Market Data

August 10, 2014

Manufacturing Demand / Releases Continue to Improve

Written by John Packard

As mentioned in a previous article in this newsletter, during our flat rolled steel market survey process we break out the different market segments into questionnaires that are dedicated to their industry. This allows us to compare market trends to see if they match. A good example is manufacturing demand. We asked manufacturing companies if they were buying more, less or the same amount of steel right now than they bought at this time last year.

What we have been seeing out of the manufacturing companies since the beginning of April, is a steady improving trend of manufacturers reporting at higher and higher percentages that they are buying more steel than one year ago. Last week we found 43 percent of the manufacturing companies reporting that their company was buying more steel than one year ago. This is a 7 percent improvement over the past two weeks and a 28 percent increase since the first week of April 2014.

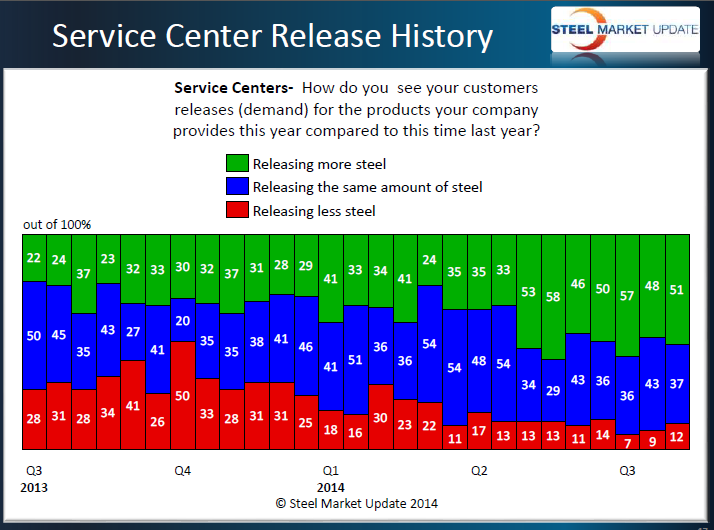

One way we check to see if the manufacturing responses are accurate is to look at our steel service center respondents as they report on whether their end users’ customers are releasing more, less or the same amount of steel as they were at this time last year. In the latest survey, we found a majority of distributors advising that their customers were releasing more steel (51 percent), 37 percent reporting releases being about the same as one year ago and 12 percent saying their customers were releasing less steel. The 51 percent is up by 3 percentage points since two weeks ago and is 16 percentage points higher than what we reported on April 1st.

Our history shows an improving release trend being reported by the service centers going back to late 3rd Quarter 2013.

If you would like to see more data from our flat rolled steel surveys you can access the data if you become a Premium Level member. Details are on our website under the subscribe tab. If you would like to upgrade your membership and you have some questions please contact our office: 800-432-3475 or by email: info@SteelMarketUpdate.com