Prices

May 4, 2014

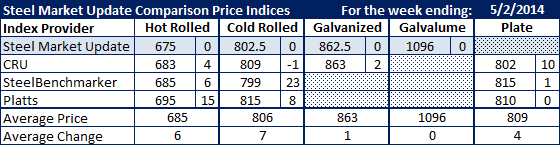

SMU Comparison Price Indices: Leveling Out (Except Platts)

Written by John Packard

This past week three of the four flat rolled steel price indexes followed by Steel Market Update (SMU) reported only modest gains in benchmark hot rolled pricing with SMU being the most conservative holding our pricing at the same levels as we had reported the prior week. Platts was the one exception as their hot rolled numbers increased $15 per ton to a $695 per ton average. We once again have a $20 spread between the highest and lowest index. The hot rolled average of the four indexes is now $685 per ton.

Part of the reason for the price spread is due to the data collection process and as of what date did the price adjustments occur. We use the Friday print from Platts as they can adjust their pricing at any point in time during the week. CRU prices are collected from the prior week and SMU from Monday and Tuesday of this past week. SteelBenchmarker only produces pricing twice per month.

The second reason for the variance in pricing is due to the FOB point and whether or not any adjustments are made to prices in order to have them within a certain geographical area (ex: Midwest or Northern Indiana). We have explained the methodologies and have a White Paper on our Home Page which you can download or, you are welcome to contact our office for a copy: info@SteelMarketUpdate.com.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.