Analysis

April 19, 2014

Will 2014 Be a Breakthrough Year for Construction?

Written by Sandy Williams

Will 2014 be a breakthrough year for construction? That was the premise of a webinar presented by Reed Construction Data paneled by Bernie Markstein, US chief economist at Reed Construction Data; Kermit Baker, chief economist at the American Institute of Architects (AIA); and Ken Simonson, chief economist at Associated General Contractors of America (AGC).

The consensus was, well, kind of. In general, the outlook appears optimistic, with 2013 getting off to a mixed start after suffering through an unusually severe winter.

Leading economic indicators suggest the economy is improving. Employment levels are rising but still at slow pace. Inflation has remained moderate and still below where the Federal Reserve would like it. Markstein says the government seems willing to provide stimulus as long as the employment figures and inflation rates are below targeted levels. The Federal Reserve tapering has not had much affect on interest rates so far and it appears that rates will not be raised until the end of next year.

The political turmoil in the House and Senate has calmed with the extension of the debt limit and designation of appropriations for 2014.

Housing data for residential homes has been somewhat disappointing in the first quarter. Housing starts rebounded in 2013 but have slowed so far in 2014, in part due to weather conditions. The housing forecast consensus suggests housing starts will be around 1.14 million in 2014, a recovery of 23 percent. Housing starts in 2015 are forecast at 1.43 million, up 24 percent.

Housing prices for single family homes have recovered about 40 percent of their losses. The largest gains have been seen in regions that were hardest hit during the downturn such as metro areas in California and Florida, Las Vegas, and Detroit, all of which are up by double digit percents.

Mortgage rates have been rising from the low of 3.7 percent in 2012 to around 4.4 percent in first quarter 2014. There is concern about homeowner mobility, said Baker. When equity levels dropped people stayed put, not wanting to lose money on their homes. As mortgage rates rise, some will be reluctant to give up low rates or find higher rates unaffordable. The homeowner population under 35, who generally are the most mobile, are already locked into lower market rates that may cause them to reconsider taking on higher rates.

There is a smaller pool of first-time home buyers, said Simonson. These buyers are waiting longer to have families and are facing tighter lending standards due to credit ratings that may be impacted by high student loan debt. Instead of locking themselves in debt, said Simonson, many are choosing to live in multifamily dwellings and rentals close to work.

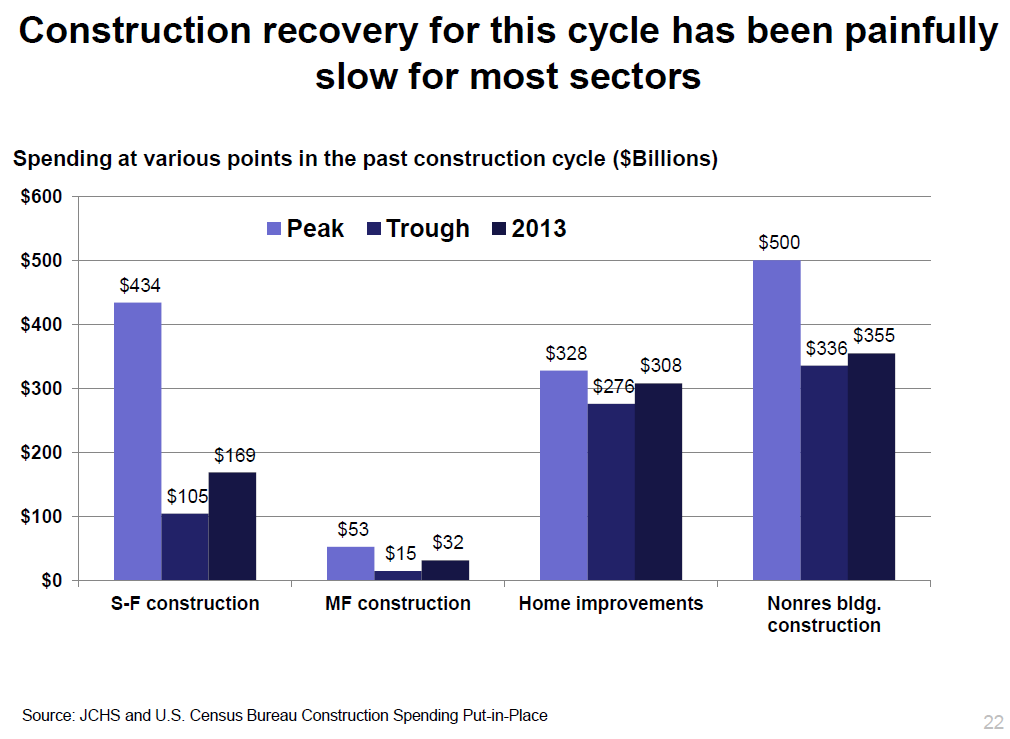

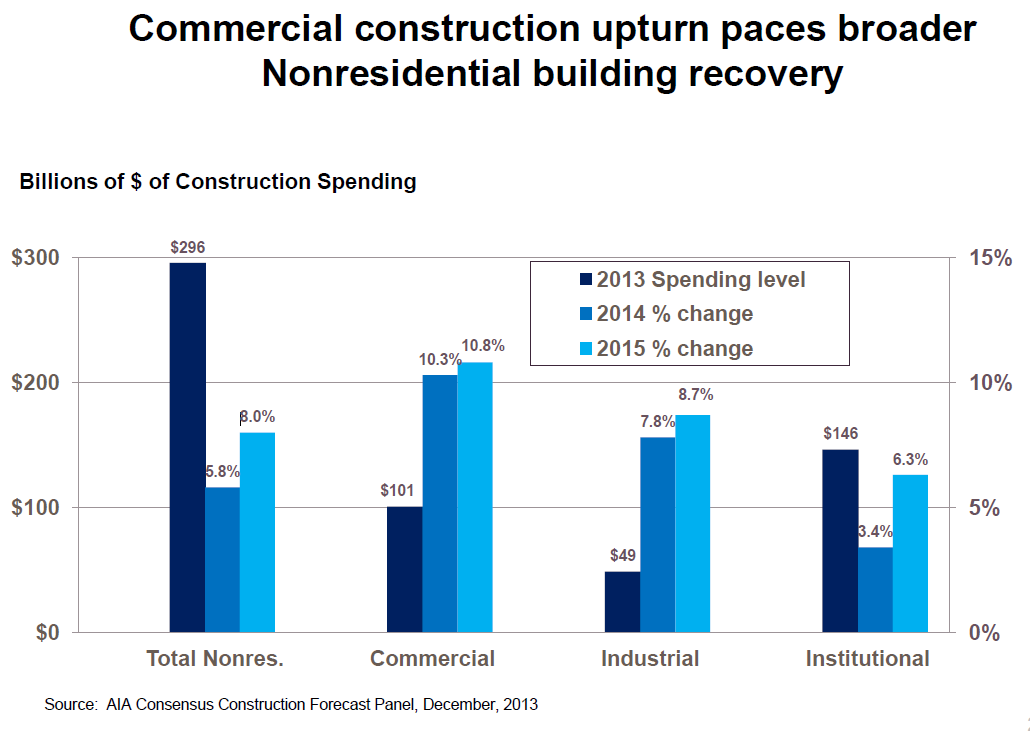

Non residential construction spending has been slow to gain momentum following the steep downturn in 2011, but is making progress in first quarter 2014. Commercial and industrial construction is recovering at a double digit pace in some regions said Baker. Institutional construction has been flat or negative with two thirds of the total (e.g., healthcare and education) still in negatives as of February.

The Architecture Billings Index (ABI) has been mostly positive over the last 18 months but has been down for two months in a row which is prompting AIA to review longer term trends to determine what is going on in the market.

AIA consensus forecasts total non residential construction spending to gain 5.8 percent in 2014 and 8 percent in 2015 with commercial construction leading the upward trend.

The latest AGC Construction Outlook Survey showed two thirds of members expect the construction market to pick up this year or next—a change from the previous survey in which recovery was thought to be two years away. Members were optimistic in all segments except for marine construction. Sentiment was more cautiously optimistic for public construction, said Simonson.

Construction spending on a 12 month basis in February, was up 14 percent for residential, 12 percent for private non residential and down 1 percent for public non residential, according to data from the US Census Bureau. Total construction spending for the period was close to 10 percent.

For residential construction, Simonson sees multi-family leading the increase in growth with single family housing construction stalling at a lower level of starts than forecasts by Baker at AIA. Permits authorizations are level with a year ago and AGC is not seeing pent up demand. Builders are being cautious and not taking permits for single family starts ahead of actual demand, said Simonson. Multifamily permit authorizations, on the other hand, are higher and banked for future use.

The positive drivers for non residential construction included shale drilling and the Panama Canal Expansion. Shale drilling requires local infrastructure like extended stay hotels and restaurants as well as industry related product production, storage, and transportation.

The Panama Canal Expansion has prompted port cities to dredge harbors, raise bridges, install rail tracks, etc., in anticipation of increased shipping and larger ships entering ports.

Negatives for non residential construction include government cut backs on funding for schools and infrastructure. Private school construction was up but is declining due to saturation, lower enrollment and competition from online enrollment.

Transportation construction is up slightly but lack of funding is still a threat. Manufacturing and lodging construction are expected to increase by more than 10 percent in 2014.

Overall, Simonson forecasts nonresidential construction to grow 4-8 percent in 2014.

AGC reported that construction employment increased in 38 states over the past twelve months. Eleven states and the District of Columbia lost construction jobs between March 2013 and March 2014 while Alaska remained unchanged. Construction unemployment rates have fallen dramatically but firms are reporting difficulty finding qualified workers for available positions. Shortages are attributed to retirement and competition from other sectors.

Construction material costs are level, up 0.6 percent in the past twelve months. Total construction spending is expected to increase 6-10 percent per year for 2014-2017, predicts Simonson. Material costs are expected to increase 1-3 percent per year and labor costs 2.5-5 percent.

Bernstein’s forecast from Reed Construction Data is somewhat more optimistic than Simonson’s with nonresidential spending up 7-9 percent next year. Internet buying aside, bricks and mortar buildings are still needed for groceries, restaurants, hair salons and service industries. These usually follow new residential building by an 8-12 month lag. Bernstein says commercial is not dead but will not return to peak levels.

Education will not see a turnaround this year, says Bernstein, but maybe in 2016 after the long planning process for public spending and as the economy and residential come back. Healthcare construction may see an increase due to the need to have facilities to cover the newly insured under the Affordable Care Act, but at a cautious pace.

Heavy engineering did surprisingly well over the last few years, said Bernstein, with peaks in spending reflecting stimulus acts. Spending was positive in 2013 and will surpass its previous peak in 2014 and 2015.

So to return to the initial question, will 2014 be a breakthrough year for construction, the answer is 2014 will see the beginning of the breakthrough with positive momentum this year in some areas and moving towards stronger growth in 2015.