Market Data

May 8, 2014

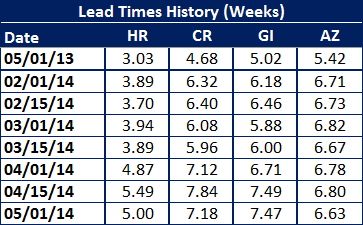

SMU Survey: Lead Times Pull Back on Hot Rolled and Cold Rolled

Written by John Packard

Steel Market Update conducted our early May flat rolled steel market survey this week and the results are raising some questions as to whether the tightness in supply is beginning to abate. We found hot rolled lead times as shrinking half a week and cold rolled a little more than what we had reported from the previous survey conducted in the middle of April. However, lead times are extended when compared to this same time last year.

The next key will be to watch mill negotiations to see if any cracks are developing or if the mills at this point in time consider this a blip on their radar screens.

We did have a conversation with the president of a mid-sized service center earlier today who reported cold rolled spot tonnage being available at AK Steel, Mittal, Severstal and US Steel for production during the month of June. “They have plenty of steel,” he told us, “However, prices are not cheap. First comes availability and then it becomes price….”