Prices

March 30, 2014

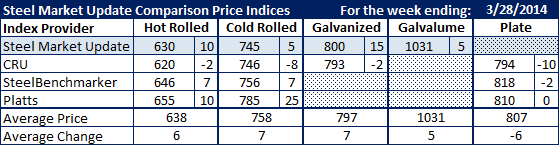

SMU Comparison Price Indices: We Agree & We Are Not the Same

Written by John Packard

When markets start to move each steel index will pick up the information in different ways. It is important to understand each index methodology, how often the markets are canvassed and how deep the reporting resources are. CRU indices are based on actual verifiable transactions from both steel mills and buyers. Platts takes into consideration mill price offers as well as actual transaction data. Steel Market Update collects the vast majority of our data points from manufacturing companies and service centers and not from steel mills. Each collection method has its pluses and minuses. This is the reason why it is important not to rely strictly on one source of information when reviewing short term flat rolled steel pricing market trends (financial instruments and contract adjustments are different stories).

Two weeks ago, ArcelorMittal USA started the push for higher prices as they announced new minimum base prices on hot rolled, cold rolled and coated flat rolled steels. Essentially all of the mills followed AM lead with announcements of their own. However, what will vary from mill to mill is how quickly did each mill actually change pricing to their customers and, how many orders were taken at pre-announcement prices which got caught up in the reporting process.

If you understand how CRU produces their numbers they are essentially saying that they caught enough low priced orders in their reporting systems which brought their numbers down on all flat rolled products. CRU’s benchmark hot rolled number was down $2 per ton to $620 per ton which is where the Steel Market Update (SMU) index bottomed the previous week.

SMU saw hot rolled prices as rising slightly as the bottom of our range moved higher this past week. We saw the market as being up $10 per ton.

Platts saw the hot rolled market as being quite strong with their Indiana based (or within approximately 200 mile radius of the Indiana mills) numbers reflecting another $10 per ton on top of the increases shown the previous week. Platts now has HRC at $655 per ton, FOB Indiana Mill.

SteelBenchmarker also reported prices this past week and their hot rolled number, which is only reported twice per month, was up $7 per ton from their previous data announcement.

So, when you look at the various indices the very first thing which should leap out and hit you is each index has a different reference point for hot rolled coil this past week. We saw HRC prices reported from a low of $620 from CRU to a high of $655 at Platts and all points between (SMU and SteelBenchmarker).

We have more information about the various methodologies in a White Paper on the Home Page of our Website. You may want to download a copy if you are not yet familiar with the differences from index to index.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Northern Indiana Domestic Mill.