Market Data

August 3, 2014

Global Manufacturing Growth Holds Steady in July

Written by Sandy Williams

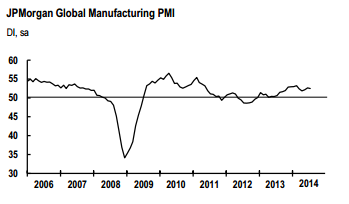

The JP Morgan Global Manufacturing PMI registered 52.5 in July, down just 0.1 point from June and indicating moderating growth. Indices for new orders and output were nearly unchanged from the prior month. The exports index increased at a faster rate, up 0.4 points to 51.5 in July. The employment index decreased by 0.4 points to 50.4.

The flat growth rate for the PMI in June contradicts last month’s commentary by JP Morgan that indicated “the stage is set for robust output gains in the coming months.” It serves as a reminder to look at longer term growth trends rather than month-to-month changes. The chart below shows the PMI has been generally in a positive growth trend since mid 2013.

The Czech Republic, US and Taiwan turned in the highest PMI ratings for July, followed by Ireland, Canada, Spain, the Netherlands and India. China growth was at an 18 month high.

Eurozone

The Eurozone PMI registered 51.8, unchanged from June’s seven-month low. Greece and France both showed PMI readings in contraction, at 48.7 and 47.8, respectively. Output in France declined at the fastest rate since December.

Weaker demand in the Eurozone kept selling prices down while input costs rose. The rate of inflation was subdued, however, said Markit. Employment levels decreased marginally.

“The situation in the eurozone has clearly worsened from the promising signs of economic revival seen earlier in the year,” said Chris Williamson, Chief Economist at Markit. “The manufacturing sector is showing signs of stalling, inflation is running at just 0.4% and the tensions with Russia are threatening to lead a further retrenchment of spending and investment by businesses and households.”

China

China reached an 18 month high for its HSBC China Manufacturing PMI with a reading of 51.7. Output, new orders and new exports all rose at faster rates in July. Input price inflation rose to its highest level since November 2013.

“The HSBC China Manufacturing PMI rose to 51.7 in the final reading for July, the highest since early 2013,” commented Hongbin Qu, chief economist, China and co-head of Asian Economic Research at HSBC. “This is slightly lower than the flash reading released earlier, as several sub-indices saw small downward revisions. Nevertheless, the economy is improving sequentially and registered across-the-board improvement compared to June. Policy makers are continuing with targeted easing in recent weeks and we expect the cumulative impact of these measures to filter through in the next few months and help consolidate the recovery.”

South Korea

South Korea manufacturing remained weak in July, rising slightly to a PMI reading of 49.3 in July but remaining below the 50.0 no-change mark for the third consecutive month. New orders decreased along with output. Weaker demand came primarily from the domestic front as new export orders declined only marginally. The government is instituting a new stimulus package to sustain demand for now. HSBC expects that a monetary stimulus may be required by the Bank of Korea.

Russia

The HSBC PMI rose for the fourth consecutive month registering a reading of 51.0 and rising out of contraction for the first time since October 2013. New orders rose but were weak due to the drop in new export orders yet manufacturing output expanded at the fastest pace since October 2013. The rise in output was attributed to stronger inventory trimming than was needed in anticipation of weakened customer demand.

“It follows that the output recovery registered in manufacturing in July is fragile, said Chief Economist (Russia and CIS), Alexander Morozov. “Weak export demand is of a particular concern, in this respect. Together with the recent surge in geopolitical tensions, this will not allow manufacturers to sustain output growth in the coming months, we think. Meanwhile, PMI inflation Indexes keep improving, showing that output prices growth eased to its 2H13 trend. This should translate into a moderation of consumer inflation in Russia going forward.”

Mexico

Manufacturing production grew at a slower pace in July with the HSBC Mexico Manufacturing PMI slipping to 51.5 in July from 51.8 the previous month. New orders picked up bolstered by an increase in exports. Input cost inflation rose for the second month as demand for raw materials increased. Mexico’s manufacturing sector is expected to continue to grow but at a slower pace supported by external orders.

Canada

Manufacturing in Canada hit an eight-month high in July according to the RBC Canadian Manufacturing PMI. The PMI rose to 54.3 from 53.5 in June signaling robust growth for the sector. Output and new orders rose along with export sales. Input buying increased as pre- and post-inventory levels dropped. Employment levels rose for the sixth consecutive month.

“Canada’s manufacturers kicked off the second half of 2014 on stronger footing, clearly benefiting from improving global economic activity – it’s encouraging to see the momentum,” said Paul Ferley, assistant chief economist, RBC. “With the U.S. economy pushing ahead, we expect this trend to continue.”