Distributors/Service Centers

June 24, 2014

Manufacturers & Service Centers Agree

Written by John Packard

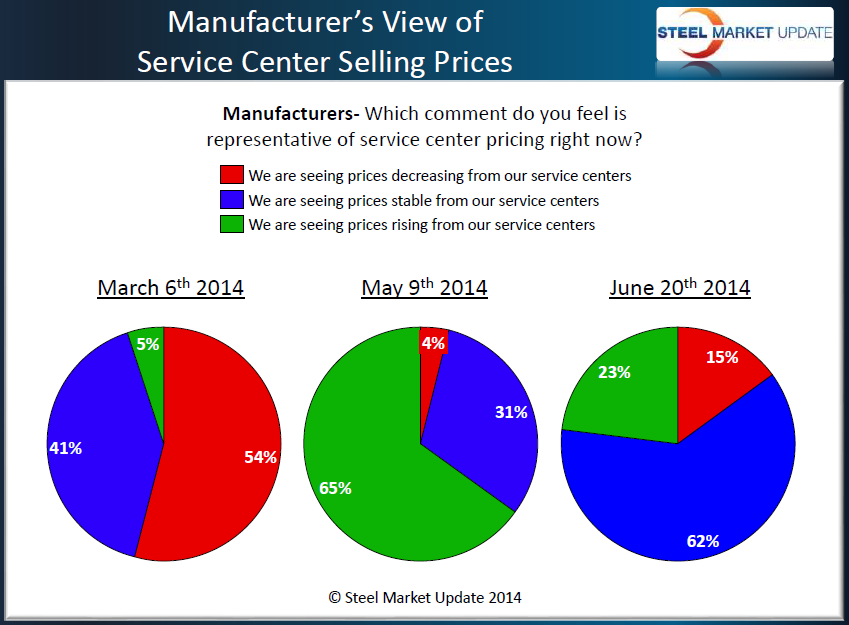

Manufacturing companies as well as their service center suppliers, reported spot service centers prices as basically stable with a tilt toward the beginning of a downward price cycle for service center flat rolled steel spot pricing. Again, this is service center spot price offers to their manufacturing customers which is being measured as opposed to steel mill spot flat rolled steel pricing.

A modest group of manufacturing companies (15 percent in last week’s survey) reported service center spot prices as declining, down from 21 percent of respondents a couple of weeks ago.

We are now seeing a 2 percentage point increase to 23 percent of the manufacturing respondents reporting service center prices as increasing. However, prior to early June we had a month and a half where the majority of respondents were reporting higher prices.

As you can see from the graphic provided below, there has been a significant reversal in service center spot price offers since the beginning of March. At that point in time spot prices were moving lower which was pressuring mill spot pricing. By the beginning of May, the market had changed and service centers were moving prices higher which supported higher mill pricing.

At this point in time, we are close to a market in equilibrium with most reporting prices as stable and a similar much smaller percentage reporting prices as swaying one way or the other.

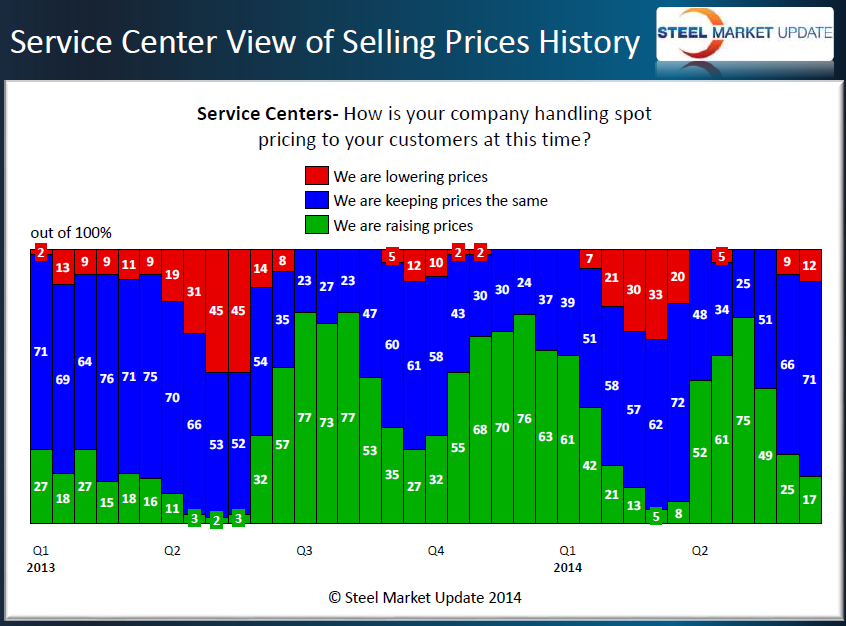

We are seeing similar results from the service centers with 12 percent of the distributors reporting spot prices as in decline and a slightly larger group (17 percent) reporting prices as rising. The vast majority of the service centers are calling the market as stable.

From SMU’s perspective we would call the market as in transition. The question is in what direction? In looking at a longer term graphic, it would appear to be the beginning of a downward price cycle (see below) although, like the previous cycle, we do not expect the length or the depth to be protracted. The real question is will we see a market similar to what we saw in late 3rd Quarter/early 4th Quarter 2013 or will it be more comparable to what we saw earlier this year?