Market Data

May 22, 2014

Steel Mills More Willing to Negotiate Steel Prices

Written by John Packard

Lead times are reported as being relatively stable compared to two weeks ago, but down slightly from the cycle highs which were achieved within the past two months. Our manufacturing and service center respondents reported the domestic steel mills as becoming more flexible in their flat rolled steel price negotiations.

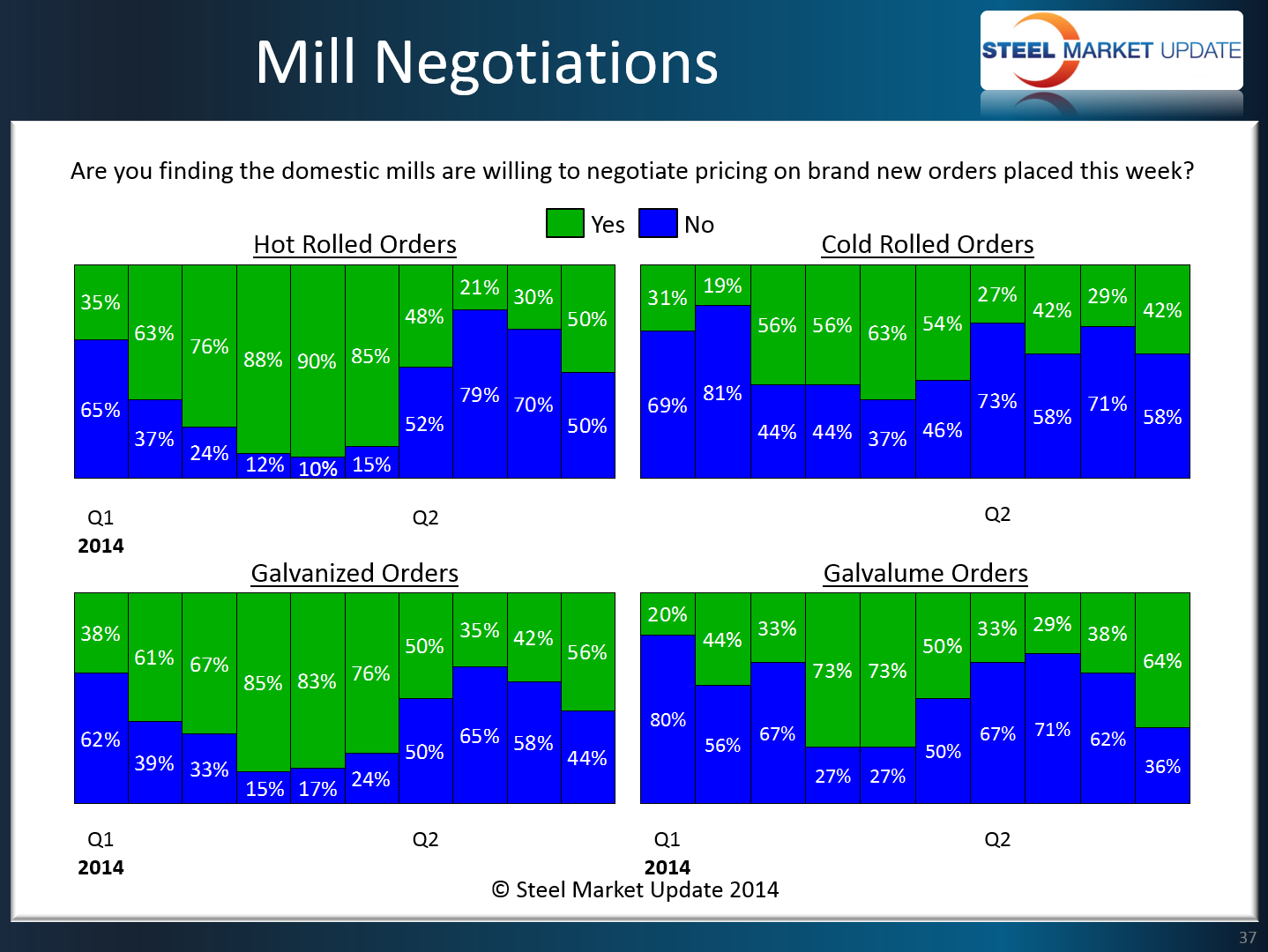

Fifty percent of the manufacturing companies and service centers responding reported the domestic steel mills as willing to negotiate hot rolled pricing. This is up from 30 percent at the beginning of the month of May and well above the 21 percent measured back in mid-April 2014.

Cold rolled continued to be the one product where the mills were “stingier” and less willing to negotiate pricing. Only 42 percent reported the mills as willing to negotiate CR pricing. This is an increase of 29 percent at the beginning of this month.

Negotiation on Galvanized grew from 42 percent to 56 percent. The low point in the cycle was 35 percent reported during the middle of April.

Galvalume was reported as the most flexible with 64 percent of our respondents reporting AZ mills as willing to negotiate. The percentage of those reporting a willingness to negotiate this week is up from 38 percent at the beginning of May and more than double what we reported during the middle of April (29 percent).

Negotiation data suggests that prices are either turning or about to turn as buyers become more aggressive and steel mills more receptive to the idea of negotiating. For example, SMU has heard that the domestic mills have pretty much abandoned the $700 per ton hot rolled spot price and are closer to $680-$680 per ton.

Our flat rolled steel price indices picked up some weakening in prices this week and we noticed that Platts has actually dropped HRC pricing twice this week.