Market Data

May 27, 2014

Consumer Confidence Approaching Long Term Average

Written by Peter Wright

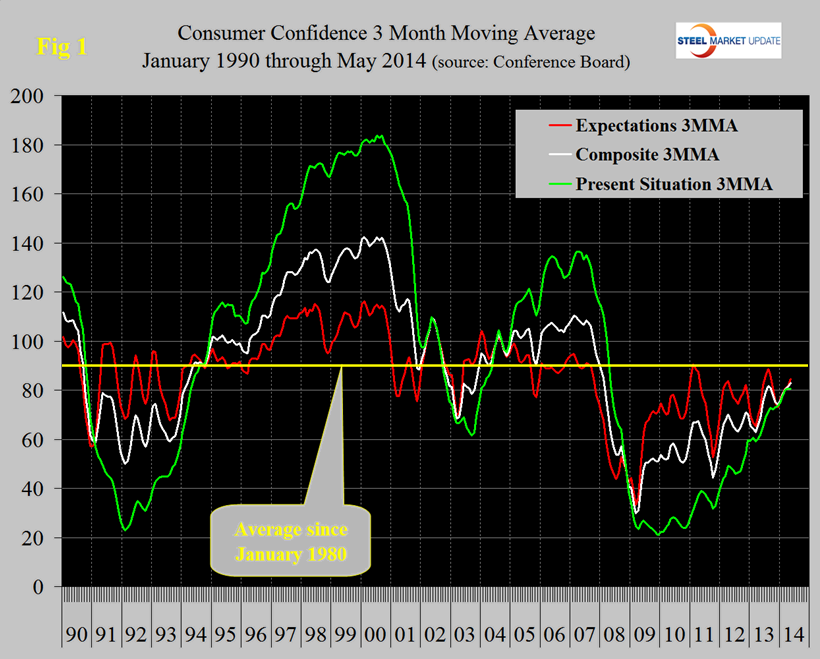

The consumer confidence index increased by 1.3 in May. The view of the present situation rose by 1.9 as expectations rose by 0.9. These two components are converging, as they always do at this stage of a recovery, after which the view of the present situation will take the lead. On the whole consumer confidence is now approaching the long term average since 1980. The three month moving average (3MMA) of the composite rose by 1.6 and in this view the driver was entirely in expectations, (Figure 1).

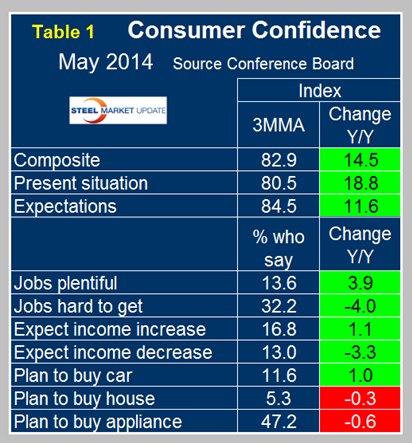

On a year over year basis using a 3MMA the composite is up by 14.5 lead by consumers view of the present situation which is up by 18.8, (Table 1).

The bad news in the May report is that intentions to buy both a house and an appliance have both become negative year over year. This is the first time in over a year that housing has been negative. Intentions regarding appliances tend to be more erratic but the 0.6 negative result for May is the worst in over a year. Year over year the consumers view of job opportunities is improving as are income expectations. Intentions for auto purchase are up year over year.

The official statement from the Conference Board read as follows: The Conference Board Consumer Confidence Index Improves in May

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was May 14.

Says Lynn Franco, Director of Economic Indicators at The Conference Board: “Consumer confidence improved slightly in May, as consumers assessed current conditions, in particular the labor market, more favorably. Expectations regarding the short-term outlook for the economy, jobs, and personal finances were also more upbeat. In fact, the percentage of consumers expecting their incomes to grow over the next six months is the highest since December 2007 (20.2 percent). Thus, despite last month’s decline, consumers’ confidence appears to be growing.”

Consumers’ assessment of present-day conditions improved in May. Those stating business conditions are “good” decreased to 21.1 percent from 22.2 percent, while those stating business conditions are “bad” declined to 24.1 percent from 24.8 percent. Consumers’ assessment of the labor market was more favorable. Those claiming jobs are “plentiful” rose to 14.1 percent from 13.0 percent, while those claiming jobs are “hard to get” decreased slightly to 32.3 percent from 32.8 percent.

Consumers’ expectations increased slightly in May. The percentage of consumers expecting business conditions to improve over the next six months edged up to 17.5 percent from 17.2 percent, while those expecting business conditions to worsen decreased marginally to 10.2 percent from 10.5 percent.

Consumers were more positive about the outlook for the labor market. Those anticipating more jobs in the months ahead increased to 15.4 percent from 14.7 percent, while those anticipating fewer jobs edged up to 18.3 percent from 18.0 percent. The proportion of consumers expecting their incomes to grow increased to 18.3 percent from 16.8 percent, but those expecting a drop in their incomes also increased, to 14.5 percent from 12.9 percent. (Source: The Conference Board)