Market Data

May 1, 2014

April - End of the Month Data

Written by John Packard

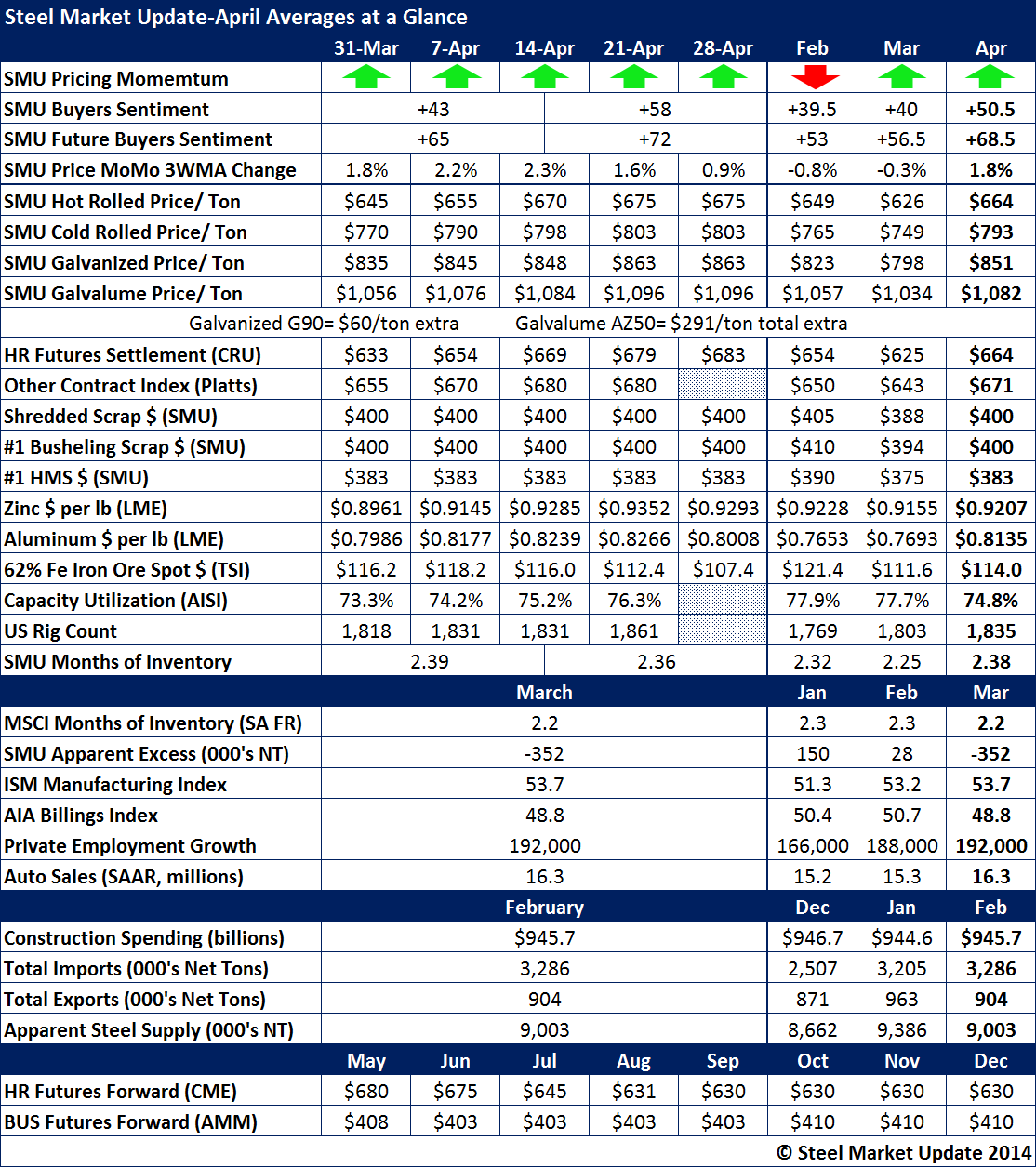

April is now behind us and it proved to be one interesting month. In looking at the key data we follow on a monthly basis for our readers, SMU Price Momentum Indicator ended the month where it began pointing to higher prices over the near term. SMU Steel Buyers Sentiment Index ended the month at +58 which is a very high bullish sign for the flat rolled steel industry.

Hot rolled prices averaged $664 according to both Steel Market Update’s monthly average and that of CRU. The amount of monthly change from the average of the previous month was $38 per ton for SMU and $21 per ton for CRU. The month of April ended with HRC average pricing at $675 per ton according to our Index ($683 at CRU). Platts average for the month of April was $671, $28 worth of price movement for the month of April.

Scrap prices were up for the month (compared to the prior month) as were the averages for aluminum and zinc (?).

MSCI inventories were down to 2.2 months while SMU had inventories rising to 2.38 months. Note: MSCI numbers are as of the end of March, SMU is the average of the two numbers collected during the month of April.

ISM Manufacturing Index reported continued expansion in the manufacturing segment of the economy while the AIA Billings Index weakened and dropped into contraction for construction. Auto sales grew as did construction spending.

Apparent Steel Supply dropped in February which is the last data we have available.

HRC Futures markets are forecasting a drop in hot rolled pricing beginning in July…