Market Segment

July 17, 2014

US Service Center Flat Rolled Shipment Rate Drops

Written by John Packard

Total steel shipments (all products) out of the U.S. service centers totaled 3,687,600 tons according to data released by the Metal Service Center Institute (MSCI) for the month of June. This represents an increase of 10.2 percent compared to June 2013. There were 21 shipping days during June 2014 compared to 20 shipping days last year.

The daily shipping rate was 175,600 tons down from 178,600 tons shipped on a daily basis during the month of May. Last year the daily shipment rate was 167,400 tons per day.

Total steel inventories stood at 8,535,300 tons at the end of the month. June 2014 inventories were 7.4 percent higher than one year ago. The months on hand was 2.3 months on an unadjusted basis or 2.4 months SA.

Carbon Flat Rolled

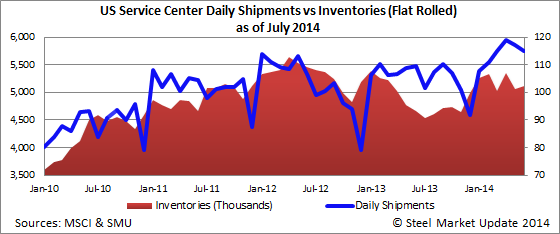

Distributors shipped 2,414,300 tons of flat rolled products during the month of June. This represents an increase of 10.1 percent above June of last year with its one less shipping day.

The daily shipment rate dropped from 117,200 tons per day in May to 115,000 tons per day during June. Last year service centers shipped 109,600 tons of flat rolled on a daily basis.

From the beginning of this calendar year through June, service centers have shipped 14,369,100 tons of flat rolled which is 4.8 percent improvement above 2013 levels.

Service center inventories stood at 5,120,400 tons at the end of June. This is up slightly over the 5,054,800 tons reported at the end of May. Inventories are 9.7 percent higher than one year ago. Based on the current daily shipment average the distributors have 2.1 months of inventory on hand (NSA) or 2.2 months on a seasonally adjusted basis. The distributors have been maintaining these inventory levels consistently since March 2014.

Carbon Plate

Plate shipments totaled 358,900 tons for the month of June. This is up 11.3 percent over June 2013 shipment levels with its one less day.

The daily plate shipment rate was 17,100 tons per day, down slightly from the prior month’s 17,600 tons per day. Last June the daily shipment rate was 16,100 tons per day.

For the first six months of the year the U.S. service centers have shipped a total of 2,185,600 tons of plate or 4.3 percent more than last year.

Plate inventories stood at 1,006,200 tons as of the end of June and are 2.2 percent higher than one year ago. At the end of May plate inventories stood at 975,800 tons. The distributors are carrying 2.8 months supply both non-seasonally adjusted and seasonally adjusted.

Pipe & Tube

Distributors shipped 248,500 tons of pipe and tube during the month of June. This was 11.6 percent more than June last year.

The daily shipping rate was 11,800 tons which was slightly higher than the 11,500 tons shipped during the month of May.

Pipe and tube service centers have shipped 1,421,600 tons during the first six months of the year or 2.4 percent more than one year ago.

Total pipe and tube inventories totaled 656,500 tons at the end of June. Inventories are 2.3 percent lower than one year ago. The month’s supply is 2.6 (NSA) and 2.7 (SA).