Market Data

June 22, 2014

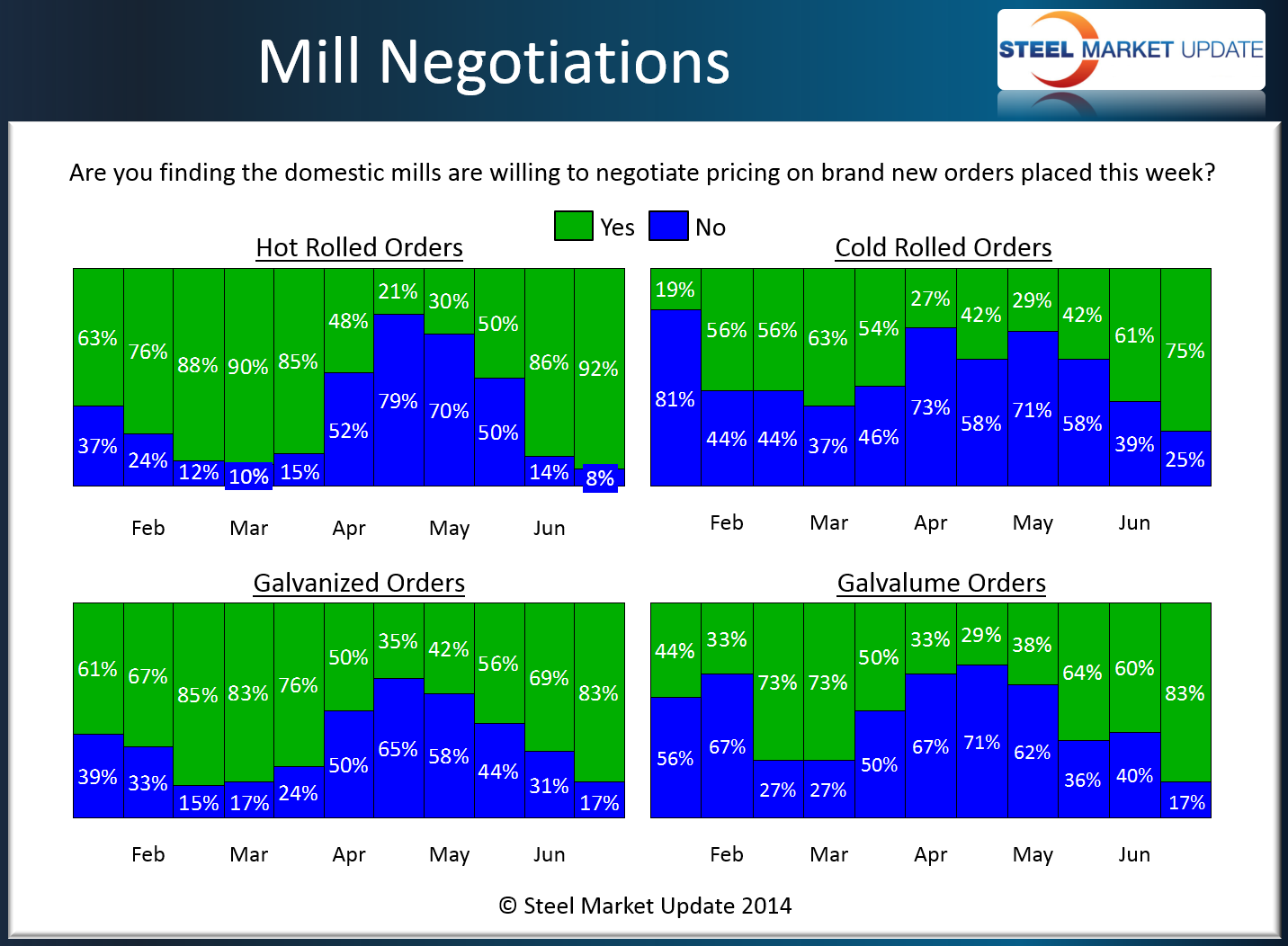

Survey Respondents Report Steel Mills as Willing to Negotiate Flat Rolled Steel Pricing

Written by John Packard

Based on the results of our survey from this past week, steel mills were actively discussing steel prices and our survey respondents were reporting mills as willing to negotiate pricing.

When looking at hot rolled the percentage of respondents reporting mills as willing to negotiate pricing rose from 86 percent at the beginning of June to 92 percent this past week.

Cold rolled was reported at 75 percent up from 61 percent at the beginning of the month.

Galvanized was 83 percent versus 69 percent at the beginning of the month.

Even Galvalume rose from 60 percent to its highest level in quite some time at 83 percent.

Based on the survey results the expectation would be for steel prices to continue to trend lower over the next few weeks.