Prices

August 12, 2014

US Scrap Exports Down 23.5% During 1st Half 2014

Written by Peter Wright

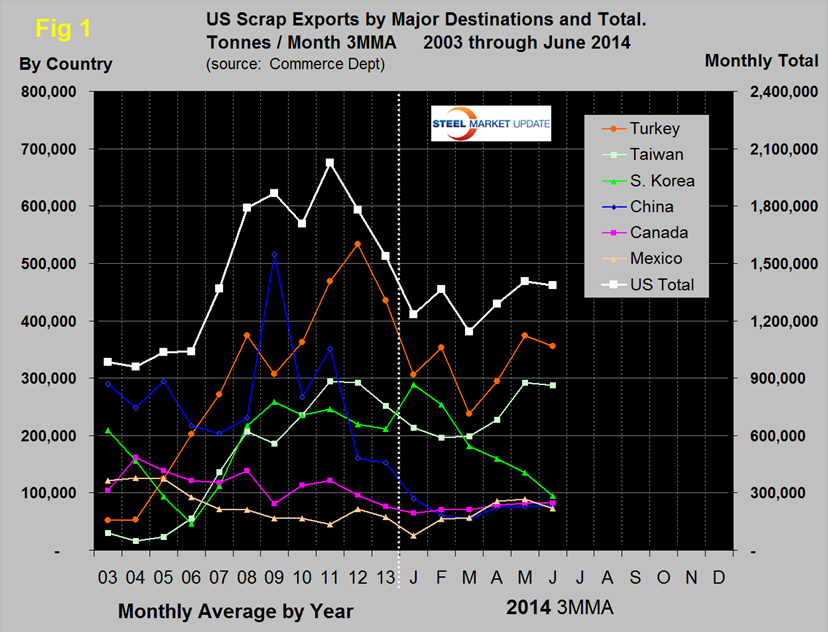

In the 1st half of 2014, scrap exports totaled 7,580,485 metric tons, down by 23.5 percent from the 1st half of 2013. In the single month of June exports were 1,270,041 tons, down from May’s volume of 1.549,070 tons. May had by far the highest tonnage of the year, the June volume was in line with February, March and April. Figure 1 shows that the three month moving average, declined by 1.4 percent in June and continued to be lower than the average in any year from 2007 through 2013.

The most obvious trend so far this year is the decline in tonnage to South Korea, down by 67 percent since January. Korea booked three cargoes in the first week of July after weeks of refusing to meet offered prices. The July price was up $8 per metric ton identical to the increase Thailand paid for a cargo of 80:20 #1 #2 heavy melt.

YTD 2014 compared to the same period in 2013, the Far East as a whole is down by 17.3 percent and China is down by 57.9 percent. On the same basis Turkey’s tonnage is down by 34.6 percent, almost a million tons. Other nations not considered in this analysis because they have been historically minor purchasers were down in total by almost 400,000 tons YTD. Some nations have taken more tonnage this year than last, Indonesia is up by 171,000 tons, Mexico by 122,000 tonnes, Vietnam and Thailand both by 91,000 tons. Tonnage moving North over the Canadian border is almost unchanged from last year.

Scrap export prices are reported by the AMM every Tuesday for an 80:20 mix of #1 and #2 heavy melt in Dollars per tonne FOB New York and Los Angeles for bulk tonnage sales. Prices on the East coast recovered by $15.37 to $363.70 between, June 16th and August 11th. The West Coast price was $344.99 on August 11th down by $9.58 since June 16th. The East Coast price has been higher than the West Coast since July 21st and the gap has been widening.