Logistics

May 6, 2014

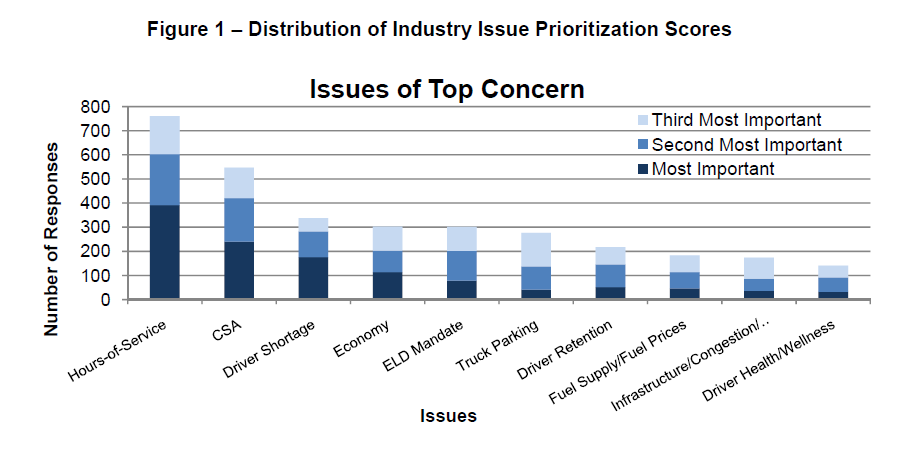

Hours-of-Service Regulations Head Truck Industry Concerns

Written by Sandy Williams

Truck transportation, the price and availability of it, has been a concern of the steel industry of late, especially after the delays that occurred during the unusually severe winter season. To determine what is affecting truck shipping, we looked at the issues currently facing the truck transportation industry.

ATRI reports, “More than 80 percent of motor carriers surveyed have experienced a productivity loss since the new rules went into effect, with nearly half stating that they require more drivers to haul the same amount of freight.”

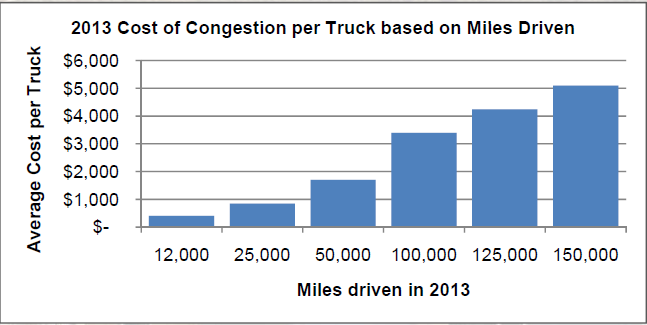

The 1 am to 5 am restriction also puts more drivers on the roads during high congestion periods, adding on average $864 in costs per truck when spread across the 10.7 million registered trucks. ATRI estimates 141 million hours of lost productivity annually due to idling in traffic and slower travel times.

A truck industry representative recently commented that finding CSA compliant drivers is cutting into the available pool of drivers, reducing capacity and pushing prices up.

A broker at a recent Association of Steel Distributors (ASD) meeting noted, “If you have one driver that messes up, he can throw that whole truck company into a negative CSA rating, and someone like me, and many of you, cannot use that truck company at all. That company goes through a very bad period—it takes six months to fix that rating. What are they supposed to do in that period?”

The third highest concern among the trucking industry is the shortage of drivers—a concern that that heads the list for industry executives. ATA estimated in a February report that 30,000 driving jobs are available today and that over the next ten years, due to attrition from an aging workforce, 97,000 new qualified drivers will be required annually.

To address the shortage, industry leaders say truck driver pay and benefits need to be competitive with other industries. In a recent Armada Intelligence Brief it was noted that the construction sector is the biggest competitor for CDL truck drivers:

“Many CDL drivers will work in construction when there is enough demand and they can find work–then when they need a backup they shift to the over-the-road segment. When driving over-the-road, many truckload drivers can be away from home for weeks on end–so it’s largely a quality of life issue. So, when we see construction hiring increase, it actually has a double-impact on trucking.”

The Armada report goes on to say: “Trucking companies only have really two options. They can continue to try and find new drivers to enter the sector and work at their rates–or they have to increase wages to try and retain drivers. In either event, it’s going to mean higher supply chain prices for you. Capacity will be tighter. Driver shortages will increase.”

ATRI suggests that state and federal authorities should help identify ways to safely incorporate younger drivers into the industry and make it easier for military veterans to transition to civilian CDL positions.

“We anticipated significant impacts on our operations and across the entire supply chain from the new rules and our experience since July 1st is bearing that out,” commented Kevin Burch, president of Jet Express, in an ATRI press release. “ATRI’s analysis clearly documents the productivity impacts and real financial costs being borne by carriers and drivers. It’s only a matter of time before these impacts ripple throughout the nation’s economy.”

Those impacts are already rippling and were exacerbated by the severe 2013-2014 winter season.

“The difficult operating environment impacted efficiency, maintenance, fuel cost and asset utilization at Con-Way Truckload,” said Con-Way President and CEO Douglas Stotlar. “However, as the quarter concluded, operations began to normalize, demand improved and the pricing environment strengthened. At the same time, driver retention and recruiting continues to be challenging.”

Pricing has been an issue for steel mills and distributors seeking to transport product, with higher premiums noted around the country. The national average for flatbed truck spot prices increased 9 percent between April 2013 and April 2014 according to DAT Trendlines. Average price per mile increased 5 cents in April. During the week of April 20-26, prices were the highest in Pennsylvania at $3.70/mile, followed by $3.07/mile in the Midwest and $2.69/mile in Atlanta.

A spokesperson for Con-Way Freight had the following comment: “We are seeing pricing firm and demand strengthen in both the less-than-truckload (smaller shipments, under 100–10,000 lbs.) and full-truckload markets (over 10,000 lbs). During the last recession (2009-2010), a significant amount of capacity left the trucking industry and was not replaced. As the economy has recovered and freight demand has increased, that’s putting more pressure on available capacity, which is supporting a stronger pricing environment for trucking firms like Con-way.”

The root problem in the transportation industry, shortage of drivers, is not an easy or imminent fix. Although shipping backlogs caused by winter delays will eventually resolve and prices may normalize, the steel industry can expect to continue to see availability issues in the coming quarters and, perhaps, years.