Market Data

July 1, 2014

Global PMI Up 0.6 Points

Written by Sandy Williams

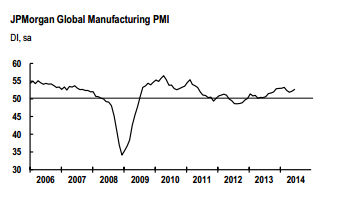

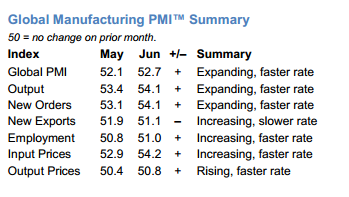

The JP Morgan Global Manufacturing PMI rose moderately to 52.7 in June from 52.1 in May, an expansion of the manufacturing sector for the 19th month. Production increased at the fastest rate since February due to a flow of new orders. International trade volumes were subdued in June reported JP Morgan and Markit. The June increase was not sufficient to fully recoup lost momentum from earlier in the quarter, according to the report.

“The global PMI suggests the growth of manufacturing output strengthened further into midyear to near 4.5% at an annual rate, which is well above trend. With new order inflows strengthening and inventories of finished goods indicated to be declining, the stage is set for robust output gains in the coming months,” said David Hensley, Director of Global Economics Coordination at JP Morgan.

Eurozone

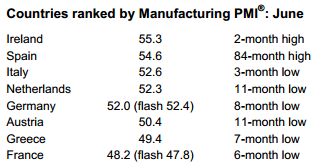

Growth momentum in the Eurozone is beginning to lose steam with both production and new order expanding at slower rates in June. The June Markit Eurozone Manufacturing PMI was down to 51.8 from 52.2 in May.

“The overall picture is a reminder of just how fragile the region’s recovery is looking,” said Chris Williamson, Chief Economist at Markit. “Employment is barely rising in the manufacturing sector as companies worry about waning growth of new orders, which reflects very subdued demand for goods from households and businesses. The slowdown will put pressure on policymakers at the ECB to do more to prevent recovery from stalling, and we will no doubt see more calls for full-scale easing to be implemented.

The HSBC China Manufacturing PMI rose to 50.7 in June, coming out of a contraction reading of 49.4 in May. Stronger demand and quicker depletion of stocks supported output growth. Exports rose for the second consecutive month.

“The economy continues to show more signs of recovery, and this momentum will likely continue over the next few months, supported by stronger infrastructure investment,” commented Hongbin Qu, Chief Economist & Co-Head of Asian Economic Research at HSBC. He added that “a slowdown in the property market will continue to put pressure on growth in the second half of the year. Fiscal and monetary policy is expected to remain accommodative until the recovery is sustained.”

South Korea

Weak demand caused output and new orders to fall further in South Korea during June. The HSPC South Korea PMI registered 48.4, falling from 49.6 in May. The rate of decline was the fastest since August 2013. Export demand weakened slightly in June, marking the third monthly decrease in a row.

Japan

Japan manufacturing recovered in June, moving from 49.9 on the JMMA Manufacturing PMA in May to a solid 51.5 in June, exceeding its flash reading of 51.1. Markit economist Amy Brownbill says the increased sales tax implemented in May appears to have had only a temporary impact on Japanese manufacturers. Employment growth from new reforms by Shinzo Abe has yet to be fully realized.

Russia

Geopolitical pressures have taken a toll on manufacturing in Russia says HSBC. The manufacturing PMI registered 49.1 in June, remaining in contraction for the eighth consecutive month and the 11th time in the past 12 months. Output increased for the first time this year although new orders fell marginally. New export orders were down for the tenth successive month.

Brazil

Brazil manufacturing production took a sharp dip in June according to HSBC data. Output fell for the third consecutive month and at the quickest pace in 33 months. The manufacturing PMI slid further into contraction to 48.7 from 48.8 in May. Subdued demand was seen in a drop in new orders and purchase of inputs. Employment levels fell slightly, most likely due to cost-cutting policies. Brazil Chief economist at HSBC, Andrew Loes, said the disruption related to Brazil’s hosting of the World Cup also added to the decline in manufacturing.

Mexico

Mexico had moderate improvement in output and new business but increased cost inflation and decreasing employment numbers kept the PMI little changed at 51.8 from 51.7 in May. The automotive sector led manufacturing in June following a historical high in May.

Canada

Canadian PMI information will be released on July 2.