Market Data

April 17, 2014

Steel Mill Flat Rolled Lead Times Shoot Out

Written by John Packard

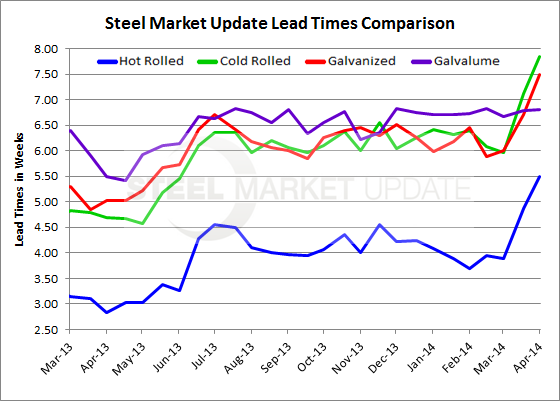

According to Steel Market Update most recent flat rolled steel market survey results, lead times at the U.S. and Canadian steel mills continue to extend on hot rolled, cold rolld and coated products with the exception of Galvalume. Hot rolled lead times are now averaging 5.49 weeks, up from 4.87 weeks just two weeks ago and almost double what we saw this time last year when HRC lead times averaged 2.83 weeks.

Cold rolled lead times have moved from 6.08 weeks at the beginning of March to 7.84 weeks as of this week. Last year cold rolled was averaging 4.70 weeks in the middle of April.

Galvanized lead times also increased by a week and a half moving from 5.88 weeks at the beginning of March to 7.49 weeks this week. Galvanized lead times are 2.5 weeks longer this April than last when we calculated the average lead time in the middle of April to be 5.02 weeks.

Galvalume lead times have not budged in the past month. We saw AZ lead times at 6.82 weeks at the beginning of March and they are now at 6.80 weeks. However, compared to last year, lead times are almost 1.5 weeks longer than the 5.50 weeks we saw last year at this time.

Our members may want to view our interactive graph which you can access on our website once logged into the site. The data can be found under the Analysis tab – Survey Results – Lead Times.