is being increased by $1.05/cwt or 11.3 percent. The new Nucor extra for the same item is $9.75/cwt.

The under .085” thru .060” G90 extra has been increased by $0.45/cwt or 11.1 percent. When looking at .060” G90 (which is the item used by SMU, CRU and others to calculate GI index averages), the Nucor extra is $3.50 vs. USS at $3.45/cwt.

The under .032” thru .028” G60 extras was increased by $0.75/cwt or 16.7 percent. Looking at the Nucor extras for the same items, they are both at $4.50/cwt.

It will take some time to analyze the US Steel changes, compare them to Nucor and to other extras as they are announced. We will produce our analysis on our website later this week or by early next week.

In the meantime here is the new USS zinc coating extras: