Prices

April 6, 2014

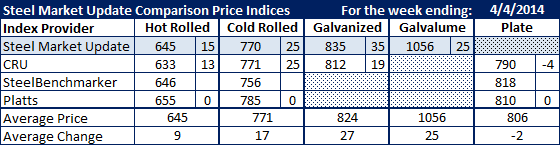

SMU Comparison Price Indices: Moving on Up

Written by John Packard

All of the indexes followed by Steel Market Update saw their averages on hot rolled, cold rolled and coated rise this past week (except Platts which remained the same). We are seeing the indices moving higher very quickly as the domestic steel mills firm up their order books at the previously announced $660 level on hot rolled steel.

Steel Market Update benchmark hot rolled coil prices rose by $15 per ton while CRU was up $13 per ton. Both CRU and SMU were up $25 per ton on cold rolled.

At the moment there is a large disparity between the SMU and CRU indexes regarding galvanized but we expect this spread to narrow in the weeks ahead.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Northern Indiana Domestic Mill.