Market Data

May 9, 2014

Bank Lending Practices- April 2014

Written by Peter Wright

The April 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months. This summary is based on the responses from 74 domestic banks and 23 U.S. branches and agencies of foreign banks. The following is an abridged version of the Federal Reserve report followed by SMU comments and graphs.

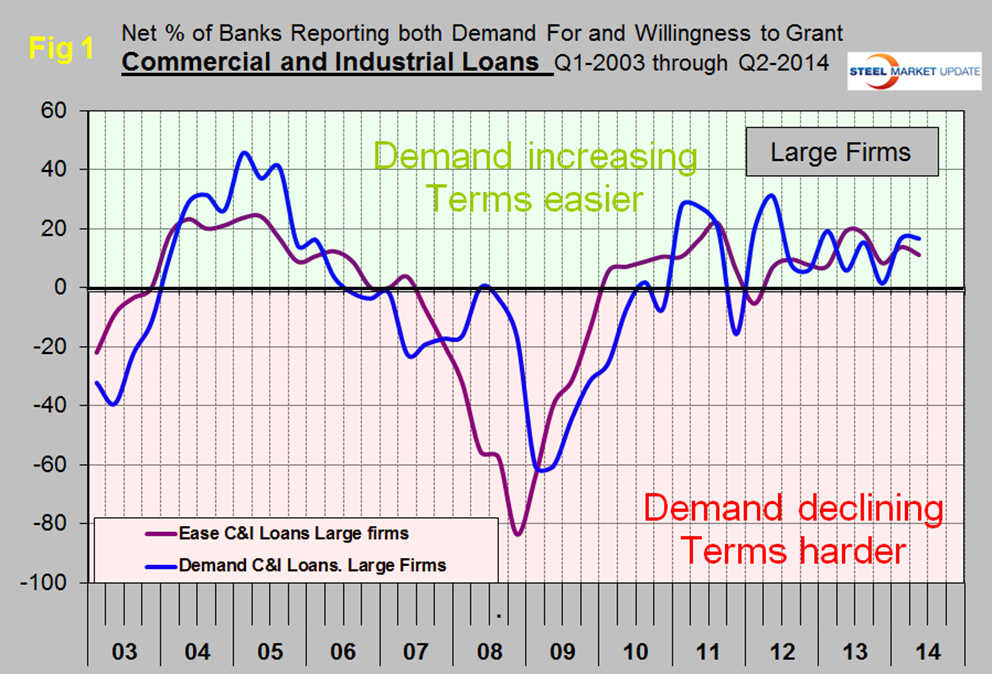

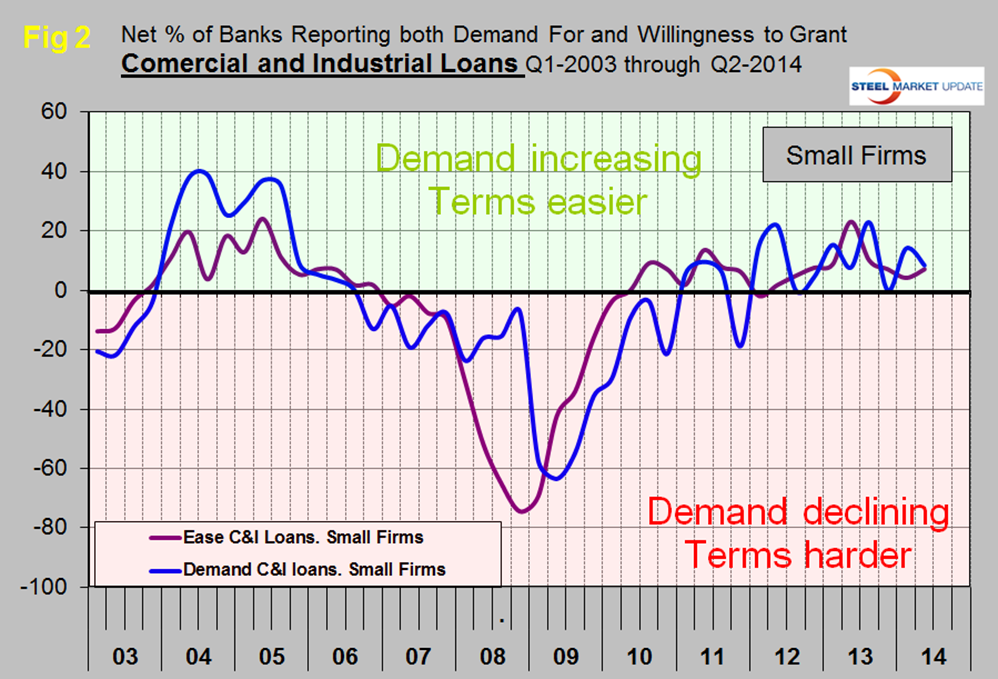

Questions on commercial and industrial lending: A small net percentage of domestic survey respondents reported having eased standards on C&I loans, both to large and middle-market firms and to small firms. Larger fractions of banks reported easing terms on C&I loans on net. Of the terms included in the survey, banks reported the most widespread easing on spreads of C&I loan rates over banks’ costs of funds. In addition, for all firm sizes, banks reported having reduced the cost of credit lines, decreased the use of interest rate floors, eased loan covenants, and reduced risk premiums.

On the demand side, slightly more banks reported having experienced stronger rather than weaker demand for C&I loans from firms of all sizes. To explain the reported increase in loan demand, banks cited a wide range of customers’ financing needs, particularly those related to inventories, accounts receivable, investment in plant or equipment, and mergers or acquisitions.

A few foreign banks reported that they had eased their C&I lending standards, while the rest described their standards as basically unchanged. Several foreign banks also reported having eased terms on C&I loans, while a smaller number tightened terms. Foreign banks reported stronger demand on net.

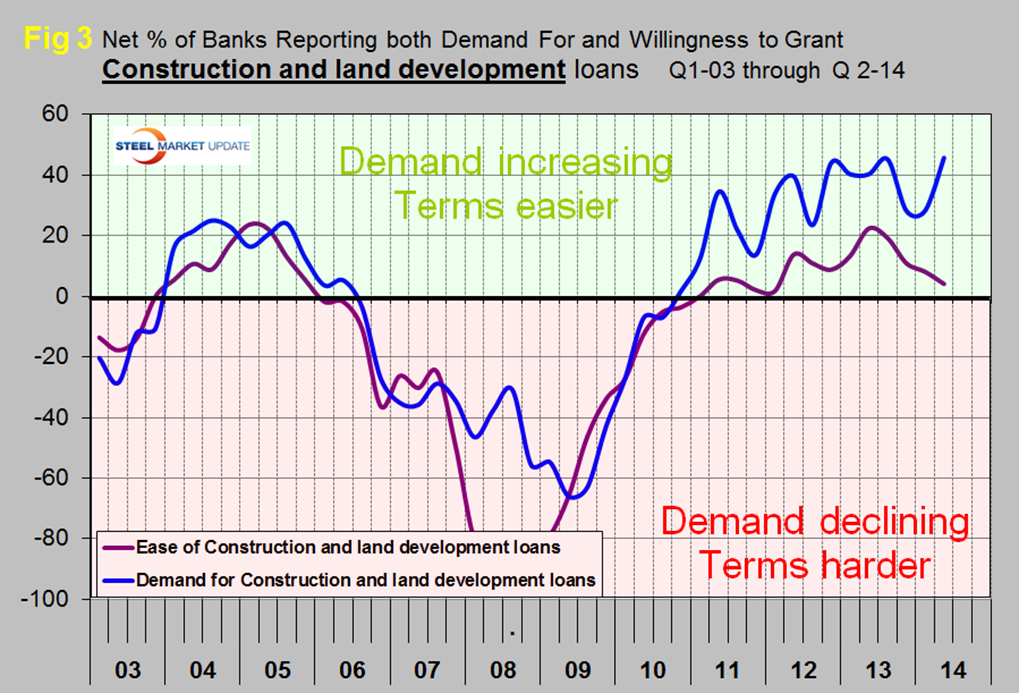

Questions on commercial real estate lending: More domestic banks reported that they had eased rather than tightened standards on each of the three categories of CRE loans included in the survey: construction and land development loans, loans secured by non-farm nonresidential structures, and loans secured by multifamily residential structures. For each subcategory of CRE loans, reports of stronger demand also outnumbered reports of weaker demand at domestic banks.

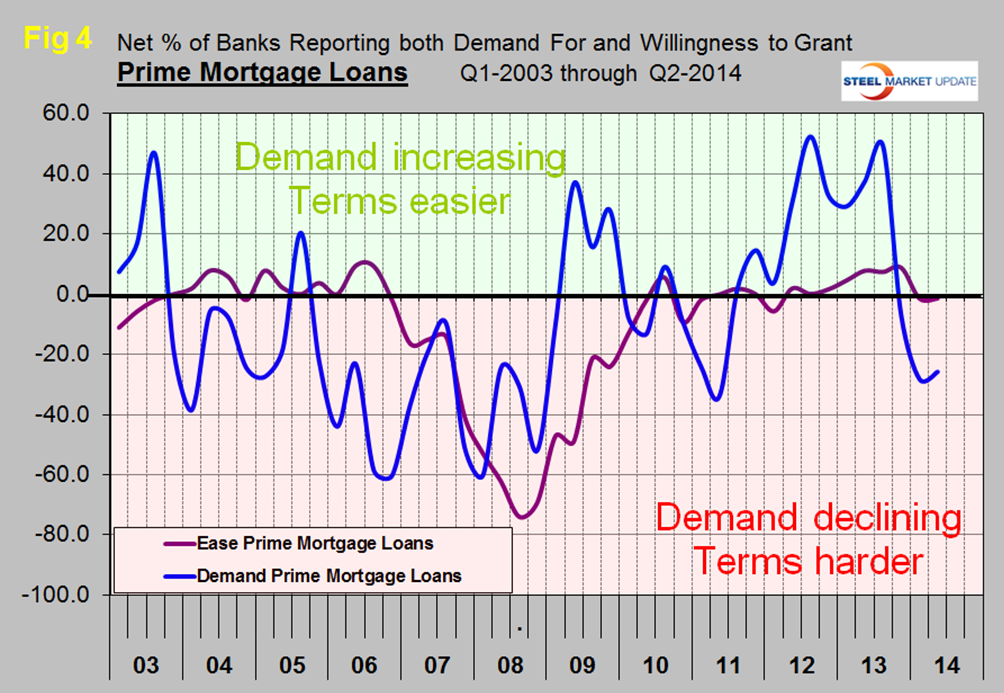

Questions on residential real estate lending: Domestic banks reported mixed changes in standards on prime residential mortgages, with several reports of both easier and tighter standards. Reports regarding home equity lines of credit were similarly mixed between easier and tighter standards. On nontraditional home loans, banks reported having tightened standards on net. Banks reported having experienced weaker demand for each type of mortgage loan on balance.

Questions on consumer lending: Several domestic banks indicated that they were more willing to make consumer installment loans as compared with the previous quarter, while no banks indicated they were less willing. A small fraction of banks eased standards on auto and consumer credit card loans, on net, while no bank reported any changes in standards on other consumer loans. Regarding consumer loan terms, several large banks increased credit limits on consumer credit cards, and banks reported having eased interest rate spreads on auto and other consumer loans on net.

The survey contained varied reports on changes in demand for consumer loans. Banks reported stronger demand for credit card and auto loans, on net, while reports of stronger and weaker demand for other consumer loans were roughly equal.

Looking ahead, a large fraction of banks, on net, expect higher growth (or lower contraction) during 2014 compared with 2013 in outstanding consumer credit card loans to prime or super-prime customers. A smaller net fraction of banks expect higher growth (or lower contraction) in outstanding consumer credit card loans to non-prime borrowers. Banks had a range of expectations for when they expect consumer credit card loan growth to stabilize at its new normal level at their banks. Some reported that such growth had already stabilized, while others expect it to stabilize between 2014 and 2016, and several other banks did not expect it to stabilize over the next few years. Among those that did expect such growth to stabilize, reports were varied as to whether growth would stabilize at a rate that would be higher or lower than the average rate their banks recorded in the years prior to the financial crisis.

There is a huge amount of valuable data in this report which can be accessed here.

At SMU we extract and graph the major elements in the survey. Regarding loans to businesses, the April survey indicated that demand for commercial and industrial (C&I) loans from large firms was little changed but declined for small, (< $50MM revenue) firms. Banks kept lending standards to both large and small firms little changed with a net 11.1 percent reporting easing to large firms and 7.1 percent easing to small firms, (Figure 1 and Figure 2). A majority of banks are reporting a strong increase in demand for construction and land development loans but lending standards have been tightening for four quarters, culminating on Q2 2014 at a net 4.1 percent reporting an easing of standards, (Figure 3). What this means is that the number of banks reporting an easing of standards was 4.1 percent higher than the proportion reporting a tightening of standards. In Q2 last year, 22.4 percent of banks reported easing standards. The bad news in this report continues to be that more than a net 25 percent of banks reported a decrease in demand for prime mortgage loans. Banks neither loosened nor tightened lending standards for prime mortgage loans, (Figure 4). The implications of this report are mixed for steel people. The expansion of non-residential construction appears to be constrained by banks declining enthusiasm and the expansion of residential construction is being constrained by declining consumer demand for home loans. Demand and lending standards for C&I loans are improving and banks seem to be relaxing when it comes to consumer loans.