Market Data

May 13, 2014

Price Increase Announcements Expected But Prices to Move Sideways from Here

Written by John Packard

Flat rolled steel buyers and sellers of steel have split personalities–believing the domestic steel mills will officially raise prices to the $700 level on hot rolled while at the same time believing that prices will essentially trend sideways from here between now and the first of June.

Last week Steel Market Update conducted our early May flat rolled steel market analysis. We invited approximately 600 companies, most being in the manufacturing or distribution segments of the market, to participate. We have been conducting these surveys twice per month since late 2008, shortly after SMU was formed as a company and began offering our newsletter to the public.

The most recent respondents consisted of 46 percent manufacturing companies, 38 percent service centers/wholesalers, 7 percent trading companies, 5 percent steel mills, 3 percent toll processors and 1 percent suppliers to the industry (such as a chemical or paint company).

As we mentioned in our last issue, demand is clearly showing signs of growth and our respondents are very optimistic about their company’s ability to be successful. Our SMU Steel Buyers Sentiment Index set an all-time high at +59 last week.

Price direction is a major concern of both our readers and those taking our survey. We asked those taking our survey if they anticipated the domestic steel mills to “officially” raise prices to the $700 level on hot rolled ($35.00/cwt) and $41.00/cwt ($820 per ton base) or above on cold rolled and coated. Most of the steel mills have not made official announcements taking spot prices to these levels.

Our respondents reported that they anticipate the domestic mills to continue to officially raise prices by 61 percent to 39 percent.

By the end of this month about one third of our respondents (34 percent) expect the price direction to be for higher prices. Almost half (47 percent) believe prices will be moving sideways at the end of the month and 19 percent think prices will be heading lower.

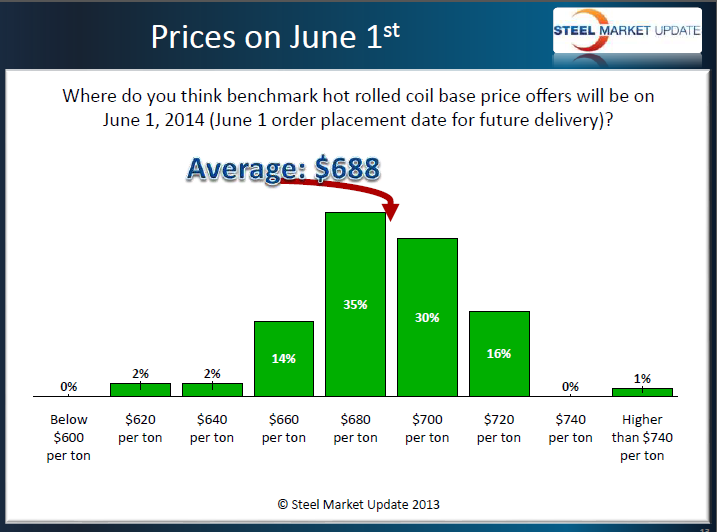

When you get to June 1st, those responding to our questionnaire believe the spot price will average $688 per ton which is right in line with current index averages for this week. We have provided the responses so you can get a feel for the balance of the responses.