Analysis

April 7, 2014

Construction Expenditures through February 2014

Written by Peter Wright

Each month the Commerce Department issues its construction put in place (CPIP) data on the first working day covering activity two months earlier. February data was released on April 1st.

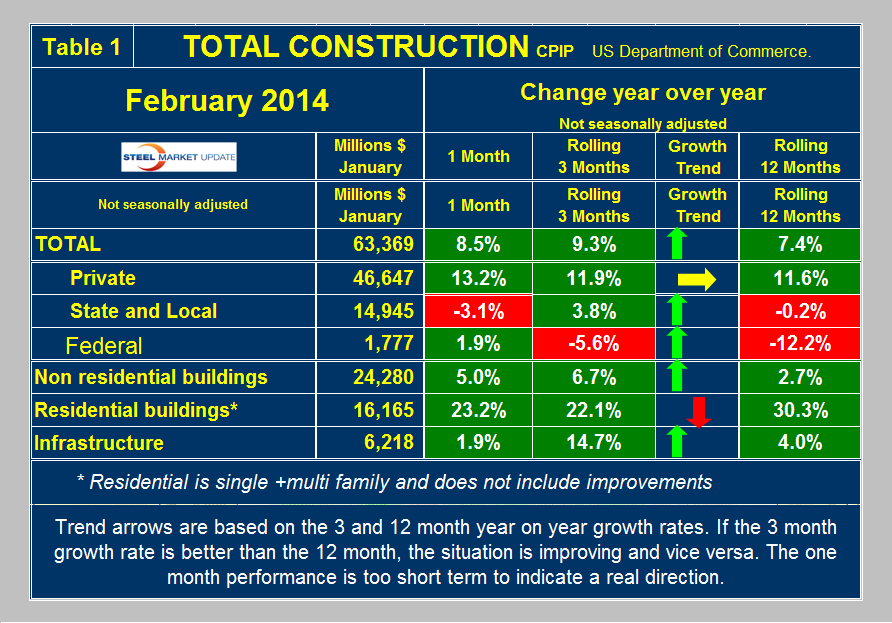

Total Construction: February expenditures were $63.369 billion which breaks down to $46.647 B of private work, $14.945 B state and locally financed and $1.777 B of federal expenditures (Table 1). Federal expenditures are declining rapidly as Washington struggles with its deficit but this construction sector is so small as to be of little interest. On a rolling three month basis total construction was up by 9.3 percent year over year (y/y) and was up by 7.4 percent on a rolling 12 months y/y. This means that total construction growth has positive momentum since the short term growth (3 months) was greater than the long term (12 months). The momentum of private construction was only 0.3 percent which we consider to be basically flat, however, state and local (S&L) work had positive momentum of 4.0 percent and positive growth of 3.8 percent in the three months through February. We consider three sectors within total construction. These are non residential, residential and infrastructure. On a rolling three month basis y/y non residential is growing at 6.7 percent and accelerating. Residential is growing at 22.1 percent and slowing. Infrastructure grew 14.7 percent y/y in the last three months showing rapid acceleration. All numbers quoted in this analysis are not seasonally adjusted. Construction is highly seasonal and for our purposes we always compare data year over year to eliminate this effect. The growth of total construction has been fairly steady for over 18 months averaging about 7.0 percent but it will be 2018 before the pre-recessionary peak is regained (Figure 1).

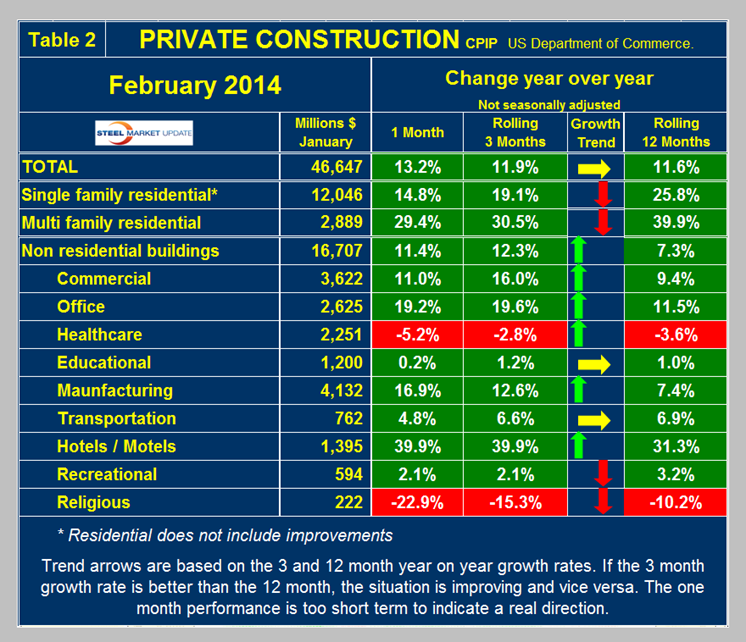

Private Construction: Private work accelerated slightly from an 11.6 percent growth rate in 12 months y/y to an 11.9 percent rate in 3 months y/y (Table 2). The single month of February 2014 was 13.2 percent stronger than February last year, which seems to fly in the face of other data that was adversely affected by severe weather. According to the Association of General Contractors analysis, this may be because of the models that the Commerce Department uses to supplement actual numbers. In which case there will be a payback in future months. The growth of private work has been in double digits for most of the last 24 months but at the current rate it will be mid 2017 before recovery is complete (Figure 2). Table 2 breaks down the private sector into project types. Residential buildings, both single and multi-family, are growing rapidly though slowing. This data coincides well with the housing starts data that SMU reports every month and supports the view that residential building continues to favor multifamily structures. Private non residential buildings are growing at a 12.3 percent rate and accelerating. Within private non residential, only health care and religious buildings are showing a sustained contraction. On the other hand, hotels/motels are showing surprising strength and accelerating. Offices, commercial and manufacturing all have double digit growth rates.

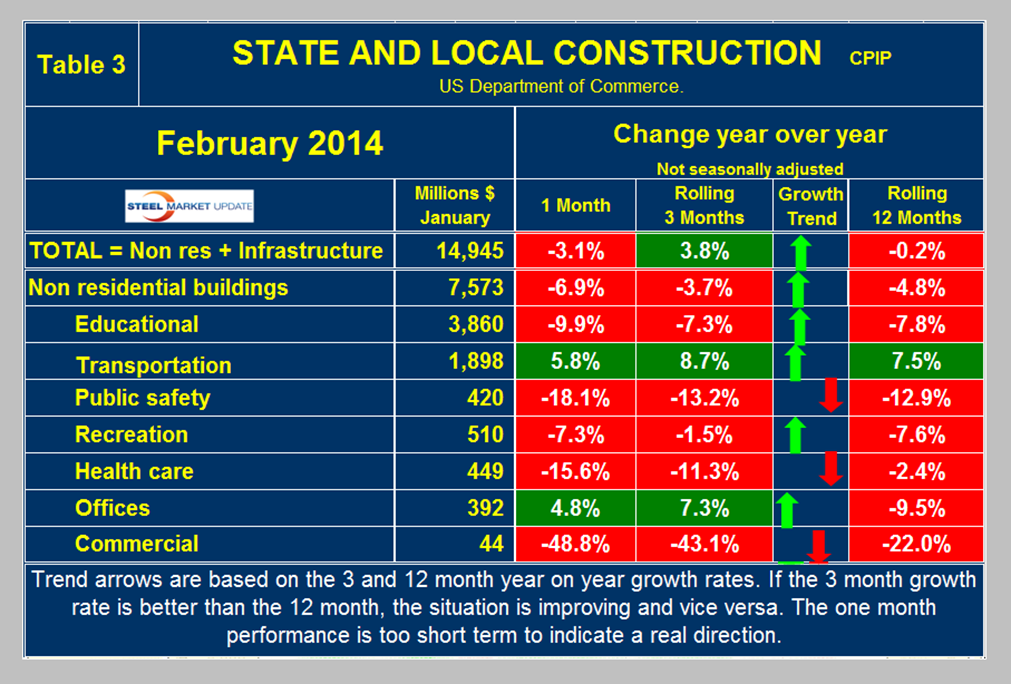

State and Local Construction: S&L work surged from a 12 month y/y rate of negative 0.2 percent to a positive 3 month rate of 3.8 percent, resulting in a positive momentum of 4.0 percent (Table 3). This overall result includes infrastructure, see below. Excluding infrastructure leaves nonresidential building which declined by 3.7 percent in three months through February y/y (Figure 3). Educational buildings are by far the largest sub sector of S&L non residential, at $6 billion in the last 12 months but contraction continued at a 7.3 percent in 3 months and 7.8 percent in 12 months y/y. Transportation terminals are doing extremely well with a 3 month growth rate of 8.7 percent with positive momentum, also government offices were surprisingly strong in the last three months of data. State tax revenues have recovered and are now 9.6 percent higher than the pre-recessionary peak of Q2 2008, however many state and local governments are far from healthy, particularly in the Northeast and Midwest. Increased revenues have been more than offset by increased future obligations, including the need to replenish reserve and rainy-day funds and to service defined benefit liabilities, pensions and Medicaid, in particular. As a result, public construction spending has not found any traction and only immediately essential projects such as road construction are still expanding in dollar terms.

Drilling down into the private and S&L sectors, as presented in Tables 2 and 3, shows which project types should be targeted for steel sales and which should be avoided.

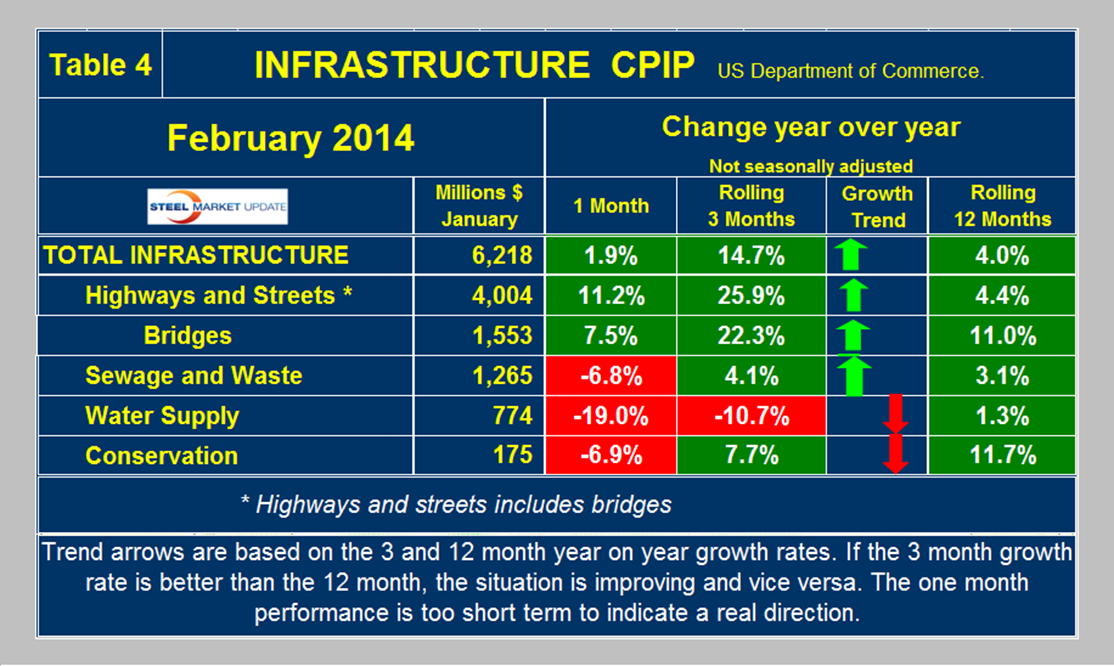

Infrastructure: Total infrastructure expenditures accelerated from a 4.0 percent growth rate in 12 months through February to 14.7 percent in 3 three months through February (Table 4). Highway and streets construction, which includes bridges, grew at a 25.9 percent rate in the three months through February y/y. The only sectors that slowed in three months through February were sewage and waste and conservation. Based on the Commerce Department CPIP reports, the state of infrastructure expenditures is not as bad as the press would have us believe. At the present rate of growth, infrastructure expenditures will reach the pre-recessionary level before the end of 2014 (Figure 4). This is far from the case with residential and non residential construction. New transportation funding proposals are alive in Congress but gridlock is preventing agreement on how to proceed.

From, “The Hill transportation and Infrastructure blog” members of both parties are desperately searching for a revenue source to plug a shortfall in the Highway Trust Fund, which could run out of money as early as August, a month before the full transportation bill expires. The highway bill was one of several topics discussed last week during an Oval Office meeting between Boehner and President Obama, who unveiled his own $302 billion infrastructure proposal later that day. Speaker John Boehner (R-Ohio) won’t revive his 2011 proposal to use oil drilling revenue for infrastructure when the House takes up a new highway bill later this year, say lawmakers and aides. “We’ve got to find a funding mechanism to fund our infrastructure needs,” Boehner said last week. “And so the hunt has been underway for the last year and half to find a funding source. I wish I could report we’ve found it, but we haven’t.”

“We have a different problem than we’ve ever had before,” said Rep. Peter DeFazio (D-Ore.), a senior Democrat on the House Transportation subcommittee on Highways and Transit. “I don’t know what the way is out of this box, but there seems to be growing recognition that, come late this fiscal year, we are going to have a huge problem on our hands.”

Sen. Barbara Boxer (D-Calif.), chairwoman of the Senate Environment and Public Works Committee, told a conference of highway administrators last week. “I don’t see support for raising the gas tax, and there’s absolutely no way we’re going to cut spending, so there’s going to have to be a creative way to fund this in reality.” Boxer said she hopes to mark up a highway bill in committee in April. Lawmakers are already warning that states are making preparations to slow down work this summer on long-term infrastructure projects out of concerns that the federal spigot will be shut off.

While the full Transportation Committee authorizes highway and public transit programs, the tax-writing Ways and Means Committee is responsible for figuring out how to pay for them. The gas tax has served as the chief funding source for the Highway Trust Fund, but it has not been increased for two decades and hasn’t kept up with spending needs.

SMU Comment: Overall we are encouraged by the February CPIP report from the Commerce Department which, if trends continue into the summer, will begin to close the gap between where steel demand currently is and where it should be at this stage of recovery from a recession.