Prices

July 17, 2014

Are Chinese Cold Rolled & Galvanized Exports to USA Surging?

Written by John Packard

Because we are a media outlet we receive from the International Trade Administration notification of all kinds of dumping filings against any number of countries. Earlier this week there was a filing against Chinese tires, this morning it was something I couldn’t even pronounce and didn’t have a clue what it was. What we are waiting for is confirmation from the ITA that the rumored new trade cases against foreign flat rolled steel have indeed been filed. At this moment, the trade cases are speculative in nature but those within the industry feel confident they will happen and that China will be singled out.

The flat rolled steel industry is anticipating a filing against Chinese cold rolled and coated steels. This is something we have heard about for almost a year. Whether a trade case ever gets filed is debatable. We will have that debate at our Steel Summit Conference in September.

In the meantime, we evaluated the Chinese cold rolled and galvanized exports over the past 8 years to see if what is occurring now is indeed a surge and something of concern to the domestic steel industry.

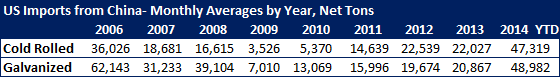

The Chinese have been regular exporters of cold rolled and galvanized steels for many years. We evaluated data going back to 2006 and this is what we found (monthly averages):

The last time the Chinese mills were exporting CR and GI anywhere near current levels was 2006 which was a year when the average monthly apparent steel supply was almost 22 percent higher than what we saw in 2013. The 2006 average monthly apparent steel supply was 11,463,840 tons (137,566,000 ton year). In 2013 the average was 8,977,080 net tons (107,725,000 ton year).

So, right away we are not comparing apples to apples since 2006 was a very strong year in the industry and the years 2013 and 2014 cannot compare as they are much weaker.

As you see by the table above, cold rolled shipments (shown as monthly averages) out of China have exceeded the averages for each of the past eight years including 2006. When you look at the data on a monthly basis in April, the Chinese mills exported 105,236 net tons of cold rolled to the United States.

With galvanized we get similar results although, as an average, 2014 monthly exports to the USA have not yet exceeded the 2006 levels. They have, however, exceeded all of the other years shown on our table. In May the Chinese mills exported 80,224 net tons beating out Canada as our biggest supplier of GI.

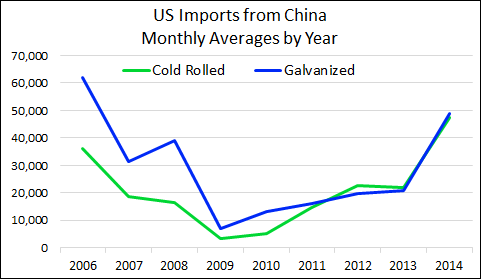

We wanted to provide a better visual for our readers and here is the data shown below in a graph. We will leave the answer to the question, Are the Chinese mills “surging” with their recent exports of cold rolled and galvanized, up to you to ponder and come to your own conclusions.