Market Data

July 24, 2014

SMU Survey: Purchase of Severstal Good or Bad for Your Company?

Written by John Packard

Steel Market Update (SMU) began our mid-July flat rolled steel market analysis (survey) on Monday of this week, shortly after Severstal announced the sale of their North American operations. We included questions about the sale both as a group and in industry segments of the survey.

As a group, those responding were of the opinion that steel mill consolidation would result in higher flat rolled steel prices. Sixty one percent of the respondents believe prices will rise while 2 percent were of the opinion that prices would fall. The remaining 37 percent do not believe consolidation will have any direct impact on pricing.

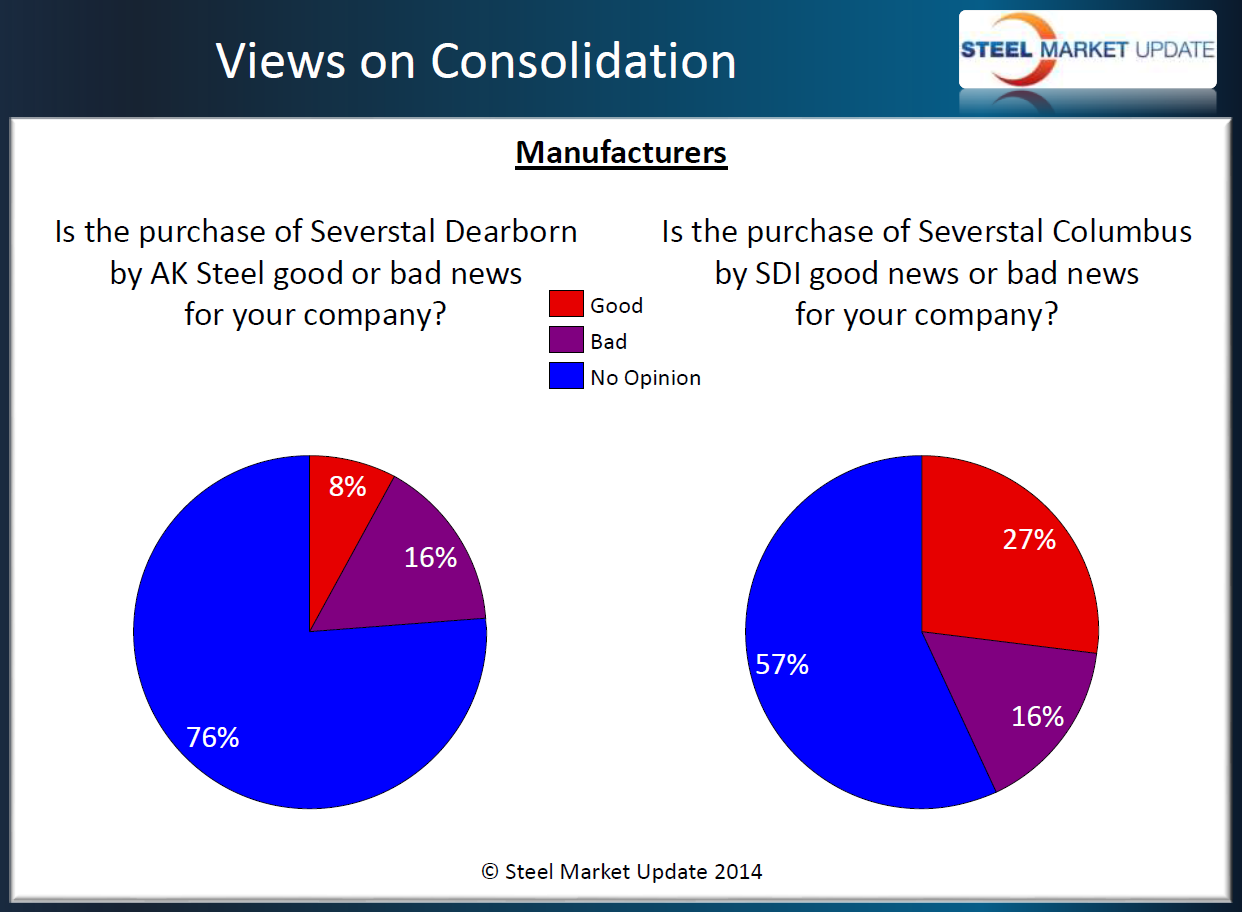

We asked the manufacturing companies responding to our survey if the purchase of Severstal Dearborn by AK Steel would be good or bad news for their company. We found 8 percent of the manufacturing companies reporting it would be good news, 16 percent bad news, and the balance not expressing an opinion on the subject at this time.

We asked the same question regarding the Steel Dynamics (SDI) purchase of the Columbus plant and we found 27 percent responding it was good news, 16 percent as bad news and the balance having no opinion at this time.

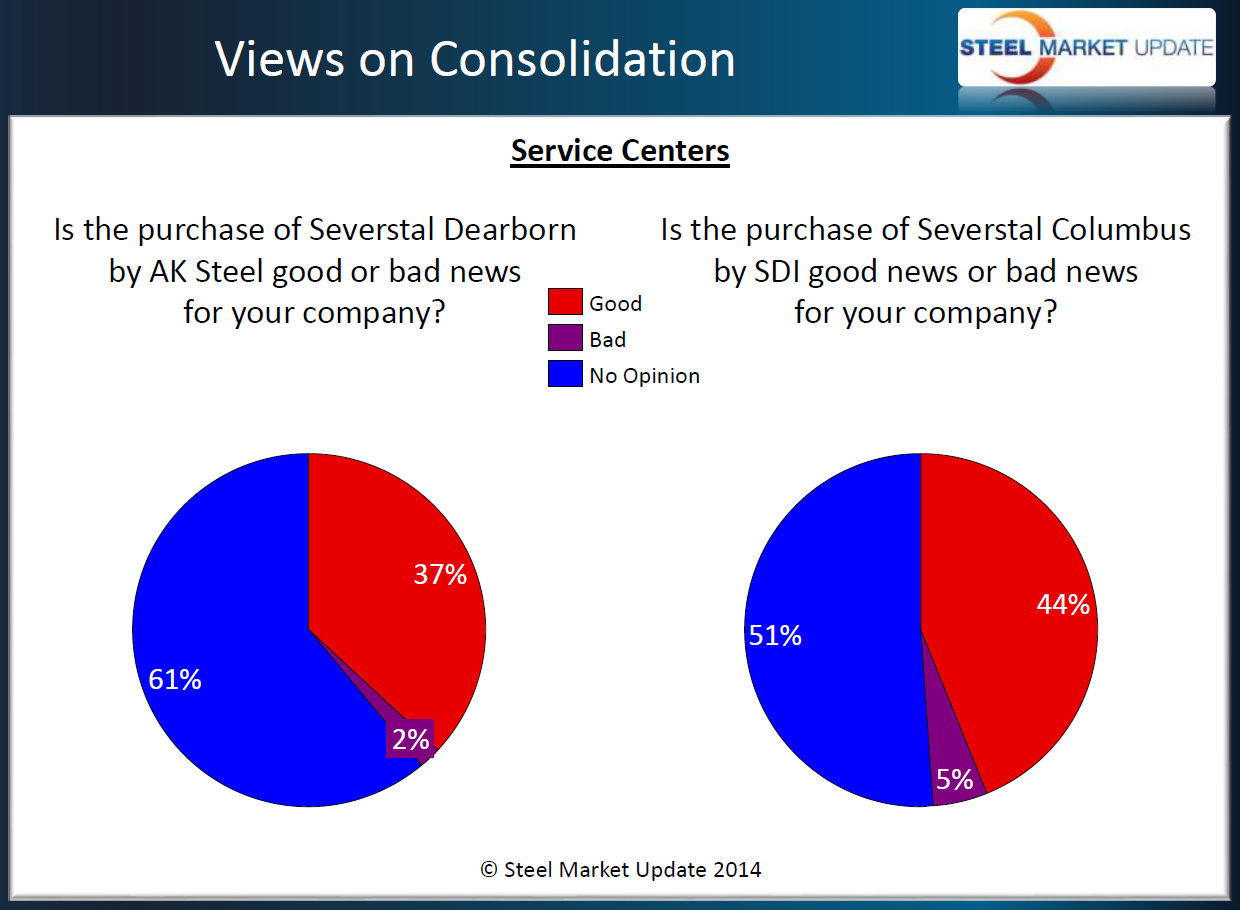

We found it interesting to compare the service center responses to those of the manufacturer’s. We found 37 percent of the service centers believed the purchase of Dearborn by AK Steel would be good news for their company. Only 2 percent believed it would be bad news and 61 percent had no opinion at this time.

When looking at the SDI purchase of Columbus, we found 44 percent of the service centers felt it was a good thing for their company and 5 percent thought it was bad for their company. The remaining 51 percent had no opinion at this time.