Market Data

April 3, 2014

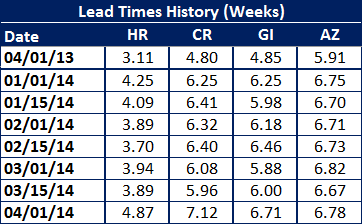

Lead Times Extend on All Flat Rolled Products

Written by John Packard

Mill lead times moved out over the past two weeks. We are seeing lead times extending by as much as one week on hot rolled and cold rolled and three quarters of a week on galvanized. We did some quick checking and HRC, CRC and GI lead times are the furthest we have recorded since we began collecting lead time data in August 2011. Galvalume lead times remained relatively stable at 6.78 weeks, which is almost one full week longer than at this time last year.

Hot rolled lead times were almost two weeks further out this week than during the same week last year. Cold rolled lead times were actually slightly greater than two weeks versus last year. In 2013 galvanized lead times averaged 4.85 weeks and this week we have them averaging 6.71 weeks – almost two weeks longer than one year ago.

Lead times are an important indicator of order flow and the strength of the market. This week may be a bit unusual having two U.S. Steel steelmaking facilities experiencing unplanned outages.

SMU lead time data is based on responses provided during our flat rolled steel market analysis which we conduct twice per month. The lead time is the average of the responses provided by manufacturing companies and service centers in the United States and Canada.