Prices

May 27, 2014

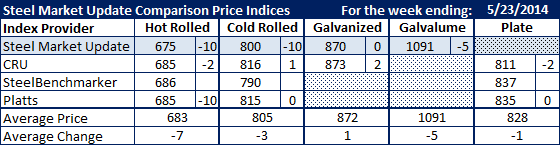

SMU Comparison Price Indices: Prices Slip

Written by John Packard

What SMU found interesting when looking at flat rolled steel price movement over this past week is Platts, the industry optimist recently, dropped their benchmark hot rolled pricing multiple times as the week progressed. Platts ended the week down $10 per ton to $685 per ton. The $685 is where SMU had its HRC index the week prior to last. We ended the week down $10 to $675 per ton. CRU matched Platts while SteelBenchmarker did not report new numbers last week.

Cold rolled prices held steady on Platts and CRU while SMU saw CRC down $10 per ton. Galvanized prices remained fairly steady at $870-$873 for .060” G90. SMU Saw Galvalume down $5 to $1091 per ton for .0142” AZ50 Grade 80 coils.

We saw a wide spread in plate prices between CRU ($811) and Platts ($835) and SteelBenchmarker ($837).