Distributors/Service Centers

July 13, 2014

Stability in Service Center Spot Prices

Written by John Packard

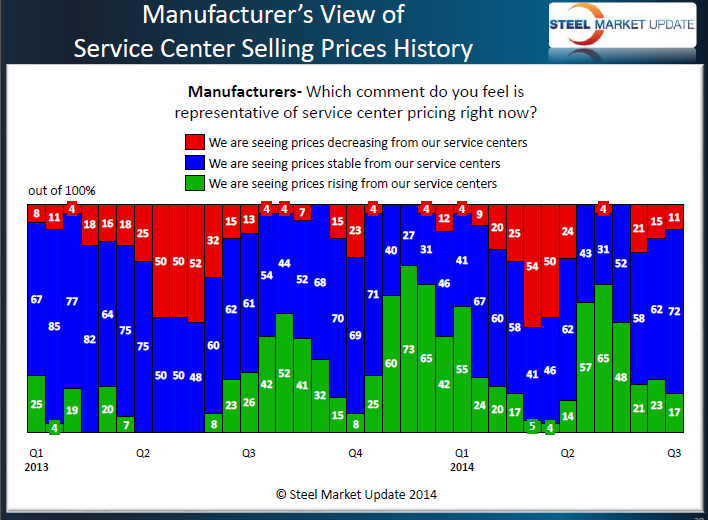

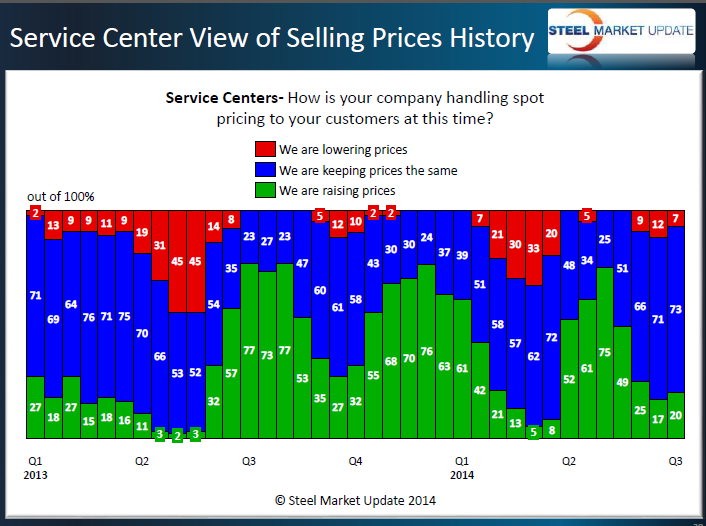

Last week, Steel Market Update conducted our early July flat rolled steel market analysis. One of the items we watch as a key market indicator is how the manufacturing companies and service centers report whether distributors are raising, lowering or maintaining flat rolled steel spot prices.

Just as the various indexes saw little movement in spot pricing out of the flat rolled steel mills. The manufacturing companies responding to our steel industry survey found a reduction in those service centers asking for price increases (17 percent vs. 23 percent in mid-June) and a lower percentage of our respondents were offering reduced spot prices (11 percent vs. 15 percent in mid-June). Of the manufacturing group, 72 percent of those respondents reported service center spot prices as stable, up 10 percent from mid-June.

We appear to be in a Goldilocks moment (see graphic below).

The service centers as a group responding to our market analysis survey reported stable spot pricing (73 percent) with 20 percent reporting they were raising prices (down from 75 percent at the beginning of May) and 7 percent reported their company as lowering spot prices (up from 0 percent in May).

Much the same results as what our manufacturing companies were reporting (see below).

For the month of July, Executive Level members can access our full survey results on the Steel Market Update website. The survey results can be found under the Analysis tab in the top toolbar. Please contact us if you have any questions: 800-432-3475 or info@SteelMarketUpdate.com.