Market Data

April 29, 2014

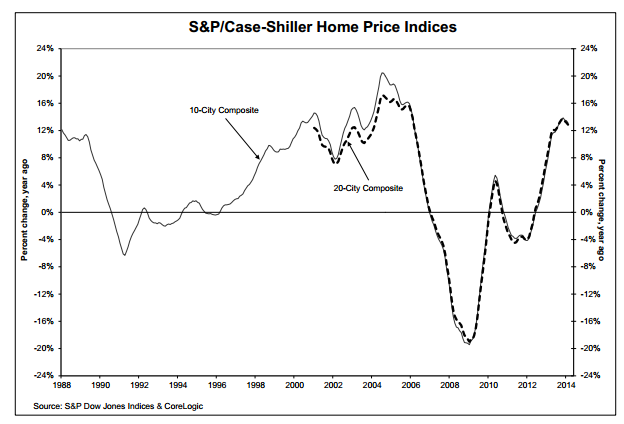

Home Price Gains Slowing Says S&P/Case-Shiller

Written by Sandy Williams

Home prices are continuing to rise but at a slower pace according to the S&P/Case-Shiller Home Prices Indices. The S&P Dow Jones Indices are released monthly and compare annual rate gain for the 10-City and 20-City Composites. The current indice, released at the end of April, shows the rate of gain in February at 13.1 percent for the 10-City Composite and 12.9 percent for the 20-City Composite.

“Despite continued price gains, most other housing statistics are weak,” said David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Sales of both new and existing homes are flat to down. The recovery in housing starts, now less than one million units at annual rates, is faltering. Moreover, home prices nationally have not made it back to 2005. Mortgage interest rates, which jumped in May last year and are steady since then, are blamed by some analysts for the weakness. Others cite difficulties in qualifying for loans and concerns about consumer confidence. The result is less demand and fewer homes being built.

“Five years into the recovery from the recession, the economy will need to look to gains in consumer spending and business investment more than housing. Long overdue activity in residential construction would be welcome, but is certainly not assured.”