Market Data

March 27, 2014

Durable Goods in February

Written by Peter Wright

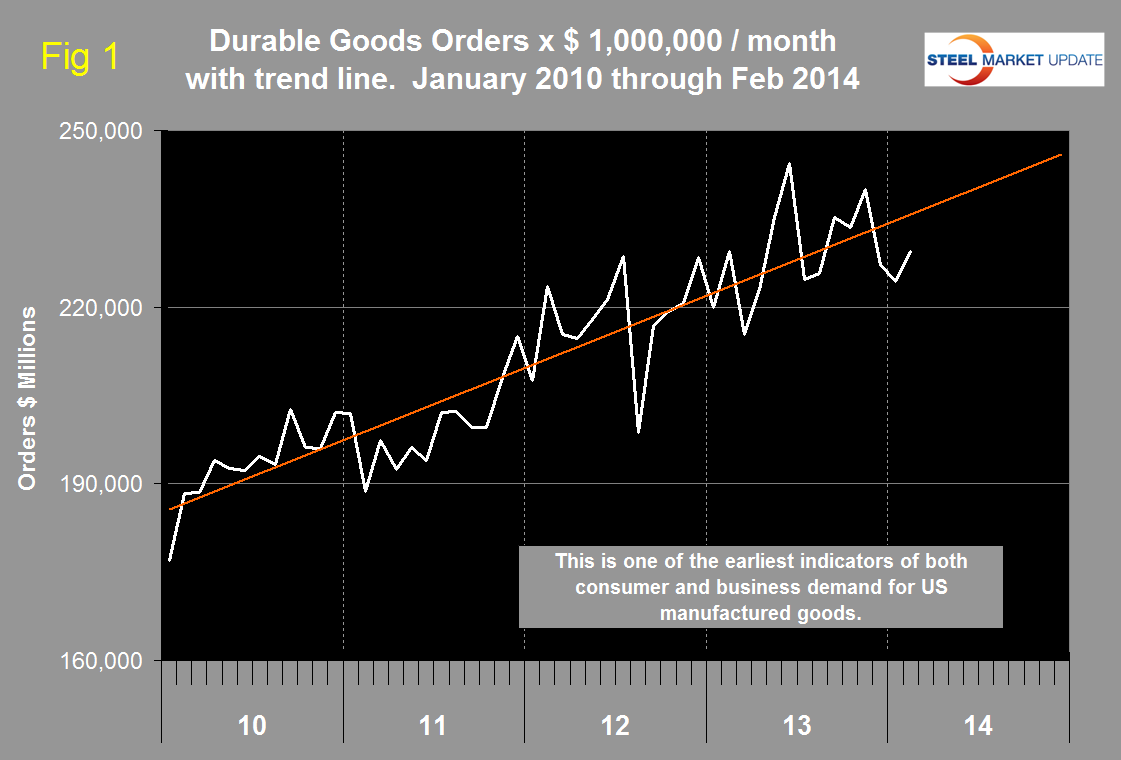

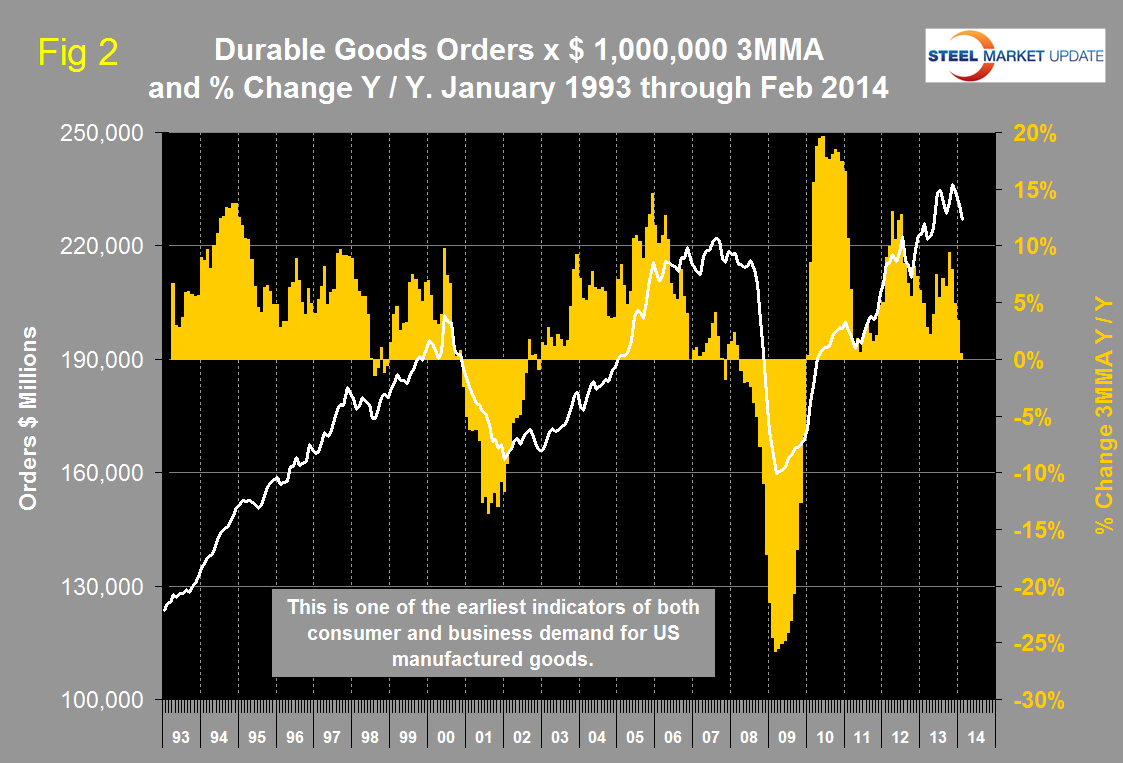

Durable goods orders increased in February continuing the healthy trend that has existed since the recession (Figure 1). However the three month moving average (3MMA) declined as November’s above trend result was dropped from the calculation (Figure 2). The year over year growth rate of the 3MMA has progressively declined from 7.9 percent in November to 0.5 percent in February.

February’s advanced report on new orders was positively impacted by an increase in aircraft orders received by Boeing. Few of us in the steel business have an active interest in the aircraft market but even so at SMU we believe the orders for durable goods are a useful data point for manufacturing in general and for that reason we include this information in our key market indicators report.

The Census Bureau press release issued today read as follows:

New Orders. New orders for manufactured durable goods in February increased $5.0 billion or 2.2 percent to $229.4 billion, the U.S. Census Bureau announced today. This increase, up following two consecutive monthly decreases, followed a 1.3 percent January decrease. Excluding transportation, new orders increased 0.2 percent. Excluding defense, new orders increased 1.8 percent. Transportation equipment, also up following two consecutive monthly decreases, led the increase, $4.6 billion or 6.9 percent to $71.4 billion. This was led by non-defense aircraft and parts, which increased $1.8 billion.

Shipments. Shipments of manufactured durable goods in February, up following two consecutive monthly decreases, increased $2.0 billion or 0.9 percent to $234.0 billion. This followed a 0.6 percent January decrease. Transportation equipment, also up following two consecutive monthly decreases, led the increase, $0.9 billion or 1.3 percent to $68.6 billion.

Unfilled Orders. Unfilled orders for manufactured durable goods in February, up twelve of the last thirteen months, increased $2.9 billion or 0.3 percent to $1,062.6 billion. This was at the highest level since the series was first published on a NAICS basis in 1992, and followed a slight January increase. Transportation equipment, up five of the last six months, led the increase, $2.8 billion or 0.4 percent to $659.6 billion.

Inventories. Inventories of manufactured durable goods in February, up ten of the last eleven months, increased $3.2 billion or 0.8 percent to $392.3 billion. This was at the highest level since the series was first published on a NAICS basis, and followed a 0.3 percent January increase. Transportation equipment, up twenty-one of the last twenty-two months, led the increase, $1.9 billion or 1.5 percent to $125.0 billion.

Capital Goods. Non-defense new orders for capital goods in February decreased $2.2 billion or 2.8 percent to $75.1 billion. Shipments increased $0.1 billion or 0.1 percent to $74.8 billion. Unfilled orders increased $0.3 billion or 0.1 percent to $644.4 billion. Inventories increased $1.1 billion or 0.6 percent to $178.1 billion. Defense new orders for capital goods in February increased $0.9 billion or 13.5 percent to $8.0 billion. Shipments decreased $0.2 billion or 1.7 percent to $9.5 billion. Unfilled orders decreased $1.5 billion or 0.9 percent to $156.6 billion. Inventories increased $0.9 billion or 4.0 percent to $23.6 billion.