Market Data

May 6, 2014

Net Job Creation through April 2014

Written by Peter Wright

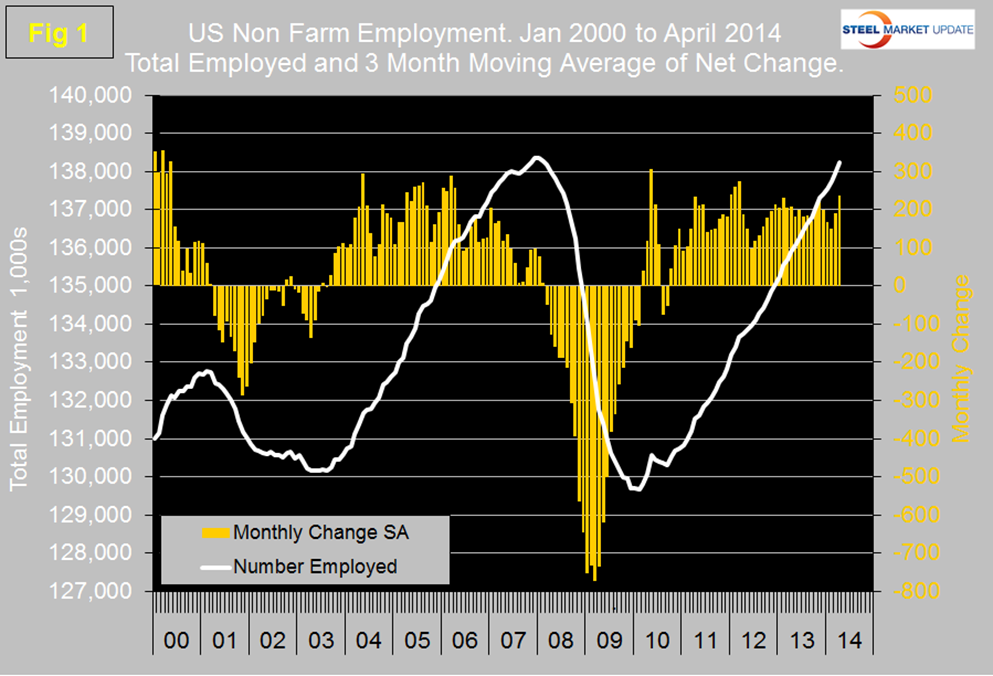

The Bureau of Labor Statistics (BLS) report on non-farm employment wildly exceeded expectations in April with a net gain of 288,000 jobs. The February and March total was revised upward by 36,000. The three month moving average (3MMA) rose from 150,000 in February, to 190,000 in March and to 238,000 in April (Figure 1).

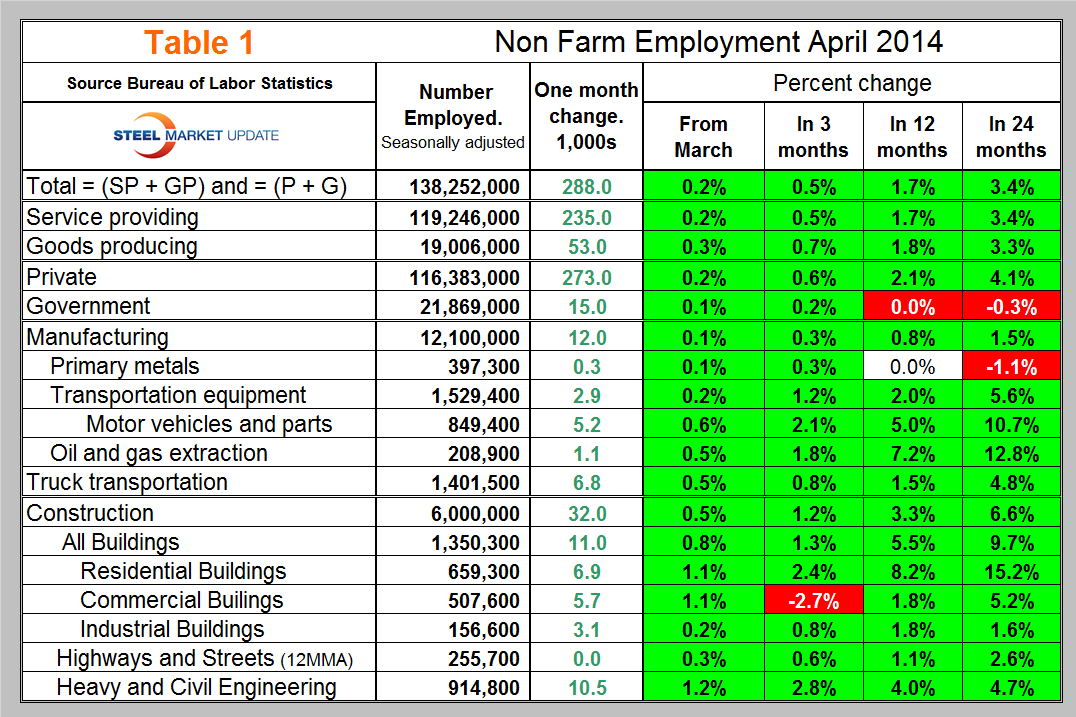

The total number of people employed in the US is now 138.252 million, very close to the previous peak of 138.365 million in January 2008. The growth trajectory is still on track to meet the pre-recessionary peak of total employed by the middle of this year however the underlying level of participation rate and under-employed has a very long way to go to absorb the estimated 7.2 million entrants to the working age population since 2008. All numbers in this analysis are seasonally adjusted by the BLS. The format of Table 1 has been expanded from previous publications in the SMU with the intent of providing a better visual of the overall situation. Total employment equals the sum of private and government employees. It also equals the sum of goods producing and service employees.

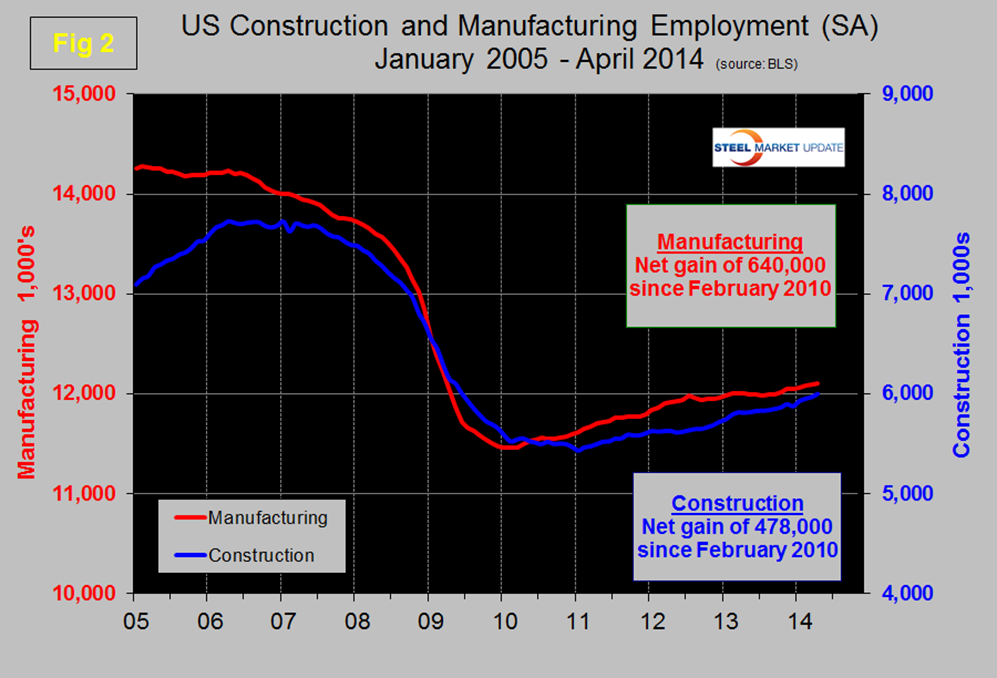

In April private employment grew by 273,000 and government by 15,000. Service industries expanded by 235,000 and goods producing by 53,000 people. Most goods producing employees are in manufacturing and construction. The growth of service and goods producing industries has been similar for the last one, three, twelve and twenty four month periods. Private sector employment has expanded by 4.1% in the last 24 months as government has contracted by 0.3%. Construction continues to experience steady job growth which is good news for future steel consumption. Of the net new goods producing jobs gained in April, 32,000 were in construction as manufacturing gained 12,000. In the last 24 months construction has added 370,000 jobs as manufacturing has expanded by 184,000, (Figure 2).

The global outplacement consultancy Challenger, Gray & Christmas, Inc. issued the following press release last week. At SMU we see relevance in this report for future nonresidential construction, retail buildings in particular.

Employers announce 40,298 job cuts; 2014 pace still lowest since 1997

Job cut announcements by U.S.-based firms were up 17 percent in April, as employers in retail and financial services continued to shed workers in a challenging business environment.

Employers announced plans to shed 40,298 workers from their payrolls in April, according to the monthly report released Thursday by global outplacement firm Challenger, Gray & Christmas, Inc. That was up from 34,399 in March and 6.0 percent higher than the 38,121 job cuts recorded in the same month a year ago.

So far in 2014, Challenger has tracked 161,639 announced job cuts, 12 percent fewer than the 183,162 planned layoffs in the first four months of 2013.

“Despite the April increase, the pace of downsizing remains relatively low. We just saw the lowest first-quarter total in 19 years and the year-to-date monthly average of 40,410 is the lowest since 1997,” said John A. Challenger, chief executive officer of Challenger, Gray & Christmas.

“However, while the economy still has a lot of room for growth, it is unlikely that monthly layoffs will experience a precipitous decline. Even during the economic boom of the late 1990s, employers still averaged about 550,000 announced layoffs annually.”

One area that has continued to struggle in the wake of the recession is retail, which announced an industry-leading 6,993 job cuts in April. To date, retailers have announced 25,224 job cuts, which is only slightly lower than the 31,297 retail job cuts reported in the first four months of 2013.

The top 5 Job Cutting Industries in April were, Retail 6,993, Financial 4,124, Aerospace/Defense 4,075, Health Care/Products 3,242 and Food 2,865

“Among the retailers announcing cuts in April was Coldwater Creek, which never found its footing after the recession and was forced to declare bankruptcy and shutter 350 stores. Like other retailers, it struggled amid a changing retail landscape, where more and more competition is coming from the internet,” said Challenger.

The financial sector announced 4,124 job cuts in April, bringing the 2014 total to 19,430. While that ranks second among all industries, the pace of downsizing in the banking industry is actually down 44 percent from 2013.

“We are seeing some stabilization in the banking industry. We may continue to see cutbacks in the mortgage departments, as banks shed the extra workers hired to handle the flood of foreclosures, but those areas are getting back to normal staffing levels,” said Challenger.

One area that has seen a surprising increase in layoffs is the technology sector, where job cuts announced telecommunications firms and computer firms have jumped 214 percent and 94 percent, respectively.

The 11,827 job cuts announced to date by telecommunications companies is only about 1,000 fewer than the 12,952 cuts announced by these employers in all of 2013.

“Rising job cuts in the tech sector is not necessarily a harbinger of a weakening economy. Change occurs so rapidly in this sector that employers have become very adept at shift their workforce levels to the latest trends. In many cases, these firms are simultaneously hiring in one area while cutting staff in another,” noted Challenger.

Indeed, telecommunications firms announced plans to hire 2,570 workers in April, while firms in the computer industry announced hiring plans totaling 1,650.