Market Segment

July 10, 2014

Steel Mill Lead Times Move Out

Written by John Packard

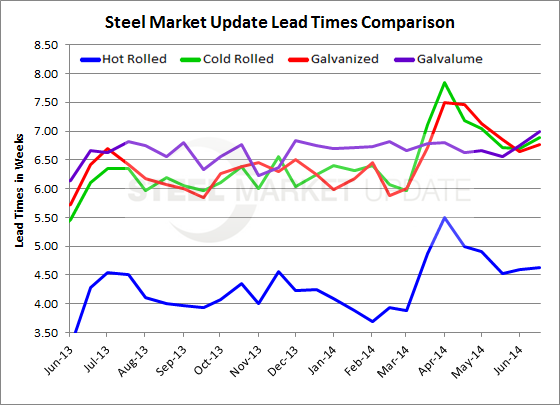

Average steel mill lead times maintained their slightly extended status according to the latest survey results from Steel Market Update. These lead times are not to be confused with mill specific promise dates which can vary radically (+/-) from the averages reported here.

Hot rolled lead times were reported as averaging 4.63 weeks up ever so slightly from the 4.59 weeks reported during the middle of June. The latest lead times were slightly higher than the 4.28 weeks reported one year ago.

Cold rolled lead times rose slightly to 6.88 weeks from the 6.70 weeks recorded in the middle of June. Last year CR lead times averaged 6.10 weeks.

Galvanized lead time move a tick to 6.76 weeks from 6.64 weeks and we slightly longer than the 6.42 weeks reported this time last year.

Galvalume lead times also rose to 7.00 weeks from 6.75 weeks and were slightly longer than the 6.67 weeks one year ago.