Market Data

May 8, 2014

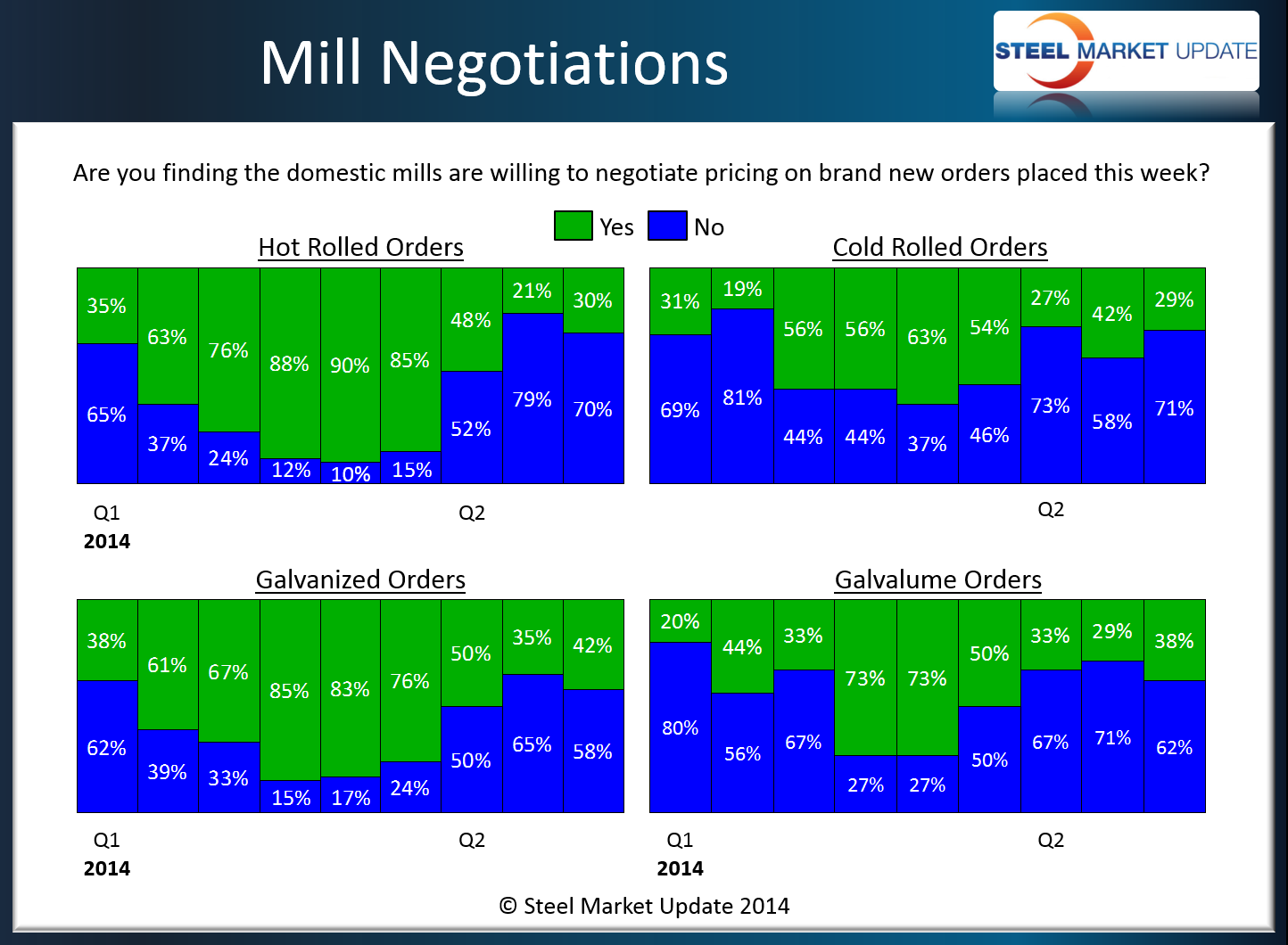

Mill Price Negotiations Show Continued Resolved by Steel Mills

Written by John Packard

The domestic steel mills continue to be united in their approach to negotiating flat rolled steel pricing. Based on data collected this week from our flat rolled steel market survey, we found that only 30 percent of the respondents were reporting the domestic mills as willing to negotiate hot rolled steel pricing. This is up from the cycle low of 21 percent reported during the middle of April. The cold rolled response rate pulled back from 42 percent in mid-April to 29 percent this week. Galvanized was the most negotiable items according to our respondents with 42 percent reporting the mills as willing to discuss GI prices. Galvalume came in at 38 percent.

With lead times potentially pulling back on hot rolled and cold rolled we will need to watch negotiations very carefully to see if the mills break ranks and begin to get more aggressive in their pricing, which would be reflected in our Negotiations data in future reports.