Market Data

July 24, 2014

Mill Lead Times: Remain Steady

Written by John Packard

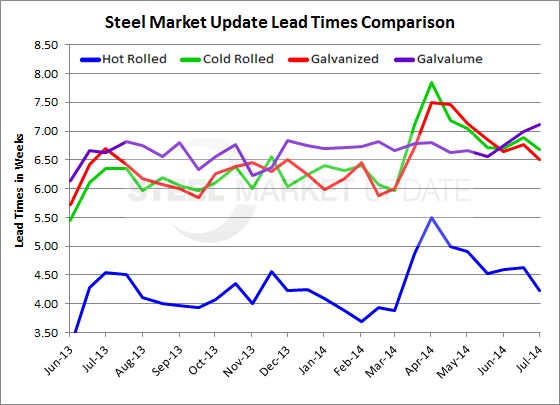

Mill lead times are an important indicator as to the strength or weakness of the mill order books. There are a number of ways to look at mill lead times. One is to go off the lead time sheets produced by some (not all) of the domestic mills. Steel Market Update does follow the lead times that are given to their customers. We also review lead times in our twice monthly flat rolled steel surveys where we take the average of the responses from manufacturing companies and service centers to come up with a number. Here are the trends we are seeing for hot rolled, cold rolled, galvanized and Galvalume production:

Mill lead times continue to be slightly extended as hot rolled averaged 4.23 weeks based on the respondents from this week’s flat rolled steel survey. The HRC average is down 0.40 weeks from the beginning of the month and is shorter than what we saw one year ago when HRC lead times averaged 4.55 weeks.

Cold rolled lead times averaged 6.68 weeks which is down slightly from the 6.88 measured at the beginning of the month and is the shortest lead time we have measured over the past few months. One year ago CRC lead times averaged 6.35 weeks.

Galvanized lead times fell to 6.50 weeks from 6.76 weeks measured at the beginning of July. Galvanized lead times have been slipping (getting shorter) when looking at the last few months. One year ago Galvanized lead times were 6.70 weeks.

Galvalume (AZ) lead times were slightly extended compared to what we saw at the beginning of July. Galvalume lead times averaged 7.11 weeks this week up from the 7.00 weeks seen at the beginning of July. One year ago AZ lead times averaged 6.63 weeks.