Prices

May 11, 2014

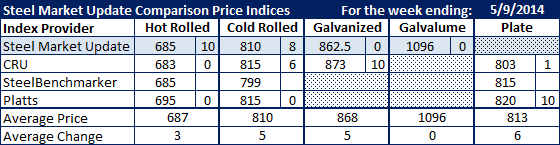

SMU Comparison Price Indices: Leveling Off

Written by John Packard

Steel Market Update was the big mover of hot rolled prices this week as we took our average to $685 per ton or $10 per ton higher than one week ago. CRU, Platts and SteelBenchmarker all held their numbers as is for the week. The hot rolled indexes average is up $5 per ton to $687 per ton.

Cold rolled spreads shrunk this past week. Platts kept their number the same at $815 per ton and CRU matched it. SMU has cold rolled at $810 per ton and SteelBenchmarker is at $799 per ton but they did not report new numbers this week (only twice per month).

Galvanized prices rose out of the CRU while SMU kept our average the same as one week ago.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.