Market Data

June 8, 2014

Survey Results Point to Steel Prices Moving Lower from Here

Written by John Packard

SMU Price Momentum Indicator Adjusted to Lower from Neutral:

Steel Market Update conducted our early June flat rolled steel market analysis this past week. The results of our survey, coupled with information being gathered independently of our survey have prompted SMU to revise our SMU Price Momentum Indicator to Lower from Neutral. We now believe prices will trend lower over the next 30 days.

Beginning on Monday of last week, Steel Market Update invited slightly over 600 companies to participate in our questionnaire. The respondents came from the following market segments: 45 percent manufacturing companies, 39 percent service center/wholesalers, 7 percent trading companies, 4 percent steel mills, 4 percent toll processors and 1 percent suppliers to the industry.

As we already reported, SMU Steel Buyers Sentiment Index dropped 8 points to +54. Sentiment continues to be optimistic but we did capture a lower rating than what we saw in the middle of May.

The area of concern was regarding price expectations. As a group 61 percent of our respondents reported that they believe mill prices will head lower by the end of the month of June. Only 6 percent responded that they believe prices would move higher.

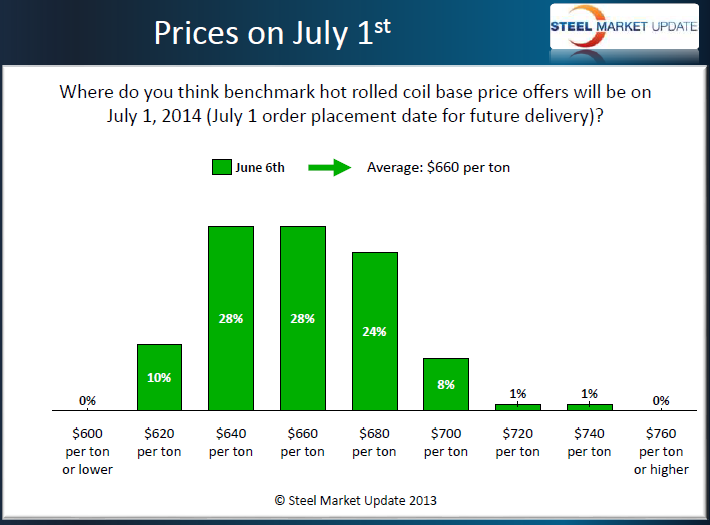

We also asked those taking our survey where they believe benchmark hot rolled price offers will be by the 1st of July. The graph below shows the responses but, as you can see the most popular responses were below our current SMU HRC spot price average of $670 per ton with 66 percent of the respondents believing prices would be at $660 or below by July 1st.

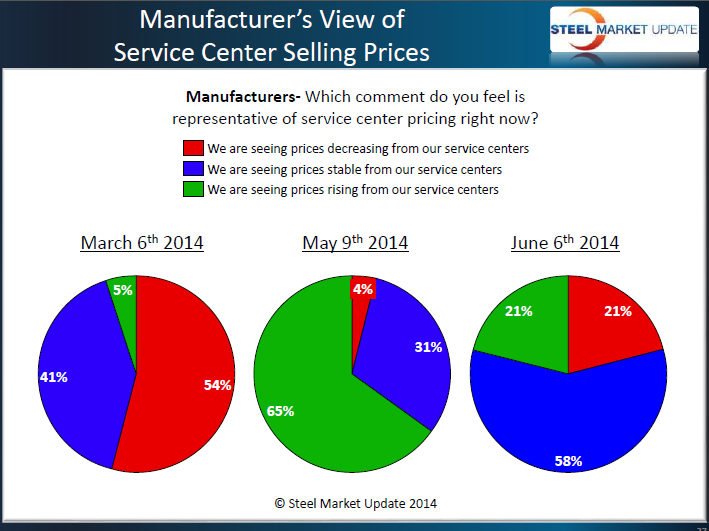

A second area of concern coming out of our market analysis from last week was regarding service center spot prices into the manufacturing segment of the industry. We are seeing the percentage of manufacturing companies reporting receiving lower spot prices from their service centers as growing. A full 21 percent of the manufacturing companies reported distributor spot prices as falling. This compares with only 4 percent one month earlier.

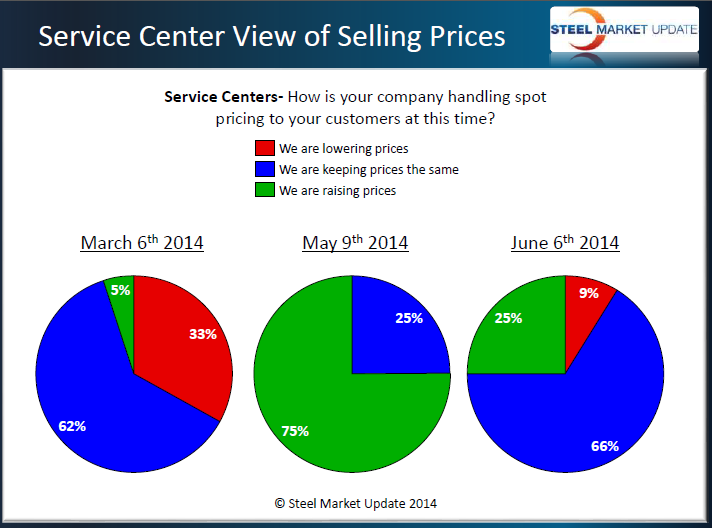

Service centers also shifted their views regarding spot pricing over the course of the past month. Back in early May 75 percent of the service centers reported they were raising spot prices. One month later that number has dropped to 25 percent and 9 percent admit their company had begun to lower prices to their end user customers. It is this shift in support for higher prices that concerns us when it comes to the ability of steel mills to hold prices from here.

We also reported last week that mills were much more willing to negotiate flat rolled steel items with every product registering at least 60 percent response rate, indicating the mills as more willing to negotiate pricing.

We have reported on the flood of foreign steel that continues to hit the U.S. ports as we sit here and write this article. The spread is well above $60 per ton on virtually all products which makes buying foreign steel somewhat “risk free” to those buying the product for future delivery. At the same time, we heard from at least one service center who reported they were going to move off the foreign tonnage and any excess tons that they have on the floor ASAP. The process of moving inventory in anticipation of lower priced domestic steel can become a self fulfilling prophecy if enough companies participate.

We have also seen a number of the domestic mills on various products make price adjustments over the last two weeks. We are aware that AK Steel has caught up on their hot rolled and cold rolled order books and other mills are out looking for June and early July tonnage.

We need to be aware that US Steel and ArcelorMittal USA may both be in unusual situations due to production issues, but production rates are rising and there are plenty of foreign tons available.

The market is expecting dumping suits to be filed on cold rolled and coated. However, until that happens or something else occurs that will allow a finger to be stuck into the dam to stop the leaking, until then we are adjusting our SMU Price Momentum Indicator to Lower from Neutral.