Prices

April 3, 2014

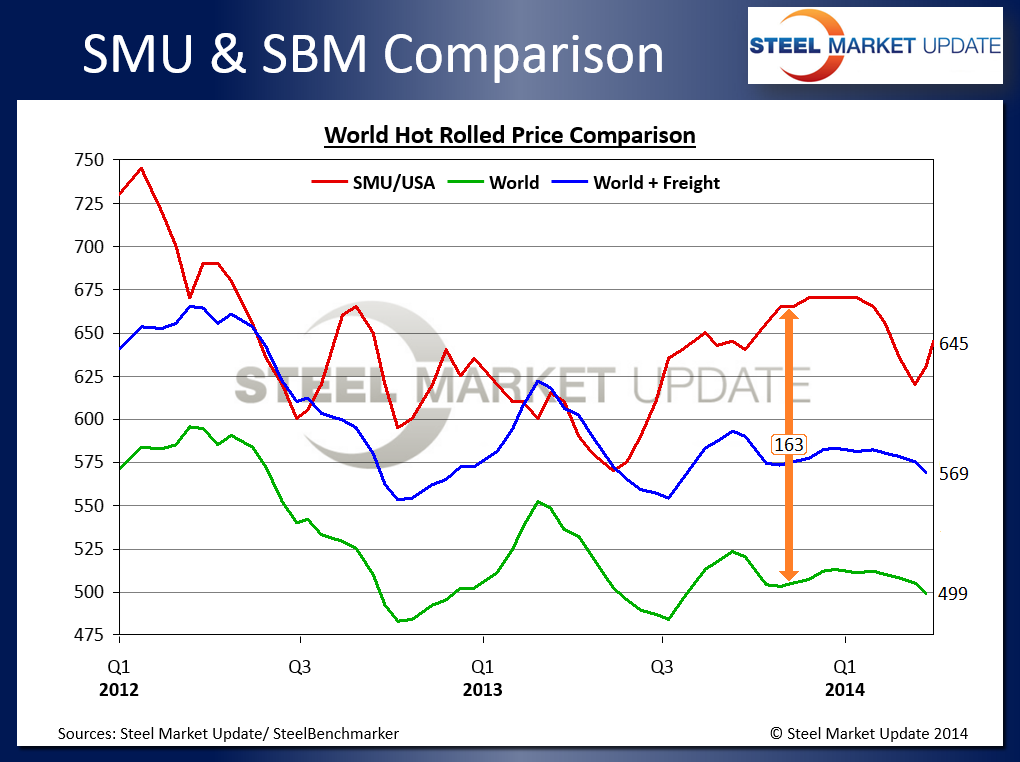

Foreign Price Spread Widens as Domestic Mills Push HRC Prices Higher

Written by John Packard

The spread between domestic (U.S.) hot rolled prices (FOB mill) and the world export hot rolled coil pricing rose this week to $146 per net ton after having shrunk to $115 last week. This jump represents a $31 per ton jump in the spread in one week (based on SMU numbers not Platts $655 number).

The highest we have seen the spread over the past two years was $163 per ton on November 26, 2013. We are now within $7 per ton of that mark.

When taking freight, handling, insurance and a margin for the trading company into consideration, the spread narrows to $76 per ton. At $76 per ton on hot rolled, the amount of interest in importing hot rolled would be tempting to many companies.

However, the numbers referenced are hypotheticals based on a mathematical formula and not the real market pricing.

Our sources are advising us that the latest hot rolled coil offers range from $29.25/cwt ($585 per ton) to $30.50/cwt ($610 per ton) CIF Duty Paid, east coast or Gulf port. The numbers into areas like Chicago would be a little higher due to barge freight.

That puts the spread at $35-$60 per ton. The spread will most likely grow in the coming days as the mills capture the full amount of their announced increase of $660 per ton. That increases the spread to $50-$75 per ton which is attractive to a HRC buyer located near a port facility. Especially, if the buyers believe prices will rise from here and, based on our most recent survey, 90 percent of those responding believe prices will rise from here.

As one of our steel buying sources located in the Southwest told us today, “Now it could get interesting.”