Market Data

April 3, 2014

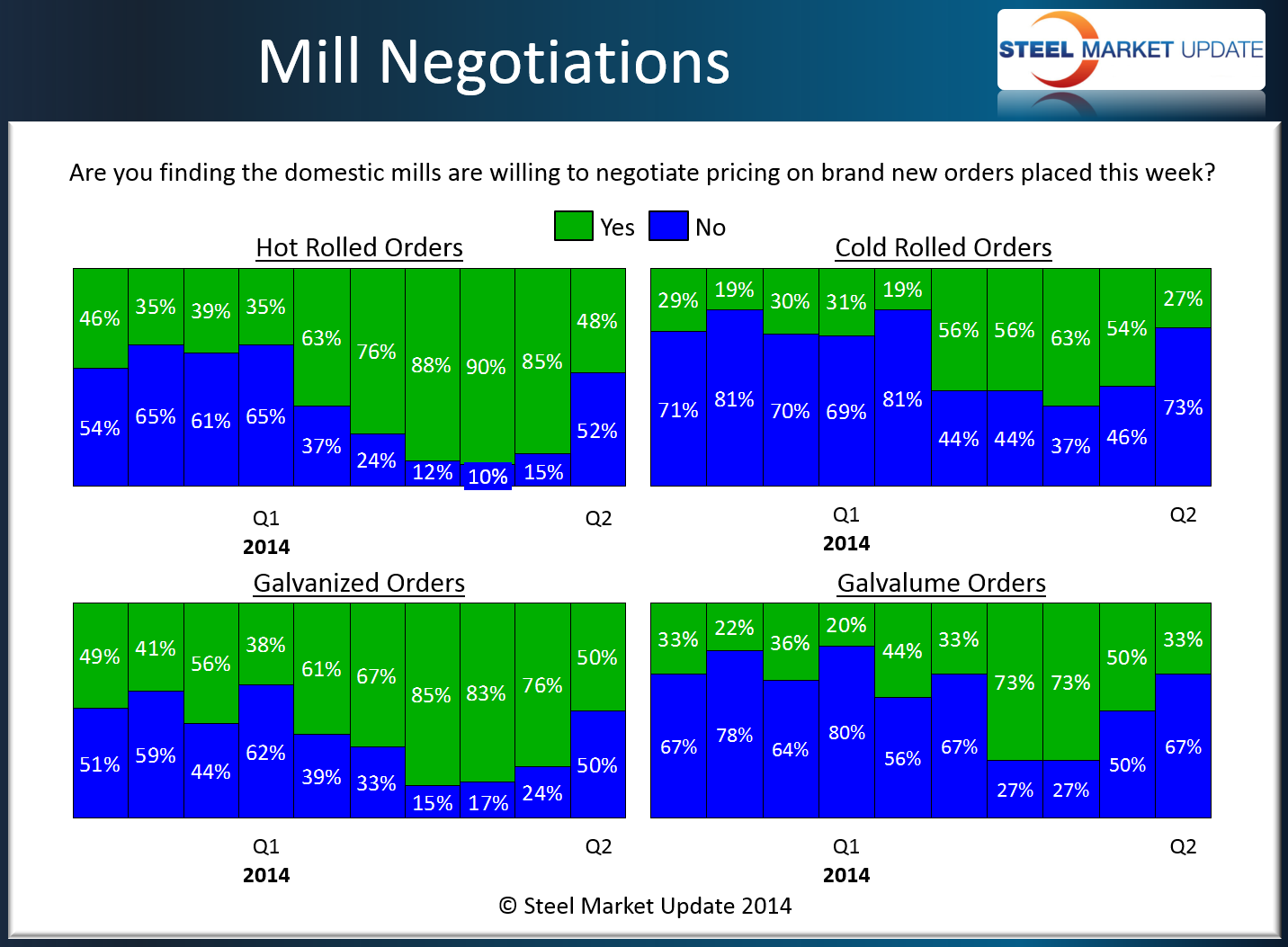

SMU Survey: Mills Not as Willing to Negotiate Steel Prices

Written by John Packard

Buyers and sellers of flat rolled steel are reporting the domestic steel mills as much less willing to negotiate prices this week as compared to two weeks ago. Our market analysis saw major contraction in each of the products with hot rolled moving from 85 percent down to 48 percent. Cold rolled halved their previous 54 percent, as this week we measured CR willingness at 27 percent. Galvanized dropped from 76 percent to 50 percent and Galvalume fell from 50 percent to 33 percent.

We are hearing that the domestic steel mills are holding at, or very close to, their announced price increase levels. We heard from one mill earlier today that they took a 7000 ton hot rolled order in the North at the full $660 per ton. Usually an order of that size is provided a discount by the producing mill.

Along with lead times (article above) negotiations provides a clearer picture as to what is happening in the market today and what the expectations or trend will be in the coming weeks.