Prices

July 13, 2014

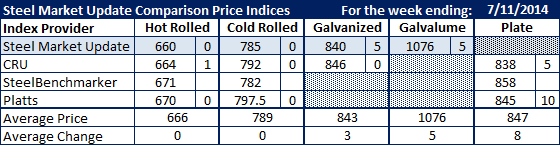

SMU Comparison Price Indices: A Quiet Week

Written by John Packard

This past week saw very little movement in any of the indexes followed by Steel Market Update. Benchmark hot rolled averages ranged from a low of $670 per ton (SMU) to a high of $671 per ton (SteelBenchmarker). The only change from the previous week was in the CRU which rose $1 per ton to $664 per ton. The average of all the indexes at the end of the week stood at $666 per ton.

Cold rolled and galvanized saw no movement from one week to the next and our averages are $789 and $843, respectively (GI is based on .060” G90).

Galvalume rose by $5 per ton and we did see changes in plate pricing with two of the indexes taking their numbers up, CRU by $5 per ton and Platts by $10 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.