Analysis

April 7, 2014

Tax Credits Renewed for Wind Turbines

Written by Sandy Williams

The Senate Finance Committee passed a bill on Thursday that would restore key tax credits for the wind industry. The renewable energy Production Tax Credit (PTC) and Investment Tax Credit were included in the Committee’s final tax extender package after the PTC was passed over in the first draft.

Sen. Michael Bennett (D-Colo.) sponsored the amendment to include the PTC that expired at the end of 2013. In a show of bi-partisanship, five Republicans joined 13 Democrats to defeat an attempt by Sen. Pat Toomey (R-PA) to remove the credits in an amendment proposed in a late Thursday morning committee markup.

Sen. Michael Bennett (D-Colo.) sponsored the amendment to include the PTC that expired at the end of 2013. In a show of bi-partisanship, five Republicans joined 13 Democrats to defeat an attempt by Sen. Pat Toomey (R-PA) to remove the credits in an amendment proposed in a late Thursday morning committee markup.

“We’re grateful to all the supporters of renewable energy on the Senate Finance Committee,” said Tom Kiernan, CEO of the American Wind Energy Association (AWEA). “This provides a critical signal for our industry, which has created up to 85,000 jobs and has a bright future ahead, as we grow from 4 percent of the U.S. power grid to an expected 20 percent and beyond, so long as we have a predictable business climate.

“Passage by the full Congress will preserve an essential incentive for private investment that has averaged $15 billion a year into new U.S. wind farms, and create more orders for over 550 American factories in the supply chain.”

The extension allows wind energy developers who start construction by the end of 2015 to qualify for the tax credits.

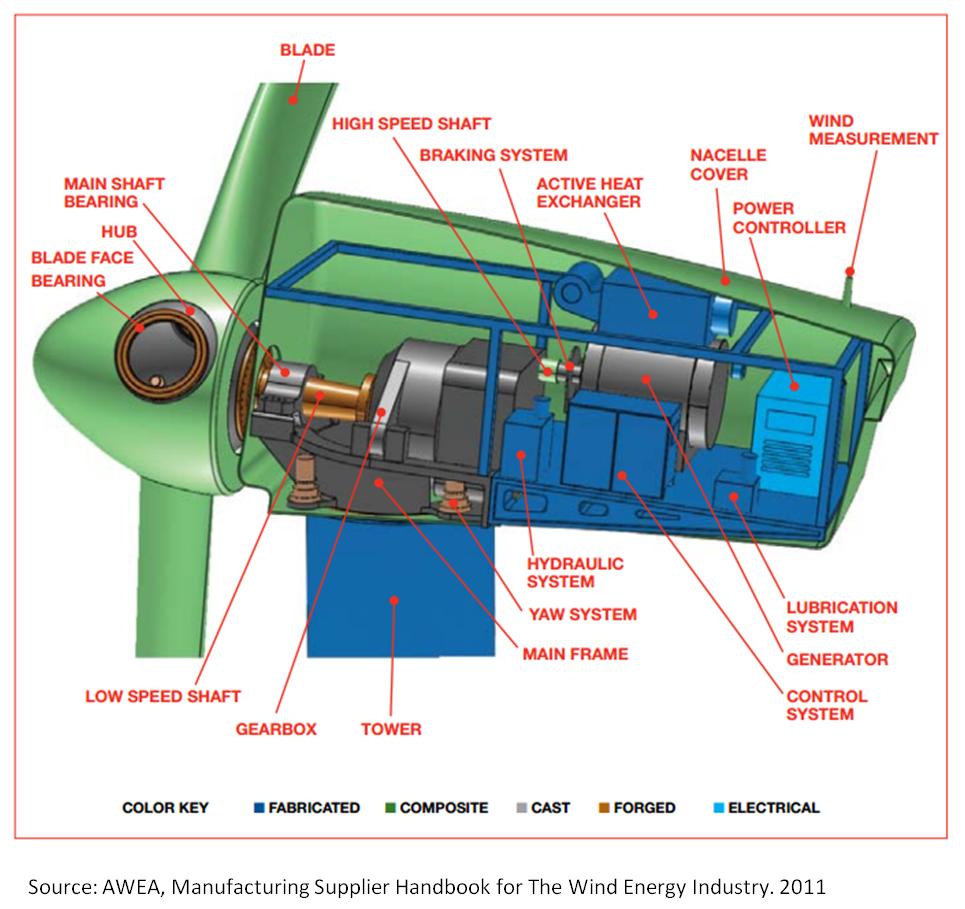

Increase in construction of wind turbines equates to increase in order books for the steel industry. Wind turbines are steel intensive structures comprised of four major parts: blades, rotor hub, nacelle and tower.

A typical tower uses between 100 and 200 tons of rolled steel sheet in the construction depending on the height. Conical towers are made of three fan shaped sections that are cut from plate steel, rolled into conical shape and then welded together.

A typical tower uses between 100 and 200 tons of rolled steel sheet in the construction depending on the height. Conical towers are made of three fan shaped sections that are cut from plate steel, rolled into conical shape and then welded together.

The rotor hub is typically cast ductile iron, weighing 7-20 tons, with tight casting and machining specifications. The hub connects the blades to the main shaft and converts the power of the wind to rotary motion.

Attached to the hub is the nacelle which contains the drive train and rotor shaft. The main shaft is forged steel weighing 15-25 tons. The nacelle itself is often a lighter weight material, such as fiberglass, on a steel frame.

The blades are generally constructed of fiberglass and can be 30-55 meters (98-180 feet) in length and weigh 6-10 tons each.

The design of the wind turbine will affect steel usage. Siemens’ newest onshore tower design, SWT-2.3-108 steel shell towers, are constructed from sheets of bended steel plate that are transported to the location by trucks and assembled on site. The towers are 80 meters (262 feet) high and weigh approximately 300 tonnes (330 tons) — 80 percent of which is steel.

A proprietary Siemens IntegralBlade® process is used to make the rotor blades from epoxy, fiberglass, balsa wood and paint. Each blade is 174 feet long—nearly half a football field—and weighs approximately 10 tons.

In December 2013, Siemens received its largest single U.S. order ever for onshore wind turbines. U.S. energy company MidAmerican requested 448 turbines to be located in Iowa.

In December 2013, Siemens received its largest single U.S. order ever for onshore wind turbines. U.S. energy company MidAmerican requested 448 turbines to be located in Iowa.

The AWEA reports wind energy provided 4.13 percent of US electricity generation during 2013. Over 20 percent of the electricity in South Dakota and Iowa is produced by wind power. Where there is strong wind resources, such as the Midwest, wind turbines can be economical and efficient.

In Wind Manufacturing Overview, the AWEA demonstrates the impact turbine construction can have on the US manufacturing industry.

“U.S. wind-related manufacturing sector consists of more than 550 manufacturing facilities across 44 states producing the more than 8,000 components that comprise a typical wind turbine. U.S.-based facilities make everything from major components such as blades, towers, rotor hubs, generators, and gearboxes, to internal components such as bearings, slip rings, brake systems, fasteners, power converters, sensors, and control systems.

“Over the past five years, new wind power project installations have grown at an average rate of 36% per year, creating new opportunities throughout the wind energy supply chain. Relatively stable policy enticed major wind manufacturers to invest in U.S.-based facilities, often bringing their supply chain with them. This has helped to bring down wind turbine costs and has boosted domestic content from less than 25% in 2005 to over 67% today. While the industry currently lacks the long-term policy support needed to guarantee a stable market, the fundamentals of the industry are strong, and the market will continue to offer new opportunities as current and new manufacturers develop domestic supply chains.”